USD/JPY:

On the H4 chart, price is still respecting the ascending channel. We are bullish bias- Price is currently testing the first support at 141.652 where the 23.6% retracement sits. Bearish momentum might bring price to the second support at 139.349 where the 38.2% retracement and overlapping support sits. Alternatively, price might continue with the bullish momentum to bring price to first resistance at 144.906 first where the 161.8% extension sits.

Areas of consideration:

- H4 time frame, 1st resistance at 144.906

- H4 time frame, 1st support at 141.652

DXY:

On the H4, prices have broken the ascending trend, we are bearish bias. Price has pulled back and is moving to test the first support at 107.995 where the 61.8% projection and previous swing low sits. If bearish momentum continues, it should bring price to the second support at 107.193 where the 78.6% projection sits. Alternatively, if price reverses from the first support, it should test first resistance at 109.323 where the 23.6% retracement sits and subsequently the second resistance at 110.769 where the previous swing high sits.

Areas of consideration:

- H4 time frame, 1st resistance at 109.323

- H4 time frame, 1st support at 108.007

EUR/USD:

On the H4, price is moving in an ascending manner signalling bullish momentum – we are bullish bias. Price seems like it’s testing the first resistance at 1.0118 where the 50% retracement and 61.8% projection sits. If bullish momentum continues, it should bring price to the second resistance at 1.0274 where the 78.6% retracement and 100% projection sits. Alternatively, if price pulls back, it should test the first support at 1.0044 levels where the overlapping support sits then the second support at 0.9906 where the previous swing low sits.

Areas of consideration :

- H4 1st resistance at 1.0118

- H4 1st support at 0.9906

GBP/USD:

On the H4, prices have broken the descending channel and are moving in a bullish momentum- we are bullish biassed. Prices seem to be moving toward the first resistance at 1.1760 where the 38.2% retracement and 61.8% projection sits. If bullish momentum continues, it should bring prices to the second resistance at 1.1872 levels where the 50% retracement sits. Alternatively, if it fails to break the first resistance, it might look to test the first support at 1.1604 where the 23.6% retracement and overlapping support sits then the second support at 1.1442 where the 161.8% extension sits

Areas of consideration:

- H4 1st resistance at 1.1760

- H4 1st support at 1.1442

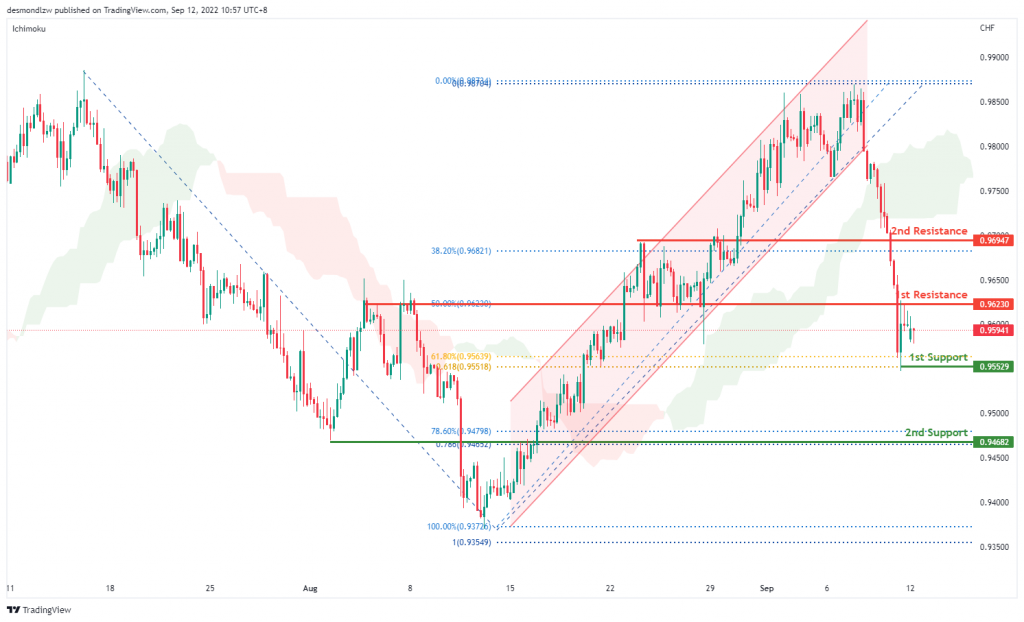

USD/CHF:

On the H4, prices have broken the ascending channel and we are currently bearish bias. Price is moving toward the first support around the 0.9552 levels where the 61.8% retracement and 61.8% projection sits. If bearish momentum continues, it should bring prices to the second support at 0.9468 levels where the 78.6% projection and 78.6% retracement sits. Alternatively, price could pull back to test the first resistance at 0.9623 where the overlapping resistance and 50% retracement sit and then second resistance at 0.9694 where the 38.2% retracement sits

Areas of consideration

- H4 1st support at 0.9552

- H4 1st resistance at 0.9623

XAU/USD (GOLD):

On the H4, with the price moving within the descending channel below ichimoku cloud, and dropping from the 1st resistance, we have a bearish bias that the price may drop to the 1st support at 1693.122, which is in line with the swing lows. Alternatively, the price may retest the 1st resistance at 1729.248, which is in line with the overlap resistance, 50 % and 38% fibonacci retracement. If the price can break the 1st resistance, the 2nd resistance could be at 1744.692, where the 50% fibonacci retracement and overlap resistance are.

Areas of consideration:

- H4 time frame, 1st resistance at 1729.248

- H4 time frame, 1st support at 1693.122

AUD/USD:

On the H4, with the price moving within the descending channel and below ichimoku cloud, we have a bearish bias that the price may drop to the 1st support at 0.67736, which is in line with the 61.8% fibonacci retracement and overlap support. If the price can break the 1st support, the 2nd support could be at 0.67007, where the swing lows are. Alternatively, the price may continue the pullback trend, break the descending channel and then rise to the 1st resistance at 0.68686, where the overlap resistance is. If the 1st resistance is broken, the 2nd resistance could be at 0.69526, where the overlap resistance and 61.8% fibonacci retracement are.

Areas of consideration

- H4 1st support at 0.67736

- H4 2nd support at 0.67007

NZD/USD:

On the H4, with price moving within the descending channel and below ichimoku cloud, we have a bearish bias that the price may drop to the 1st support at 0.60583, where the 61.8% fibonacci retracement and previous swing low are. If the price can break this level, the next support level could be at 0.60050, where the 78.6% fibonacci projection and swing low are. Alternatively, the price may break the descending channel and rise to the 1st resistance at 0.61564, which is in line with the overlap resistance and 61.8% fibonacci retracement.

Areas of consideration:

- H4 time frame, 1st support at 0.60583

- H4 time frame,2nd support at 0.60050

USD/CAD:

On the H4, with the price breaking the ascending channel, below the ichimoku cloud, and there’s a possible “double top” pattern, we have a bearish bias that the price may drop to the 1st support at 1.29682, which is in line with the overlap support and 50% fibonacci retracement. If the 1st support is broken, the 2nd support could be at 1.28938, where the overlap support and 61.8% fibonacci retracement are. Alternatively, the price may rise to the 1st resistance at 1.30713, where the “neckline” of the “double top” pattern and 38.2% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st support at 1.29682

- H4 time frame, 2nd support at 1.28938

OIL:

On the H4, with price below ichimoku cloud and within the descending channel, we have a bearish bias that the price may drop to the 1st support at 88.332, where the 78.6% fibonacci projection and swing low are. Alternatively, the price may retest the 1st resistance at 93.235, where the overlap resistance and 50% fibonacci retracement are. If the price can break this resistance level, the next resistance level could be at 98.726, which is in line with 61.8% fibonacci retracement and overlap resistance.

Areas of consideration:

- H4 time frame, 1st resistance at 93.235

- H4 time frame, 1st support at 88.332

Dow Jones Industrial Average:

On the H4, with price expected to reverse off the stochastic resistance, we have a bearish bias that price will drop to 1st support at 31904 where the pullback support is. Once there is downside confirmation that price has broken 1st support structure, we would expect bearish momentum to carry price to 2nd support at 31025 where the swing low support is. Alternatively, price could rise to 1st resistance at 32632 where the pullback resistance, 50% fibonacci retracement and 78.6% fibonacci projection are.

Areas of consideration:

- H4 time frame, 1st resistance of 32632

- H4 time frame, 1st support at 31904

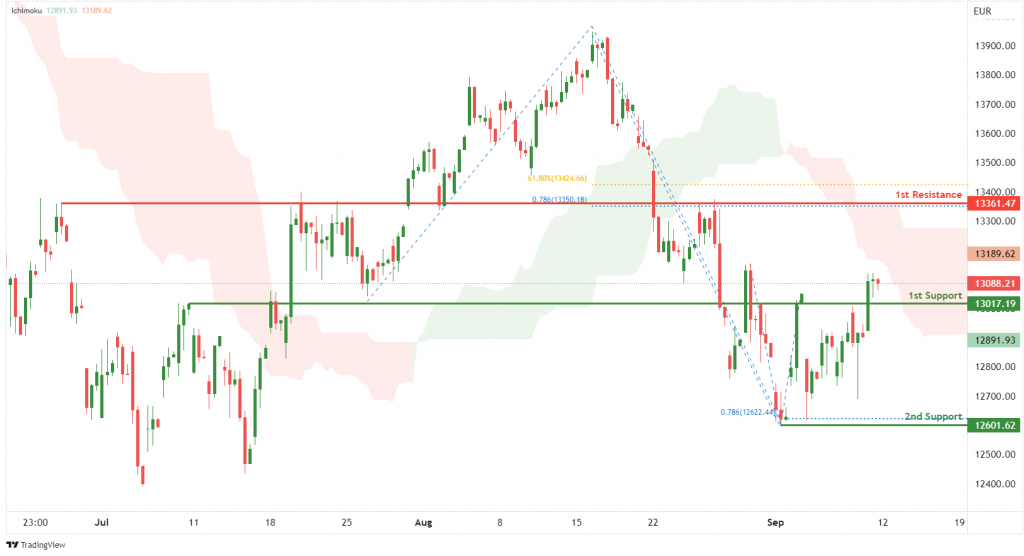

DAX:

On the H4, with price moving below the ichimoku indicator, we have a bearish bias that price will drop to 1st support at 13017.19 where the pullback support is. Once there is downside confirmation that price has broken 1st support structure, we would expect bearish momentum to carry price to 2nd support at 12601.62 where the swing low support and 78.6% fibonacci projection are. Alternatively, price could rise to 1st resistance at 13361.47 where the overlap resistance, 61.8% fibonacci retracement and 78.6% fibonacci projection are.

Areas of consideration:

- H4 time frame, 1st resistance of 13361.47

- H4 time frame, 1st support at 13017.19

ETHUSD:

On the H4, with price moving above the ichimoku indicator, we have a bullish bias that price will rise to 1st resistance at 1791.19 where the overlap resistance and 61.8% fibonacci retracement are. Once there is upside confirmation that price has broken 1st resistance structure, we would expect bullish momentum to carry price to 2nd resistance at 2034.14 where the swing high resistance is. Alternatively, price could drop to 1st support at 1723.42 where the pullback support and 23.6% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance of 1791.19

- H4 time frame, 1st support at 1723.42

BTCUSD:

On the H4, with price breaking out of a descending channel and moving above the ichimoku indicator, we have a bullish bias that price will rise to 1st resistance at 22509.87 where the pullback resistance, 61.8% fibonacci retracement and 127.2% fibonacci extension are. Once there is upside confirmation that price has broken 1st resistance structure, we would expect bullish momentum to carry price to 2nd resistance at 25250.07 where the swing high resistance is. Alternatively, price could drop to 1st support at 20711.10 where the pullback support is.

Areas of consideration:

- H4 time frame, 1st resistance of 22509.87

- H4 time frame, 1st support at 20711.10

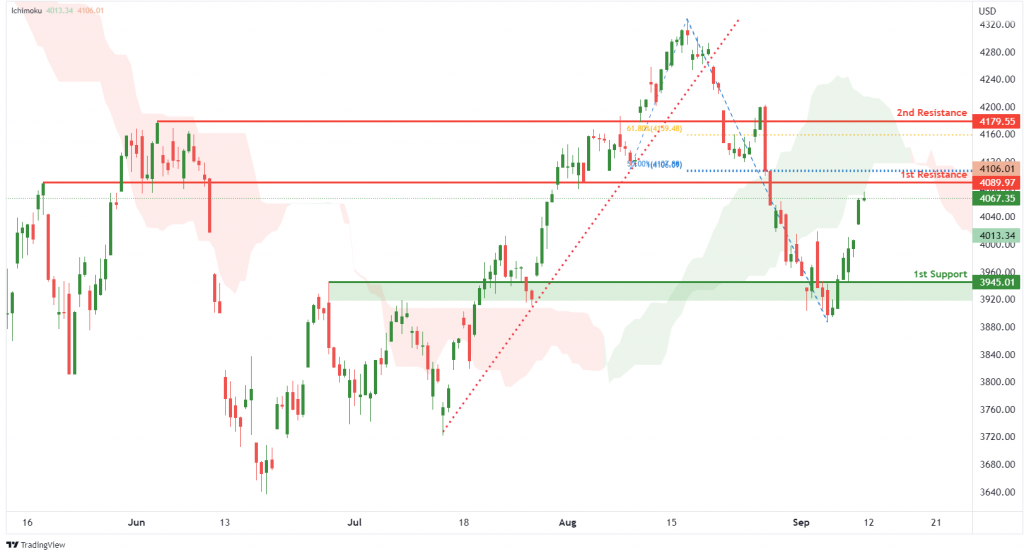

S&P 500:

On the H4, with prices breaking out of the ascending trendline and moving below the ichimoku indicator, we have a bearish bias that the price will drop from 1st resistance at 4089.97 where the pullback resistance, 50% fibonacci retracement and 100% fibonacci projection are to the 1st support at 3945.01 where the pullback support is. Alternatively, price could break 1st resistance structure and rise to 2nd resistance at 4179.55 where the pullback resistance and 61.8% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance of 4089.97

- H4 time frame, 1st support at 3945.01

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.