A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, andhas really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

EUR/USD:

Following the open 1.0971, the EUR currency pair had a relatively quiet round of trading yesterday. Price attempted to tackle the round number 1.1000, but, as you can see, fell short by a mere six pips before selling off down to 1.0940 which marked the low for the day.

Going into today’s sessions, we feel that price will likely be drawn to the 4hr Quasimodo support level a few pips below current price at 1.0924, which not only converges nicely with the 61.8% Fibonacci level, but if you look across to the daily timeframe, you’ll also notice that it marks the upper limit of a minor daily demand area seen at 1.0868-1.0926. With this, we believe this 4hr level could provide a nice place for the Euro to bounce today. However,with the round number 1.0900 lurking just below, there is a high probability price will fake past 1.0924. As such, we would not recommend placing pending buy orders at this level. Waiting for the lower timeframe price action to confirm strength exists here before committing capital to this idea is a far more conservative approach in our opinion, and one that we firmly support.

Should all go to plan and we manage to spot a suitable entry long from here, partial profits will likely be taken at around 1.1000. Nevertheless, depending on how long price consolidates today above our buy area since this could form minor supply which could repel the market, so do take this into consideration guys when considering your take-profit zones.

Levels to watch/live orders:

- Buys: 1.0924 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells: Flat (Stop loss: N/A).

GBP/USD:

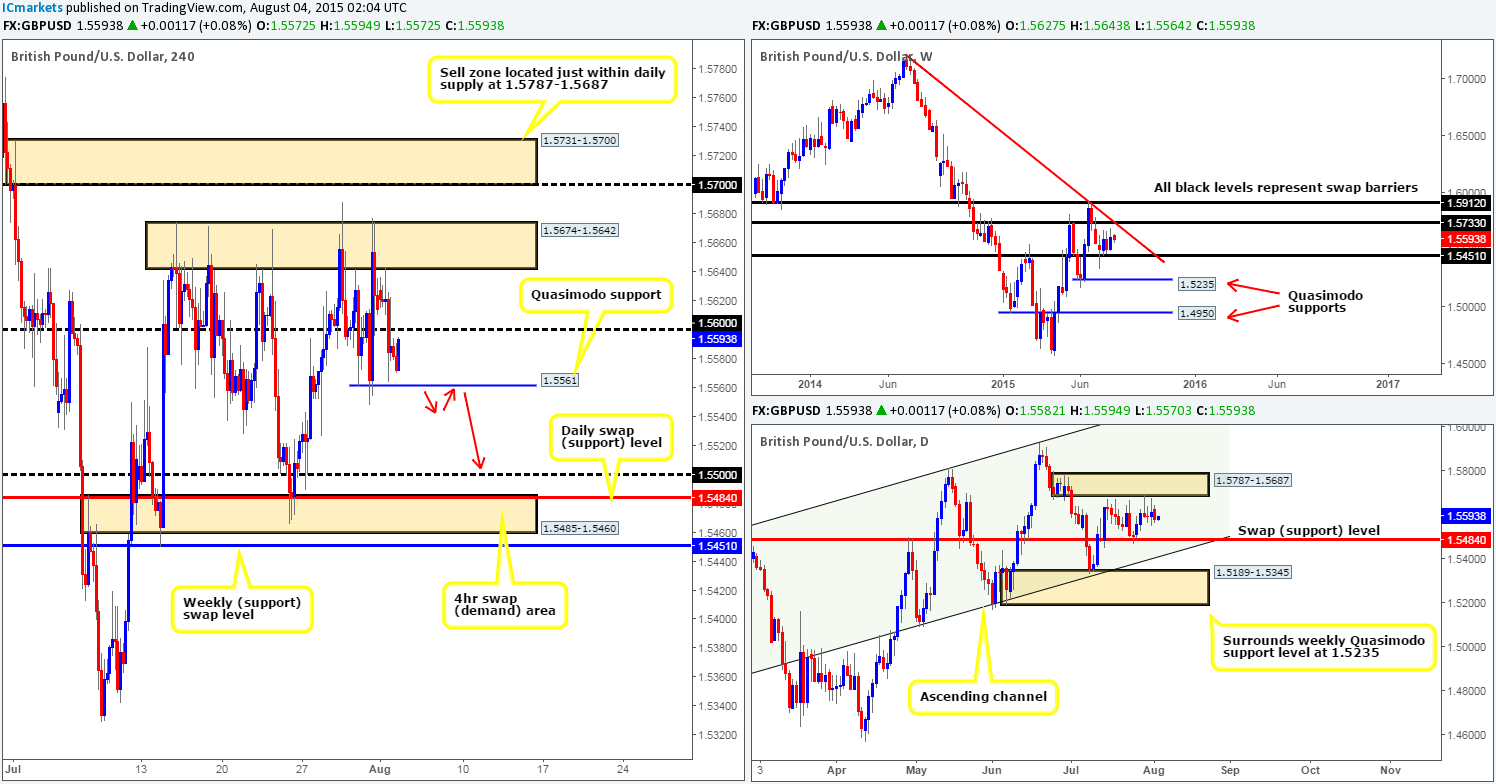

Working our way from the top-down this morning, we can see that the weekly swap (support) level at 1.5451continues to provide a floor to this market. Meanwhile, however, on the daily timeframe, price is currently being held lower by a daily supply area coming in at 1.5787-1.5687, which could effectively force this market down to test the daily swap (support) level at 1.5484 sometime soon.

Moving down to the 4hr timeframe, it is relatively clear to see that as we entered into yesterday’s London session, price sold off down to 1.5564, which just missed the 4hr Quasimodo support at 1.5561 by a mere three pips! The reaction seen from this area has shown strength but as of yet has been unable to close above near-term resistance at 1.5600. This – coupled with there not being much in the way of higher timeframe support backing a trade long from this level, we’ll likely pass on attempting to enter long from here.

With that, should the aforementioned 4hr Quasimodo support level give way today, this would likely expose the round number 1.5500. To trade this potential 40-50 pip move south following a break lower, we’d require a retest of 1.5561 (see red arrows) along with corresponding lower timeframe confirmation. In the event that price does hit target here – 1.5500, we’ll then then be entering into higher timeframe buying territory (Weekly swap [support] level at 1.5451/Daily swap [support] level at 1.5484), so you may want to take a note of this as a bounce higher from this region is very likely.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for 1.5561 to be consumed and then look to enter on any retest seen (lower timeframe confirmation required).

AUD/USD:

Throughout the course of yesterday’s sessions, the Aussie pair saw a conservative wave of offers hit the line, consequently losing a little over 50 pips of value to begin the week.

Now, considering that the AUD/USD pair is in one humongous downtrend at present, and the daily timeframe shows price has been held lower for the past six trading days at the underside of a daily swap (resistance) level at 0.7326, entering long (even though price is trading within along-term weekly demand at 0.6951-0.7326) with a medium to long-term outlook right now may not be the best path to take.

With the above taken into account, our team has come to a general consensus that we would only be comfortable trading this pairfor small intraday moves from pre-determined areas of interest (only with confirmed price action from the lower timeframe mind you)until we get a somewhat clearer direction from the higher timeframe structures. Areas we currently have noted to watch today are as follows:

Buy zones:

- 0.7250/0.7227 (Green area) is an interesting barrier to keep an eye on today. It comprises of a mid-level number and a daily swap (support) level.

Sell zones:

- 0.7330. This small, almost invisible 4hr Quasimodo resistance level which converges just nicely with the upper boundary of the4hr downward descending channel taken from the high 0.7531 and low 0.7371 could provide a nice base to short from today. However, traders will need to be prepared for price to fake higher to the 4hr supply area at 0.7360-0.7342, since this barrier has proven itself several times now to be an zone

Levels to watch/ live orders:

- Buys:0.7250/0.7227 [Tentative – confirmation required] (Stop loss: 0.7218).

- Sells:0.7330 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).