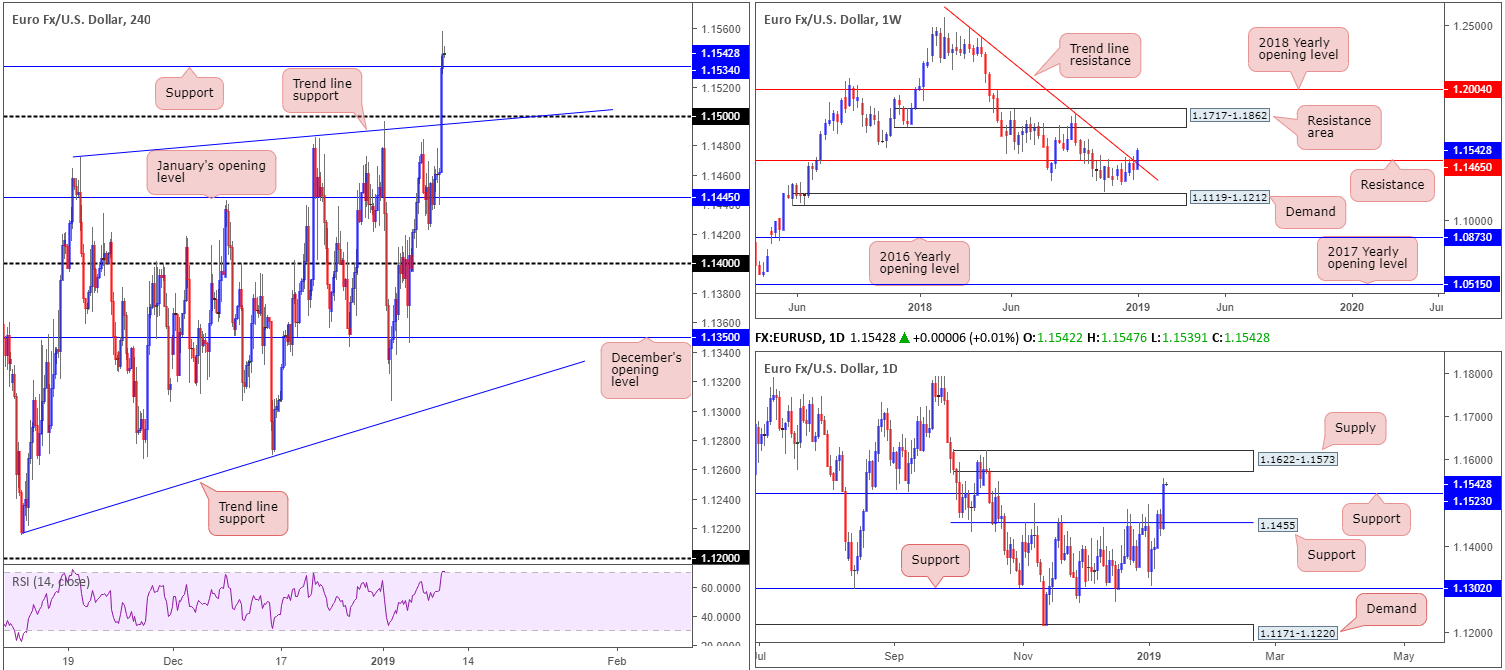

EUR/USD:

In recent sessions, four Fed Presidents advised moderation and caution in the central bank’s rate policy this year. In addition to this, the meeting minutes from the Fed’s December meeting also struck a dovish tone, with many policymakers reporting the Fed could be patient about further policy tightening due to muted inflationary pressures. Combined, this weighed on the greenback and propelled the euro to higher ground Wednesday.

From a technical perspective, weekly price broke free of a long-term resistance at 1.1465 and trend line resistance (extended from the high 1.2476), consequently exposing a resistance area coming in at 1.1717-1.1862. In terms of daily action, the unit cleared two resistances at 1.1455 and 1.1523 (both now acting supports), highlighting nearby supply at 1.1622-1.1573 as the next upside target.

A closer reading reveals the H4 candles conquered its 1.15 handle along with nearby Quasimodo resistance at 1.1534 (now acting support) Wednesday. According to this scale, this has potentially set the stage for further buying today towards 1.16.

Areas of consideration:

In light of Wednesday’s upbeat session, our technical studies observe an upside bias this morning.

Should H4 price rotate lower and retest its support at 1.1534 (traders may want to note there is also a daily support lurking just beneath this level at 1.1523 so price could just as easily surpass the H4 support in favour of daily support here) in the shape of a bullish candlestick formation (entry/stop parameters can be defined according to this pattern), a long in this market, targeting the underside of daily supply at 1.1573, followed by 1.16, is an option.

Today’s data points: ECB Monetary Policy Meeting Accounts; Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

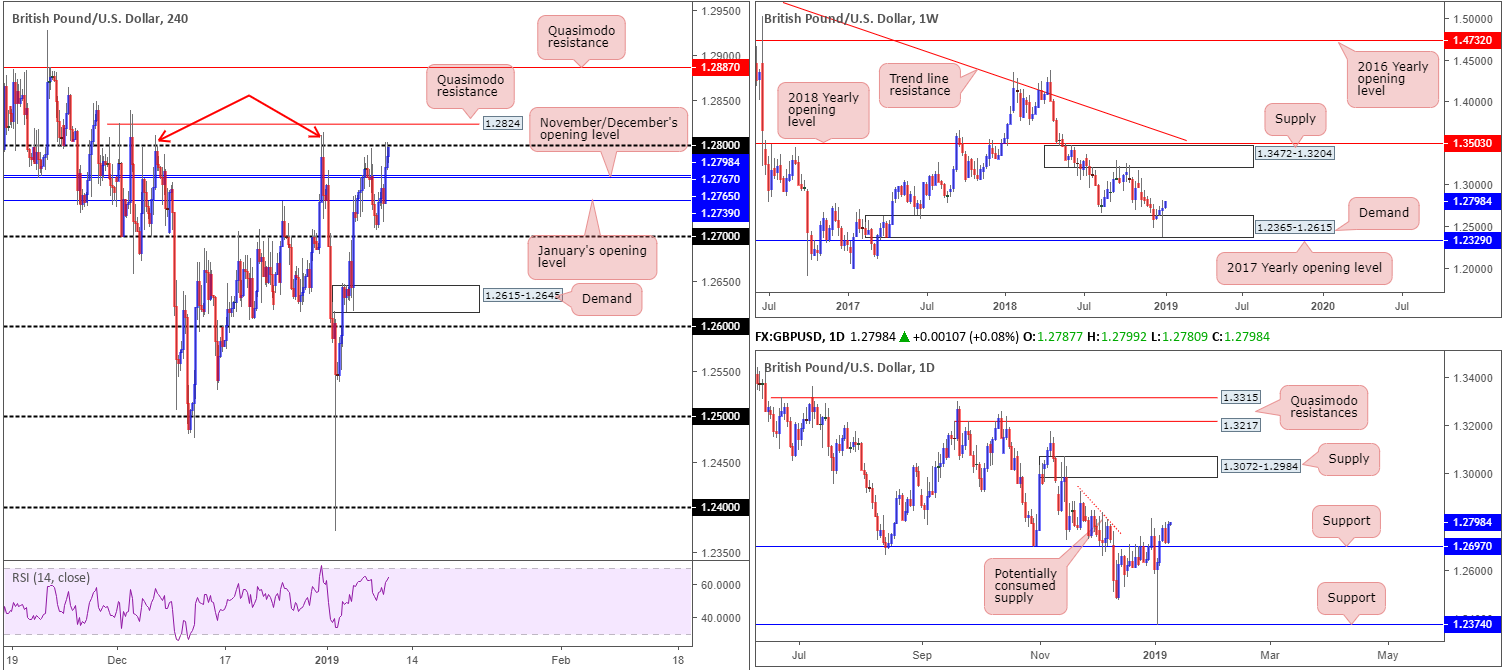

GBP/USD:

UK Government lost the vote on the Grieve amendment Wednesday, meaning Prime Minister Theresa May has 3 days to present the next steps on Brexit if her deal is rejected in Parliament next week. BoE’s Carney also took to the stage yesterday, reiterating future rate hikes are to be limited and gradual.

In spite of the above, both weekly and daily technical structure display signs of further upside materializing over the coming weeks. Cable firmly entered the parapets of weekly demand at 1.2365-1.2615 in the opening stages of the year, challenging the lower borders of the area before finding willing buyers and pushing higher. Assuming buyers remain defensive, a run towards supply painted at 1.3472-1.3204 may be in store over the coming weeks. In conjunction with weekly movement, daily activity concluded recent trade closing above resistance priced in at 1.2697 (now acting support). Continued buying from this point could lead to a test of supply at 1.3072-1.2984. Above 1.2697, limited supply is visible, with a major portion of orders likely consumed as price declined lower in late November of 2018 (see red descending line).

Lower down on the curve, however, H4 movement is testing the underside of 1.28, which, as you can see, is shadowed closely by a Quasimodo resistance at 1.2824.

Areas of consideration:

While higher-timeframe structure indicates further upside, the short-term outlook bodes well for those looking to short this market off the H4 Quasimodo resistance mentioned above at 1.2824. This level is perfectly positioned to facilitate a stop run above not only the 1.28 handle, but also the two tops marked with red arrows at 1.2811 and 1.2815. In terms of stop placement for a sell from 1.2824, above the Quasimodo apex is a possibility at 1.2839. As for take-profit targets, November and December’s opening levels at 1.2767/65 are logical starting points should the unit overcome 1.28 (could potentially act as support).

In the event we overthrow 1.2824 as a sell zone today, as the higher timeframes suggest, traders’ crosshairs will likely be pinned on another layer of Quasimodo resistance at 1.2887. A H4 close above 1.2824, therefore, followed up with a retest by way of a bullish candlestick formation (entry/stop parameters can be defined according to this pattern) would be considered a high-probability long, targeting 1.2887 as the initial upside target.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

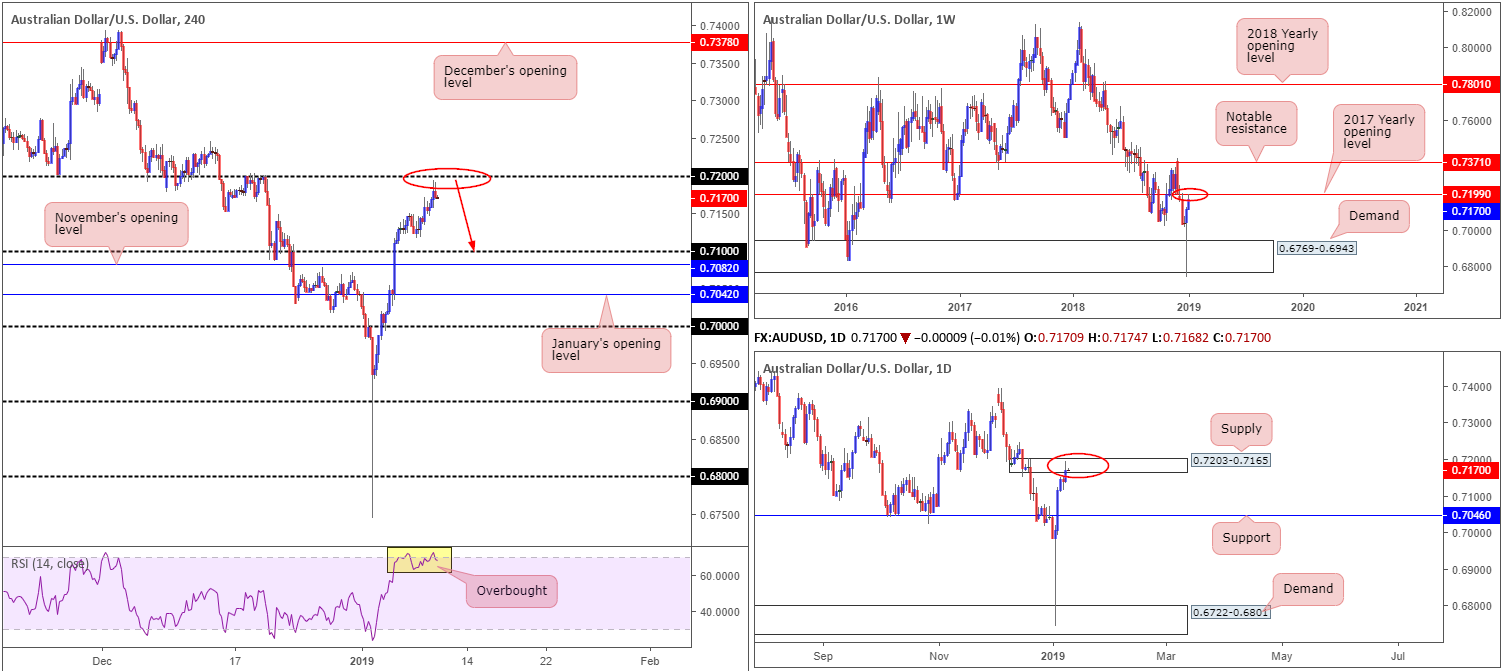

AUD/USD:

In early trade Wednesday, the Australian dollar suffered a hit to the mid-section against its US counterpart on the back of disappointing Australian building approvals. Despite this, though, the commodity currency swiftly recovered and ended the day topping just south of 0.72, up 0.44%.

The psychological handle 0.72 remains a critical level in this market, according to our analysis. Besides the H4 RSI offering a confirming overbought reading, 0.72 also represents the 2017 yearly opening level at 0.7199 on the weekly timeframe. Further adding to this, traders may also want to acknowledge daily supply around 0.7203-0.7165. This area boasts strong momentum to the downside out of its base, indicating strength.

Areas of consideration:

0.72 is a key level in this market this morning for potential shorts. As round numbers are prone to stop runs/fakeouts, however, traders are urged to consider waiting for additional confirmation to form before pulling the trigger. A bearish candlestick pattern, for example, not only identifies seller interest, it’d also offer structure that defines entry and stop parameters.

In terms of downside targets from 0.72, the 0.71 handle appears logical, thus providing traders ample room to secure reasonable risk/reward.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

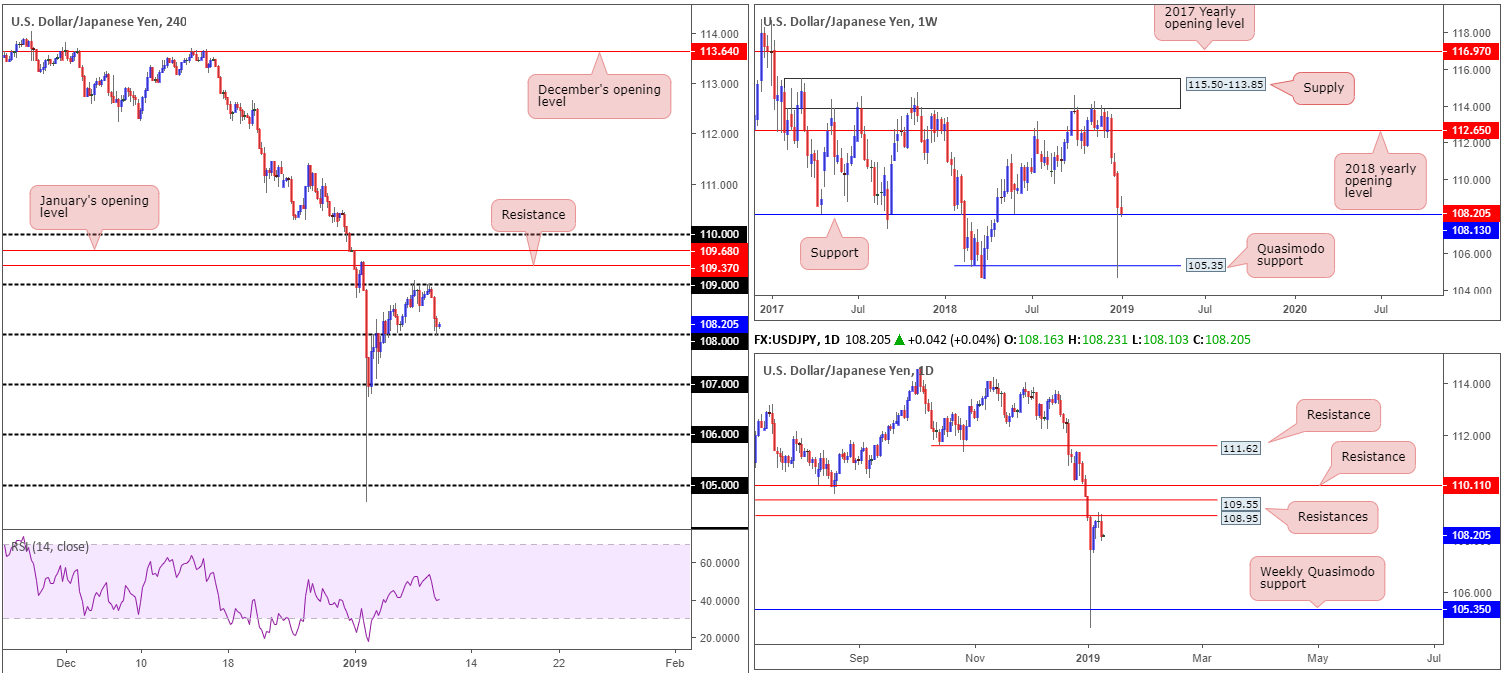

USD/JPY:

Broad-based USD selling decorated the charts Wednesday, following Fed Presidents voicing concerns over the central bank’s rate policy this year. Further downside was observed after the meeting minutes from the Fed’s December meeting hit the wires, also striking a dovish tone.

Sellers on the H4 timeframe remained defensive at 109, forcing the unit to lower ground towards 108, which, as you can see, is currently holding ground. Beyond 108, should the candles drop lower today, the research team sees limited support until reaching 107.

Higher-timeframe movement is interesting. Weekly structure shows price action testing support at 108.13, after retreating from a weekly peak of 109.08. This level, as can be seen from the chart, boasts incredibly strong historical significance. Contrary to this, nevertheless, the daily candles are visibly seen respecting the underside of resistance at 108.95 – a Quasimodo support-turned resistance. Note directly above this we also have another layer of resistance plotted at 109.55, also a former Quasimodo support level.

Areas of consideration:

Having seen weekly price retest support at 108.13 and daily price establish a ceiling off 108.95, this is concerning for longer-term traders.

Rather than guessing which direction the market will trade today, why not let price action lead the way? 108, in this case can be our base. A firm rejection off of this number in the form of a H4 bullish candlestick pattern (entry/stop parameters can be defined according to this pattern) would indicate weekly buyers may be looking to take things higher from its support at 108.13.

On the other side of the field, however, a H4 close beneath 108 suggests weekly buyers are weak and daily sellers are likely to gain traction. This, therefore, opens up the possibility of a short either on the breakout candle, or on the retest of 108 as resistance.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

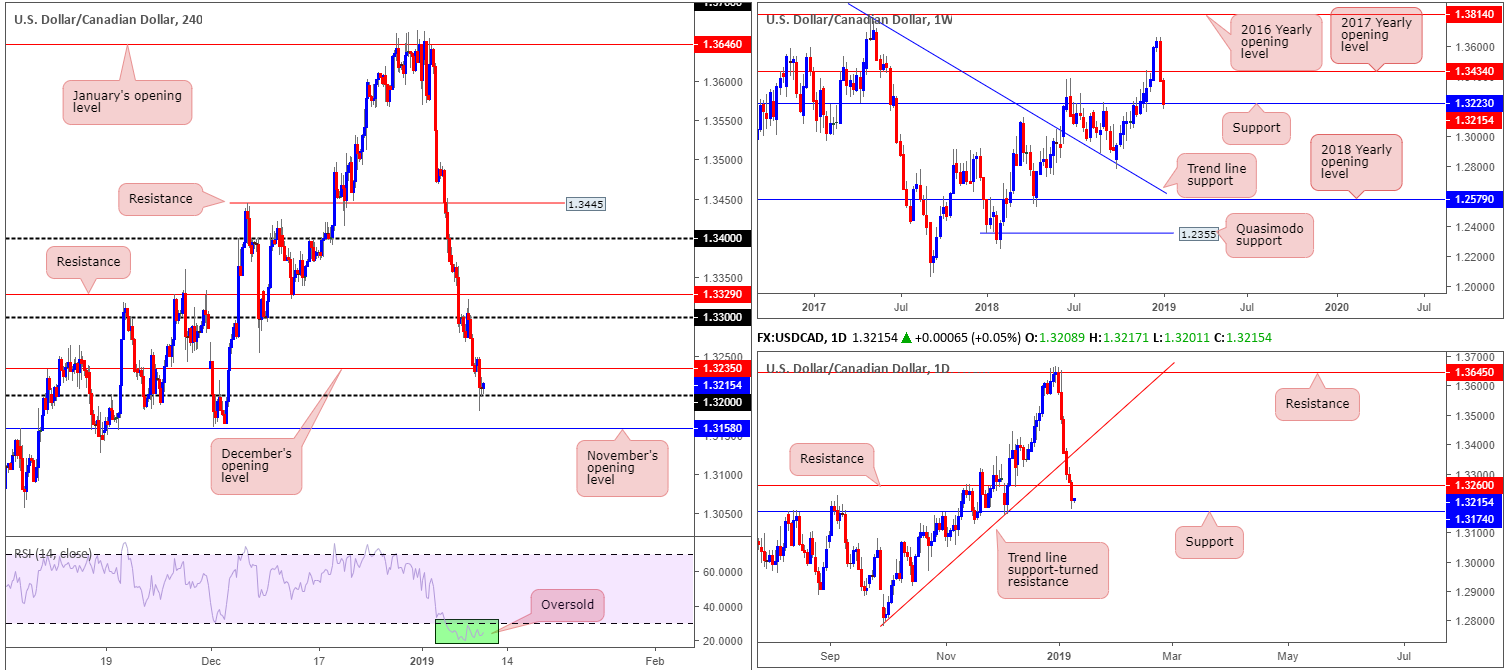

USD/CAD:

In the shape of another near-full-bodied daily bearish candle, the US dollar ceded further ground to its Canadian counterpart Wednesday.

The Bank of Canada kept rates unchanged at 1.75% as expected, though introduced tweaks to its guidance stating rates will need to rise over time into a neutral range to achieve its inflation target. This – coupled with strong moves north in oil and a waning US dollar on the back of comments out of the Fed – collectively weighed on the USD/CAD market yesterday.

From the top, weekly activity is shaking hands with support coming in at 1.3223. This is a long-term level and is, therefore, likely to offer some form of a floor to this market. A closer look at price action on the daily timeframe, however, shows support at 1.3260 (now acting resistance) was overthrown in recent trade, clearing the pathway south towards support pinned at 1.3174.

Closer examination of this market on the H4 timeframe brings in the 1.32 handle, after price conquered support in the form of December’s opening level at 1.3235. Beneath this number, we have November’s opening level lurking nearby at 1.3158. In addition, it might interest some traders to note the RSI indicator is displaying an oversold reading (green).

Areas of consideration:

Buyers looking to long from 1.32, given we are trading at weekly support drawn from 1.3223, today are faced with the threat of a possible move lower to November’s opening level mentioned above at 1.3158, which happens to be sited just beneath daily support at 1.3174.

An alternative to trading 1.32 blindly is wait for a H4 close to print above December’s opening level at 1.3235. This, followed up with a pullback to 1.32 for a long (with stops planted beneath 1.3158), could be enough to clear sellers out from 1.3235 and open up an approach towards daily resistance at 1.3260, followed by 1.33 on the H4 scale.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

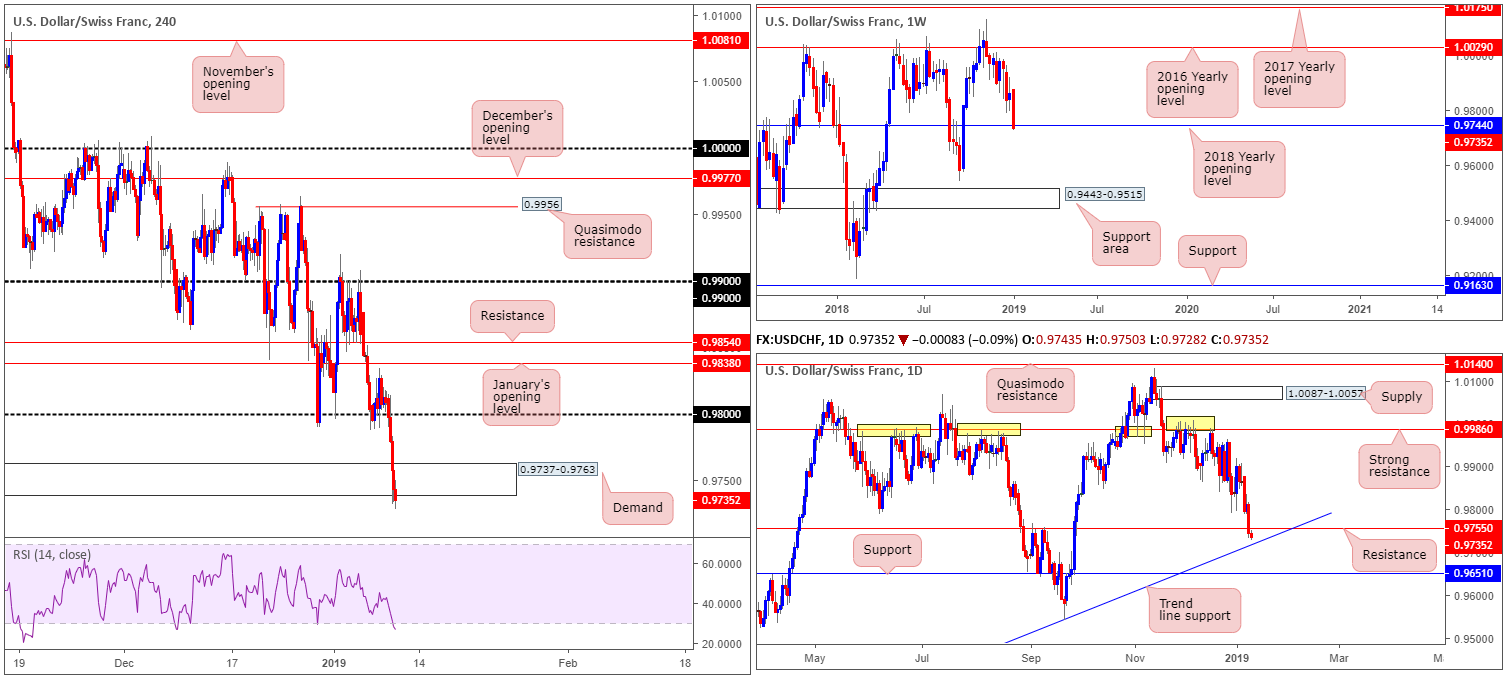

USD/CHF:

Dovish comments by a number of Fed officials, and a dovish stance set by the meeting minutes from the Fed’s December meeting, further pressured the already weaker USD Wednesday.

Using a top-down approach this morning, we can see weekly price, in the shape of a full-bodied bearish candle, crossing swords with its 2018 yearly opening level at 0.9744. Beyond here, the team notes an absence of support until the 0.9524 September 17 low (2018), tailed closely by a support area visible at 0.9443-0.9515.

In terms of daily price, support at 0.9755 (now acting resistance) was overthrown yesterday, consequently unlocking the door to a nearby trend line support (extended from the low 0.9187). Across the charts, H4 movement reclaimed 0.98 to the downside and eventually conquered demand coming in at 0.9737-0.9763. This, although not visible on the screen, opens up the runway south towards support drawn from 0.9694.

Areas of consideration:

In essence, we have the weekly timeframe suggesting a possible round of buying off its 2018 yearly opening level at 0.9744, though this is somewhat hindered by the recently broken H4 demand at 0.9737-0.9763 and nearby daily resistance at 0.9755.

Logically, neither a long nor short seems attractive at the moment, according to our current read. Irrespective of which direction traders choose, opposing structure is clearly visible. With that being the case, opting to remain on the sidelines could be an option going into today’s sessions.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

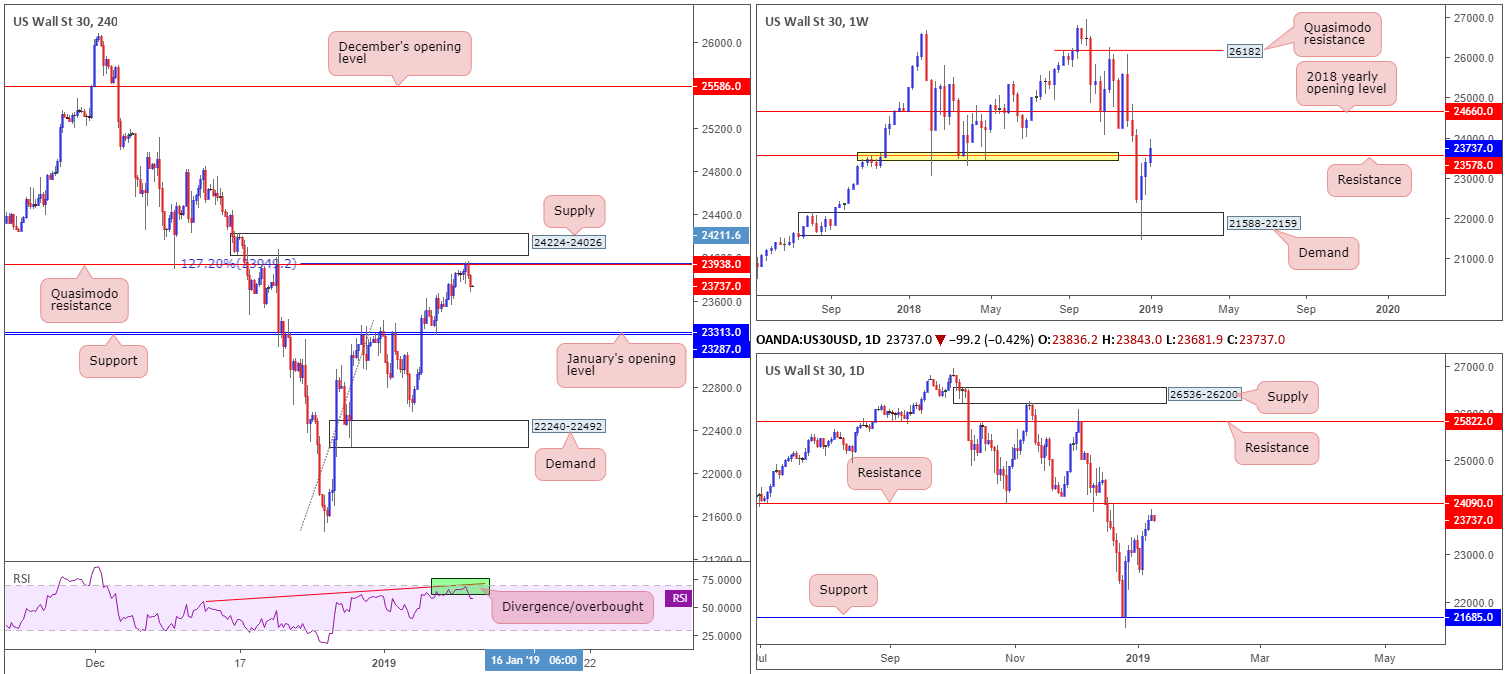

Dow Jones Industrial Average:

US equities built on recent gains Wednesday, closing higher for a fourth consecutive day. In recent hours, however, risk appetite hit a sour note as H4 flow challenged a Quasimodo resistance at 23938, which also merges with a 127.2% Fibonacci extension point at 23949. This – coupled with the RSI indicator displaying a clear overbought/divergence reading – has seen the index turn lower in early trade this morning.

Bringing forward the higher-timeframe picture, traders will note weekly price remains above resistance at 23578, eyeing a possible run towards the 2018 yearly opening level at 24660. Daily flow, on the contrary, is poised to attack nearby resistance drawn from 24090. Note this level boasts reasonably strong historical meaning. As you can see, the current H4 resistance level boasts limited connection to higher-timeframe structure.

Areas of consideration:

For folks who read Wednesday’s briefing you may recall the piece highlighted a possible sell from either the current H4 resistance level at 23938, or the H4 supply seen overhead at 24224-24026. Well done to any of our readers who managed to jump aboard the move from 23938. Downside targets from this region fall in around H4 support at 23287/January’s opening level at 23313.

Today’s data points: Fed Chair Powell Speaks; FOMC Members Bullard and Evans Speak.

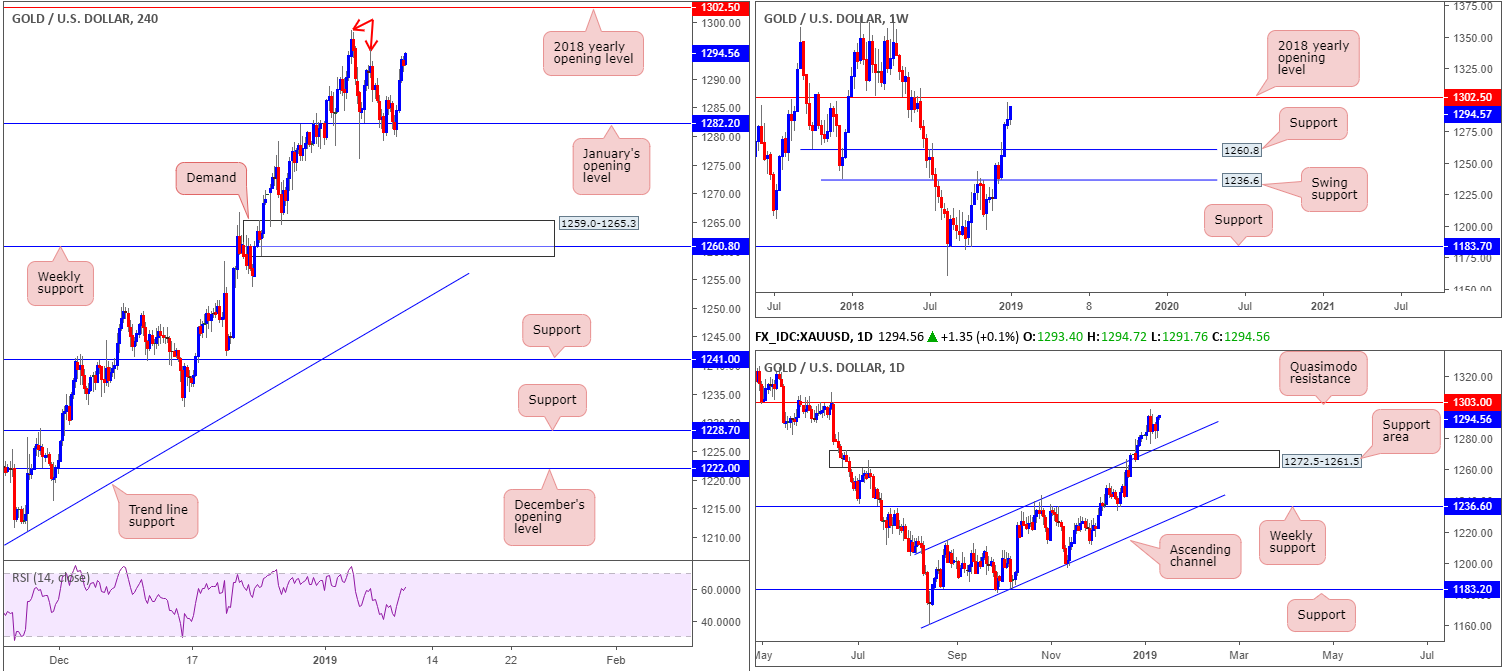

XAU/USD (Gold):

Across the board, the US dollar explored lower ground, consequently lifting the price of gold to higher levels Wednesday, up 0.64%.

From the weekly timeframe, bullion is poised to extend gains towards the 2018 yearly opening level at 1302.5. This level served the market well back in June of 2018 as resistance, therefore there’s a strong chance history may repeat itself. The picture on the daily timeframe, nevertheless, shows price action lodged between a Quasimodo resistance level at 1303.0 (positioned just north of the 2018 yearly opening level), and a channel resistance-turned support (taken from the high 1214.3) that intersects closely with a support area coming in at 1272.5-1261.5.

January’s opening level at 1282.2 on the H4 timeframe remained supportive Wednesday, despite a number of attempts to push lower in recent trade. Aside from some local peaks at 1295.2 and 1298.5 (red arrows), limited resistance is seen in this market until the 2018 yearly opening level at 1302.5.

Areas of consideration:

While further buying is possible, according to all three timeframes analysed, taking advantage of this move is proving challenging as the only logical support on the H4 timeframe is January’s opening level drawn from 1282.2.

Therefore, the only alternative we see is to drill down to the lower timeframes and attempt to trade local zones long, with an ultimate target set at 1302.5. An example of this would be a break of resistance followed up by a retest as support.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.