The price of bitcoin has been steadily rising in 2023 – rebounding from the 2022 crash that saw the total market capitalization of cryptocurrencies cut by two-thirds.

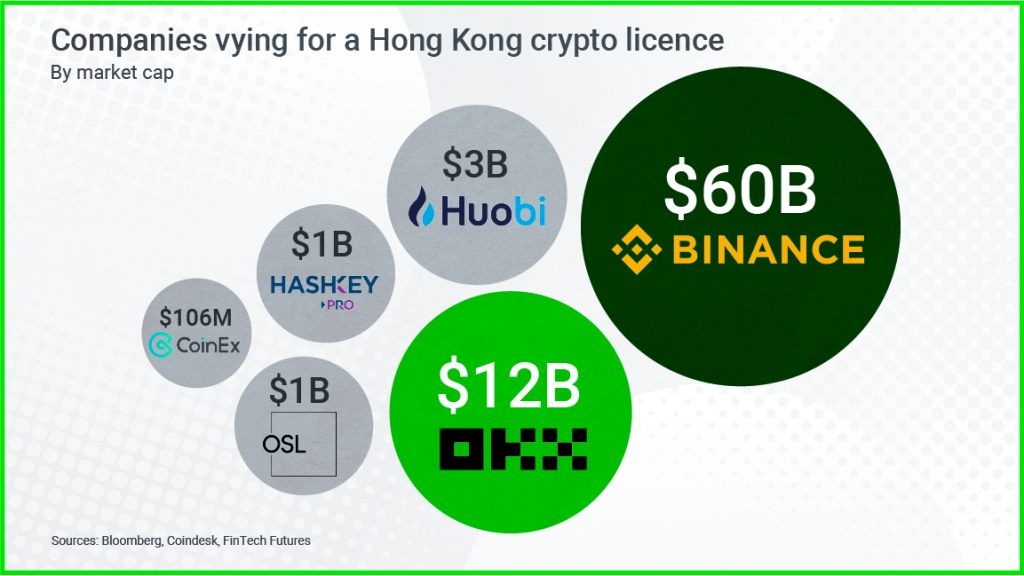

BlackRock is doggedly pursuing its Bitcoin ETF, and Hong Kong has opened the floodgates to retail crypto trading on the Chinese-owned island.

The momentum is prompting crypto bulls to declare the so-called “crypto winter” over.

Yat Siu, the Co-founder and Executive Chairman of Animoca Brands, which is based in Hong Kong, believes the regulatory change is going to be a gamechanger for the sector globally.

“I’m really bullish about Hong Kong. If you think about what just happened in the last six to nine months, Hong Kong has really progressed in terms of bringing people into the Web3 narrative.”

He also said there is no doubt that Hong Kong’s crypto ambitions are being supported by mainland China.

“They wouldn’t be doing it without the approval of China. It’s also notable that when Hong Kong came out and spoke about retail trading, they also started giving out licenses to some exchanges in Hong Kong. At the same time, China, as in Beijing, released its Web3 whitepaper.”

One of the underlying thematics that may underpin China’s decision, according to Yat Siu, is the concept of “de-dollarization,” which is rapidly gaining momentum.

De-dollarization refers to countries reducing their reliance on the U.S. dollar as a reserve currency, medium of exchange, or as a unit of account.

Oxford Economics economist Alex Holmes said the rise in the value of cryptocurrencies, particularly Bitcoin, in 2023 feeds into the de-dollarization narrative.

“You’ve got countries like Iran and Russia launching a gold stable token to conduct bilateral trading. And some people are touting crypto as one possible alternative to US dollar hegemony.”

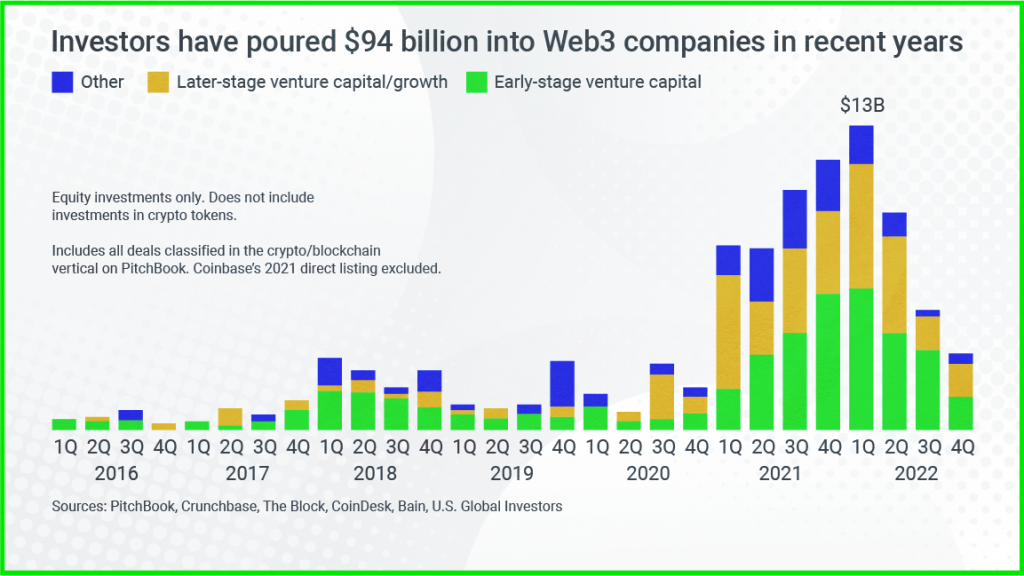

Another major thematic driving renewed interest in cryptocurrencies is Web3, which is an extension of cryptocurrency, using blockchain technology in new ways to new ends.

Yat Sui has joined the Hong Kong Government’s Web3 Taskforce to accelerate Hong Kong’s Web3 agenda.

“Web3 provides new platforms and new ways in which you can build companies, social networks, games and platforms that aren’t dependent on US-based tech companies like Apple and Google.”

Web3 is gaining momentum, particularly in Asia, where Japan has created a national Web3 strategy to promote the transition to Web 3.0.

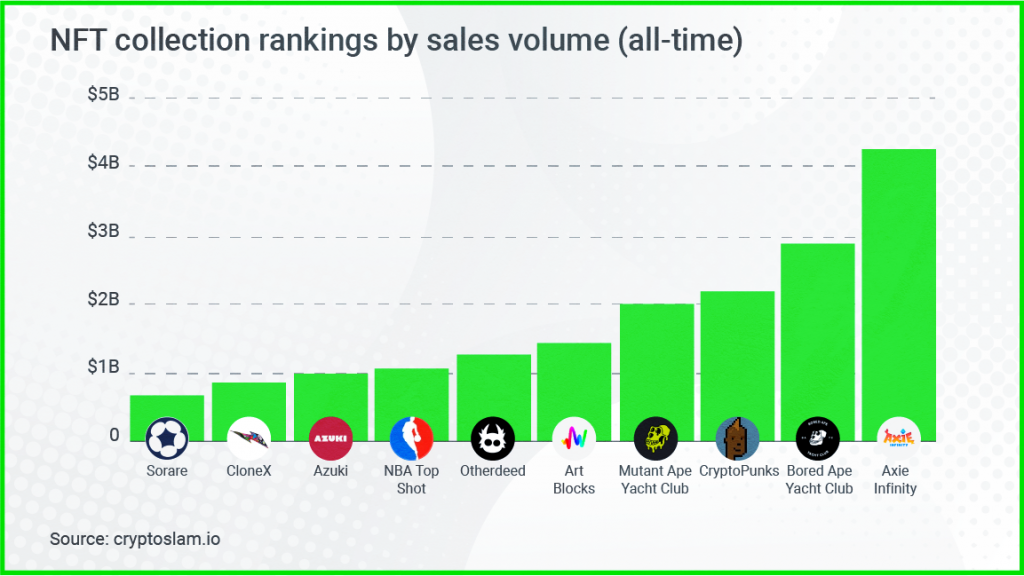

Japan has also put out a national White Paper about non-fungible tokens (NFTs).

Yat Siu said the total volume of NFT trading was $24 billion in 2022, but unlike some other forms of content, 90% of the value went to the creators and the artists behind the projects.

Yat Siu started his career at gaming company Atari in Germany before starting the multi-billion dollar Animoca Brands, which has partnerships with the likes of Formula 1®, Marvel, WWE, Power Rangers, MotoGP™ and, more recently, Honda.

“We would be looking at bringing in something like close to 500 million users hopefully onto Web3 with these partnerships,” said Mr Siu.

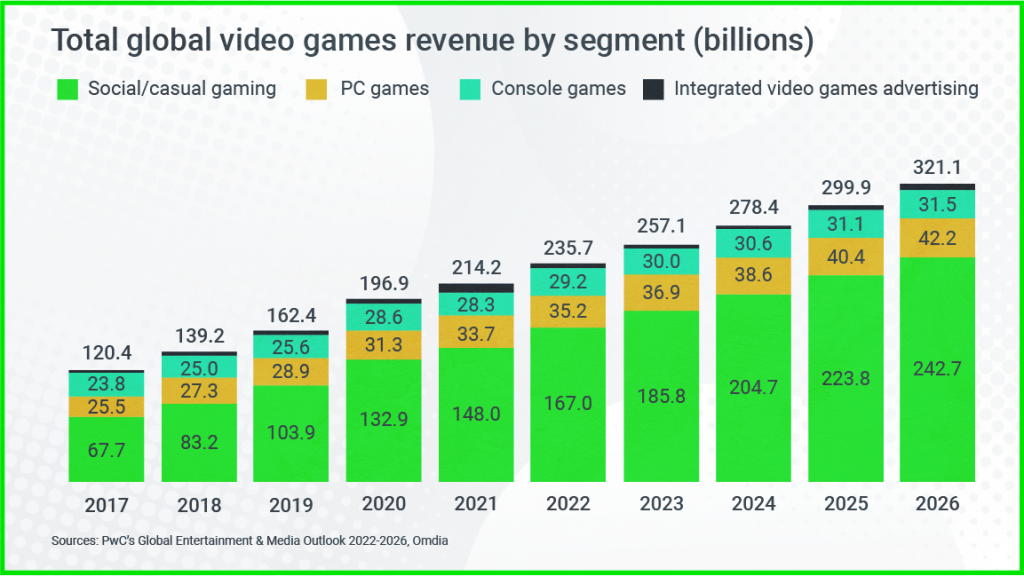

At the core of this transition, is the shift from 2D gaming to Web3 gaming, which allows for ownership of items within the virtual environment.

“They are accustomed to virtual currency because they’re really spending, whether it’s on Roblox or Minecraft, or Fortnite and they spend it inside the game- so they’ve got that familiarity. From our perspective, it’s a sort of very natural onboarding and it’s something quite fluid.”

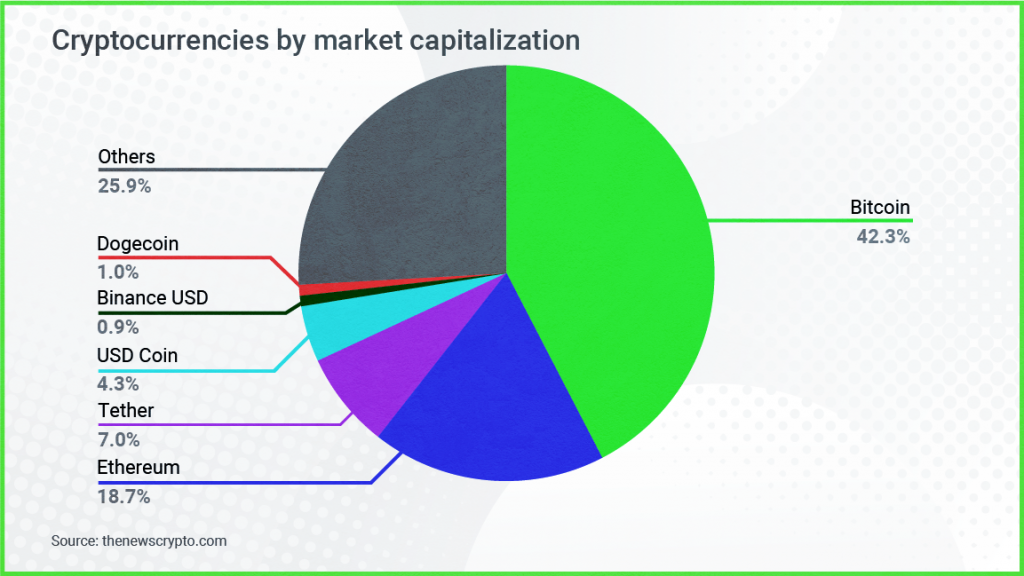

While there are almost ten thousand active cryptocurrencies in the world, the total market is still dominated by Bitcoin and Ethereum.

According to analysts from Bloomberg, the proposed BlackRock Bitcoin ETF could unlock $30 trillion of wealth.

The Blackrock ETF speculation has sparked a new wave of optimism in the crypto market, which is prompting many to ask “is the crypto winter over?”