Mark Zuckerberg’s Harvard classmate Magnus Grimeland is behind Antler – which is one of the world’s most active early-stage investment firms.

Antler has coined the term “day zero investing,” which refers to the process of backing companies from the moment of inception.

Grimeland’s proximity to the Facebook juggernaut taught him the power of startup investing – provided you have a methodology for identifying potential from the outset.

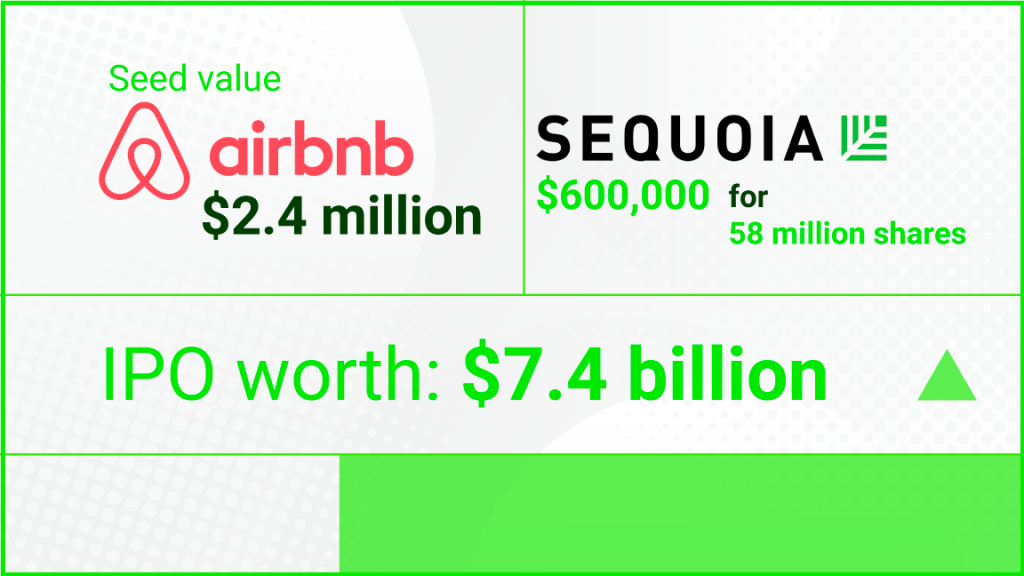

Peter Thiel famously invested $500,000 for just over 10% of Facebook, which at IPO would have been worth $500 million.

Grimeland’s commitment to startup investing is not only about making money, it’s also deeply philosophical.

We fundamentally believe that the world will only move forward if great people choose to innovate. If the smartest people in the world choose to solve some of the world’s biggest problems, then the world becomes a better place for everyone.

The rule of thumb for startup investing is to dedicate between 5 -10% of an investment portfolio to risk assets, like startups.

His advice for picking the most promising startups is to look at the founder.

Take Elon Musk, probably one of the most successful founders today; back in the early days of SpaceX, and in the early days of Tesla, you probably didn’t back the idea, but you backed the individual based on the track record that person has

Successful exits for startups like Airbnb, Uber, and Facebook fueled interest in startup investing, sending a flood of capital into startup ventures in 2020 and 2021.

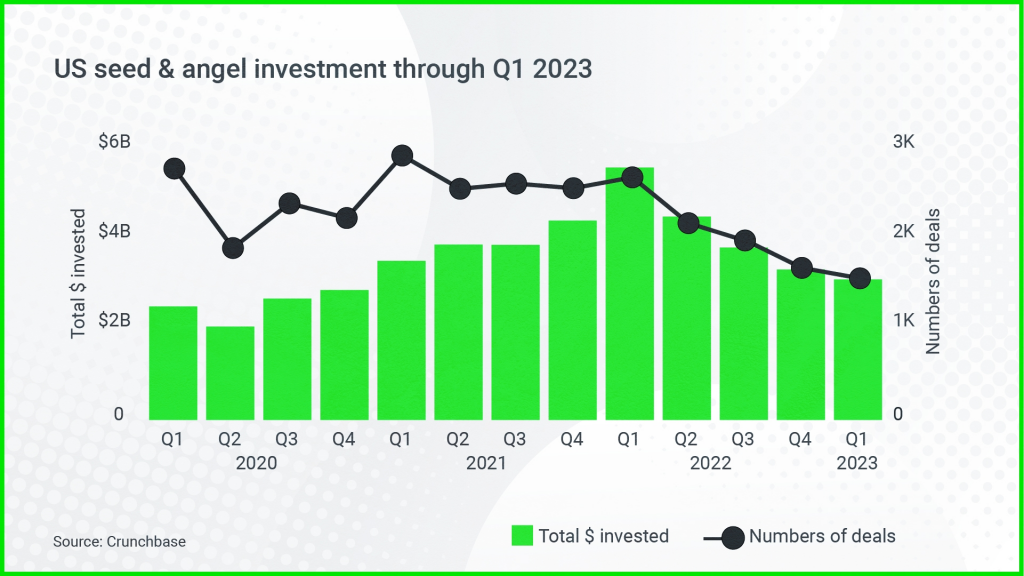

The rush of angel and seed funding in the United States drove up valuations and sparked a euphoria, which preceded the 2022 tech crash.

However, in the wake of the 2022 so-called “tech wreck,” the ability for companies to attract seed and angel investment has significantly declined.

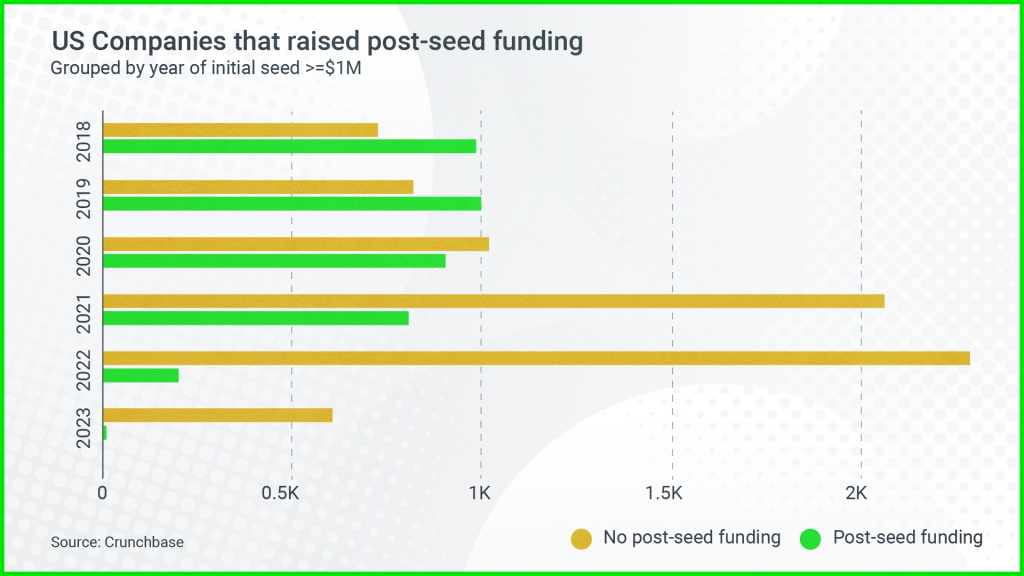

Venture capital has dried up and companies that did manage to raise seed capital are finding it difficult to raise their Series A.

According to Grimeland, this situation will be temporary.

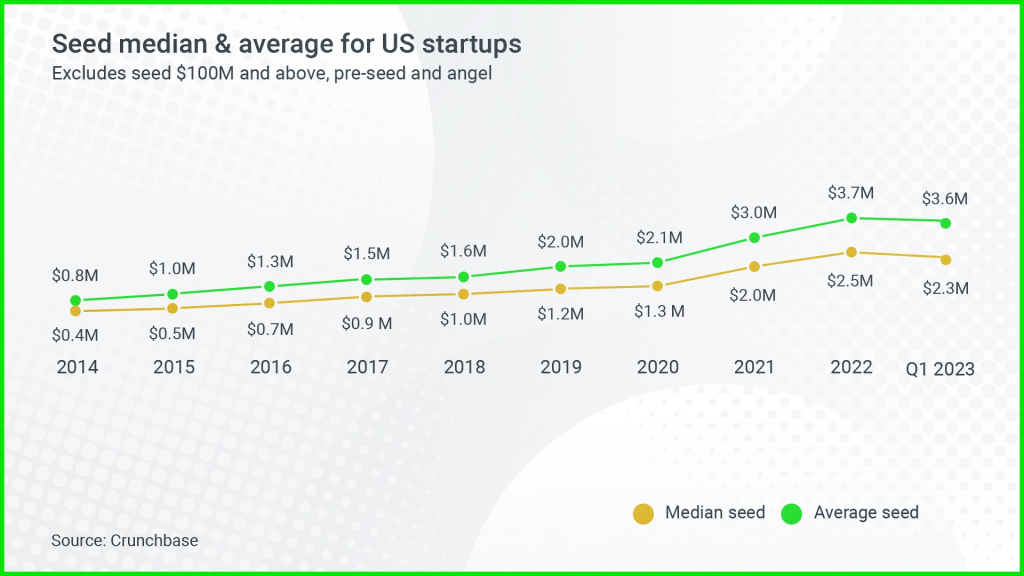

While the data also shows that there are fewer deals, the size of the seed investment is getting bigger.

There is a caveat, in that this potentially indicates venture capitalists are becoming more discerning.

There is still capital on the table, but only the quality projects are managing to attract funding.

Startups are also quickly learning that they need to be more fiscally responsible with any money raised during the seed round.

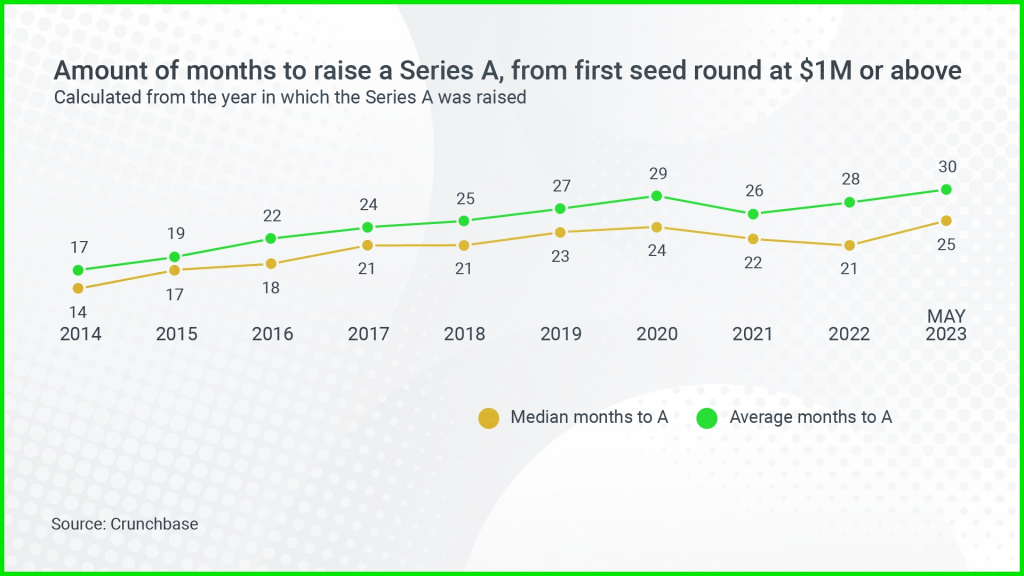

The average time from seed to Series A has almost doubled over the last decade, from 17 months to 30 months.

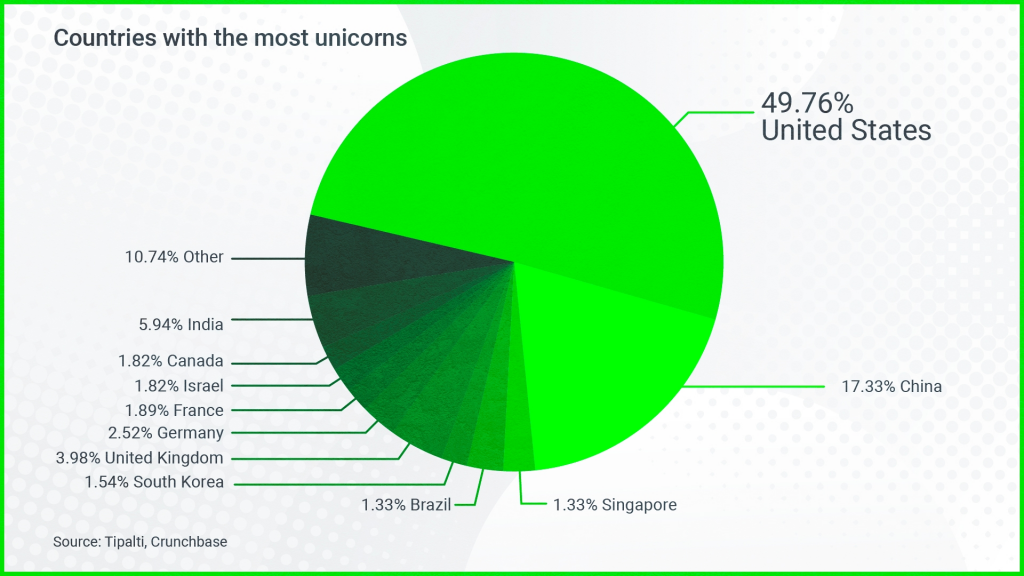

Antler has offices in more than 20 countries around the world, with the belief that the next wave of unicorn startups won’t necessarily originate from the United States.

Historically, the world’s very best companies typically have a tendency to be started in a downturn and not at the very top, or on the way to the top, because they’re going to exit seven, eight, nine, ten years into the future.