Euro traders are bracing for significant movements in the single currency early in the London session today, with the latest Eurozone CPI Estimate data set for release. The market anticipates the CPI Flash Estimate to show a 1.8% year-on-year increase, with Core CPI projected to rise by 2.7%. However, some market participants are speculating that these figures could come in lower than expected, fuelling hopes that the European Central Bank may expedite interest rate cuts. Recent weaker inflation data from Spain and France, alongside a series of lower PMI prints across the continent last week, have bolstered this view.

Conversely, a stronger-than-expected print could quickly quash such hopes, paving the way for a break above the recent highs near 1.1200.

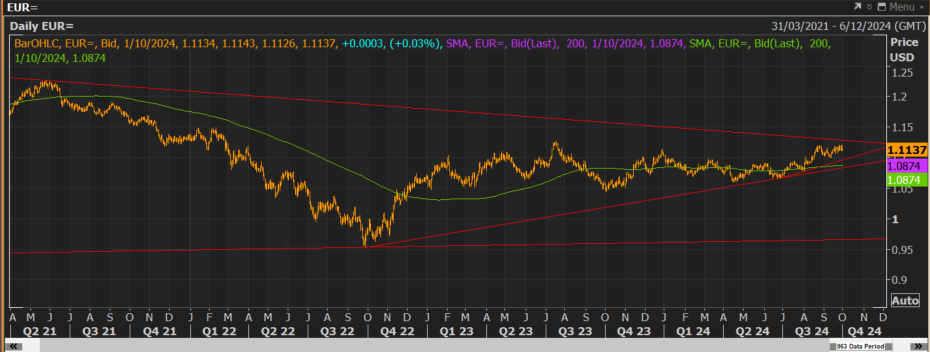

Over the past week, the Euro has traded within a relatively tight range, repeatedly bouncing off the 1.1100 level and encountering resistance near 1.1200. On the longer-term daily chart, trendline resistance now sits around 1.1280, while trendline support is positioned around 1.0970.

Resistance 2: 1.1280 – Daily Trendline Resistance

Resistance 1: 1.1213 – September High

Support 1: 1.1101 – Hourly Trendline Support and weekly lows.

Support 2: 1.0970 – Daily Trendline Support.