Are you interested in expanding your investment portfolio and finding new opportunities in the financial markets? Or, are you stepping into Australian share trading for the first time and looking to gain a better understanding of how it all works? IC Markets now provides both share trading and CFD trading options for Australian clients, allowing you to select the method that aligns with your trading goals

These are two different approaches to capitalise on a market’s price movement.

In this guide, we’ll take you through:

- What is Share Trading?

- What is CFD Trading?

- Share Trading vs CFDs: a comparison

- What is right for you?

The main difference between trading shares and CFDs is that CFDs won’t give you any ownership of the underlying asset whilst trading shares will. Furthermore, CFDs are more complex financial products with a higher risk of losing money due to leverage. If you are not of high risk appetite, you may consider opening a share trading account to trade shares on the Australian stock market.

What is Share Trading?

Trading shares, also known as stock trading or equity trading, is the practice of buying and selling shares or stock of publicly listed companies. When you trade shares with ICMarkets, these shares represent direct ownership in the company with the goal of making a profit when you choose to sell your shares. Each share has a price tag determined by the supply and demand of the company’s shares in the market, influenced by a company’s performance.

Investing in shares is appealing among those who have a positive long-term outlook on that share with the view of many profits down the track. Holding shares grants you voting rights and the potential to earn dividends.

Additionally, share trading requires the full amount of capital to get started & any additional fees. For instance, you choose to purchase $500 worth of shares with Woolworths Group, the maximum amount of capital you could lose is $500 & additional fees, should the share prices fall down to zero.

What is CFDs trading?

Now, let’s dive into CFDs, where ownership takes a beat seat. Here, you’re speculating on asset price movements. Essentially, it’s an agreement between the trader and the broker to exchange the difference between the opening and closing price of your position. Whilst shares only allow you to benefit from a company’s increased value, CFDs allow the trader to speculate on prices rising (going long) or prices falling (going short).

Unlike share trading where you have to commit the full amount upfront, CFDs provide the ability to use leverage, giving you full market exposure while only having to commit a deposit to open your position.

So, if you wanted to open a $500 CFD trade on Woolworths Group shares, you’d only need to put down a margin, for example, 20% of the position value to trade the movement of Woolworths Group share price – an initial sum of $100. However, remember that leverage carries risk as profits and losses are calculated on the full-size position, in this case, $500.

Looking to learn more? Let’s sum it up with a handy comparison.

| Share Trading | CFD Trading | |

| Do you own the underlying asset? | Yes. When you buy shares you become a direct shareholder | No, you speculate on price movements |

| Can you go short? | No | Yes. You can go long or short |

| What markets are available? | 2,200+ Australian listed companies | 2,250+ products including Forex, Commodities, Shares, Cryptocurrencies, Indices, and Bonds |

| Do you get shareholder privileges and dividends? | Yes, you may receive dividends and shareholder rights. | No. |

| What are the trading hours? | You can access the Australian Securities Exchange market from 10AM to 4PM (Sydney time) | Flexible |

| What deposit is required to open the position? | $500 AUD | $200 USD or currency equivalent |

While both share trading and CFD trading carry risks, CFDs are generally seen as riskier. This is because they use leverage, which lets you open larger positions with a smaller amount of money. While this can boost potential profits, it also increases the chance of bigger losses — sometimes more than your initial investment. CFDs also tend to be more affected by short-term market changes, often come with extra costs like overnight fees, and don’t involve owning the actual asset.

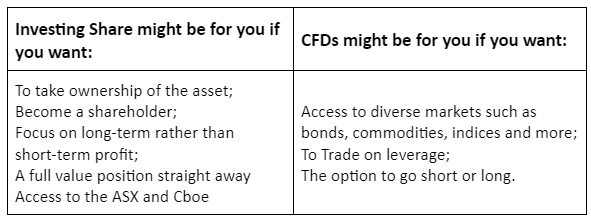

What is right for you?

As you now know, these two trading instruments are vastly different. Investing in financial markets can be a rewarding experience but comes with inherent risks. Before diving in, it’s important as a trader to do your own research and due diligence.