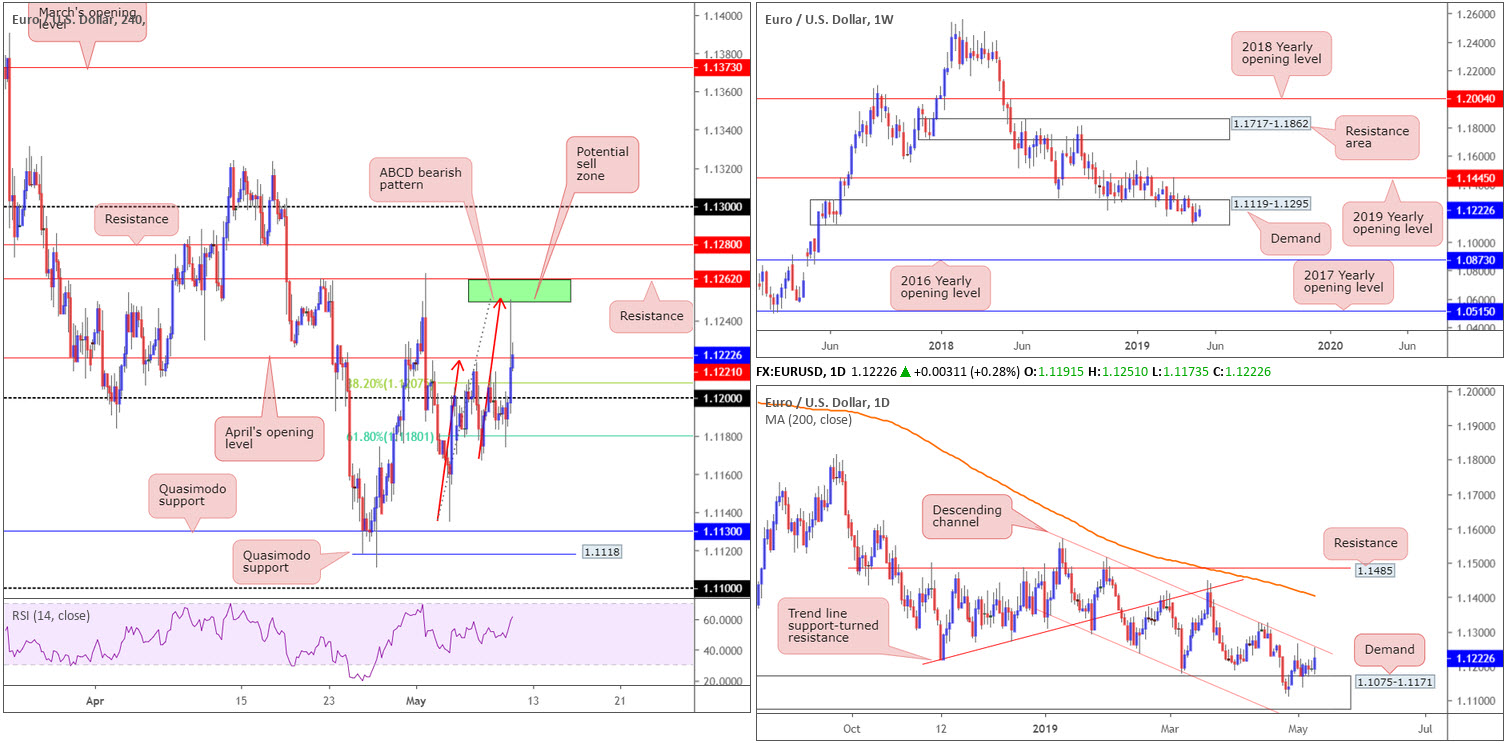

EUR/USD:

It was a particularly interesting session Thursday, having seen EUR/USD bulls punch out of its weekly range to a high of 1.1251. Bolstered by broad-based USD weakness – US players came in and sold the buck on risks of a breakdown in trade talks between the US and China – the H4 candles overthrew a number of key resistance levels and connected with an area of resistance (green) at 1.1262/1.1251 (comprised of a resistance level at 1.1262 and an ABCD measured move [red arrows] at 1.1251). For folks who read Thursday’s morning briefing you may recall the piece underlined this zone as an area worthy of shorts. Well done to any of our readers who managed to jump aboard this move.

Although weekly price remains warring for position within the parapets of a long-standing demand zone coming in at 1.1119-1.1295, the research team noted 1.1262/1.1251 boasted additional support by way of a daily channel resistance taken from the high 1.1569.

Areas of consideration:

Traders short the 1.1262/1.1251 H4 zone have the 38.2% Fibonacci support value (of legs A-D) at 1.1207 to target, followed by the 61.8% Fibonacci support value at 1.1180. The aforementioned Fib levels are considered traditional take-profit targets. Structurally, nonetheless, traders are also urged to note possible support emerging from the round number 1.12 and also the top edge of daily demand (fixed to the underside of the current weekly demand area) at 1.1075-1.1171.

Aside from 1.1262/1.1251, the research team sees little else to hang their hat on this week. Good luck to those short this market, though, and remember to keep eyes on the aforesaid H4 supports for signs of buying.

Today’s data points: US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

GBP/USD:

Outlook unchanged.

The British pound received fresh impetus Thursday amid a broadly weaker dollar, allowing the pair some much-needed respite. Amid a distinct lack of Brexit related commentary, we can see the H4 candles remain toying with the 1.30 neighbourhood and its surrounding supports.

As highlighted in Thursday’s morning brief, 1.30, by and of itself, is a widely watched figure, though you’ll notice it also draws in additional H4 support by way of (green) a Quasimodo resistance-turned support at 1.3008, a nearby 61.8% Fibonacci support value at 1.2985 and a symmetrical three-drive bullish pattern (black arrows) that terminates around 1.2988. Despite a whipsaw to lows of 1.2967, this area remains intact.

Reaching over to the bigger picture, similar to previous reports, has weekly price displaying signs of weakness ahead of a notable supply zone at 1.3472-1.3204, situated a few points south of the 2018 yearly opening level at 1.3503. Having observed this area hold price action lower on a number of occasions in the past, history has a good chance of repeating itself here should the area eventually be tested. Daily movement, on the other hand, is hovering just north of the 200-day SMA (orange), currently circulating around the 1.2954 region.

Areas of consideration:

Despite weekly flow screening signs of further selling and daily action poised to challenge its 200-day SMA, the H4 green zone pictured between 1.2985/1.3008 remains an area of interest for longs today. Before pressing the buy button, though, traders may wish to hold fire and wait for a DECISIVE H4 close above April’s opening level at 1.3018 to form (yesterday’s close above the level is not considered decisive). Entry can then be taken on the breakout candle’s close with a stop-loss order placed accordingly. This potentially clears the pathway as far north as the 1.31 neighbourhood, shadowed closely by February’s opening level at 1.3108.

Today’s data points: UK GDP m/m; UK Manufacturing Production m/m; UK Prelim GDP q/q; UK Prelim Business Investment q/q; US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

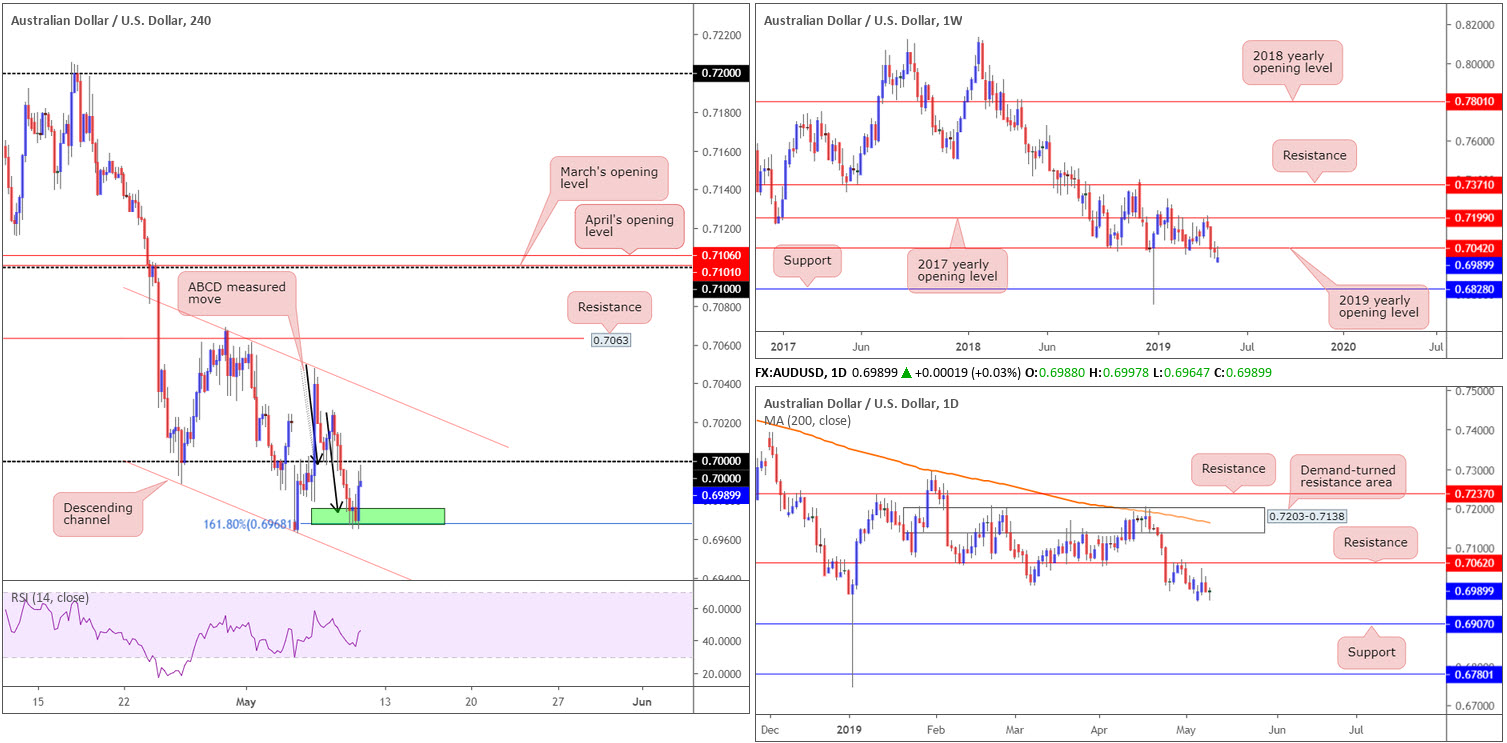

AUD/USD:

Heading into the later phase of Thursday’s segment the market observed a modest recovery take shape, bolstered on the back of commentary from US President Trump stating it was still possible for the US and China to reach a deal this week.

Technically speaking, however, the H4 candles encountered buying off its 161.8% ABCD measured move (black arrows) that completed around 0.6968/0.6976 (green). The move out of the said zone has positioned the unit within touching distance of key figure 0.70. Beyond the ABCD completion, as highlighted in previous analysis, the research team has channel support extended from the low 0.6988, followed by the round number 0.69 (not visible on the screen) in sight.

According to the higher-timeframe structure, further selling remains a likely event. Weekly flow is retesting the underside of its 2019 yearly opening level at 0.7042. An established move below here has support at 0.6828 to target. In conjunction with weekly movement, the daily timeframe also exhibits scope to explore lower ground beneath its resistance at 0.7062, steering for a move towards support at 0.6907.

Areas of consideration:

Traders might wish to consider selling the underside of 0.70, should the number come into play. In the event 0.70 is retested in the shape of a H4 bearish candlestick formation (entry and risk can be adjusted according to this pattern’s structure), a sell has a strong chance of reaching as far south as 0.69ish.

Remember, both weekly and daily action portends lower levels, therefore adding weight to 0.70 as a platform for sellers.

Today’s data points: RBA Monetary Policy Statement; US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

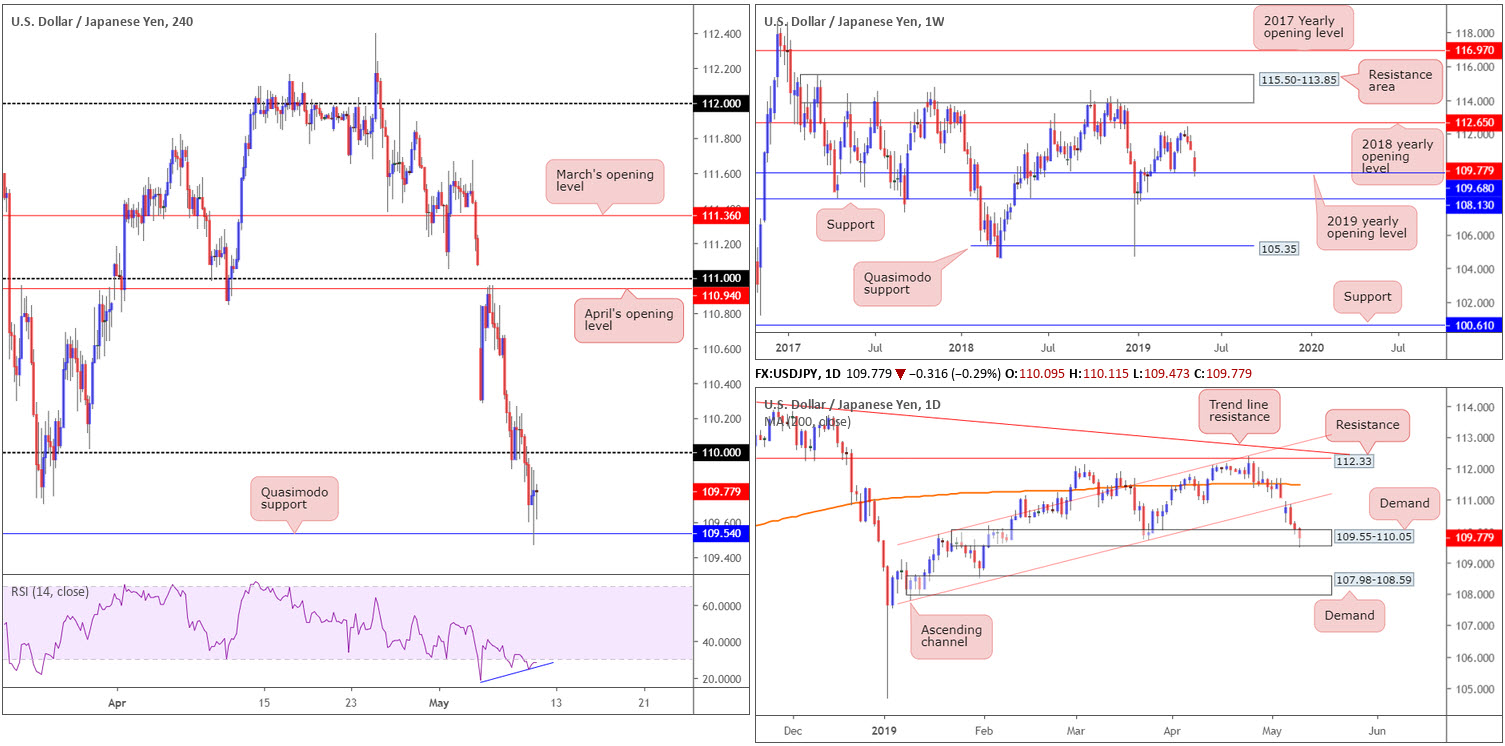

USD/JPY:

The Japanese yen, Swiss franc, gold and US Treasuries gained on risk aversion Thursday, consequently sending the USD/JPY sub 110 on the H4 timeframe towards Quasimodo support at 109.54. Traders may also wish to acknowledge the RSI indicator is currently churning out a positive divergence reading within oversold terrain (blue line).

In addition to the above, 109.54 boasts further backing from the higher timeframes. Weekly price, as you can see, is challenging its 2019 yearly opening level pencilled in at 109.68. What’s also interesting is daily flow is seen testing the lower limits of a demand zone drawn from 109.55-110.05. In fact, the current H4 Quasimodo support denotes (off by one point) the lower edge of the said daily demand zone.

Areas of consideration:

Having seen 109.54’s connection with higher timeframe demand, the research team notes to expect a move to at least 110. Of course, according to the higher timeframes, we could potentially stretch much higher than this point, though this is a logical starting base in terms of upside targets.

According to our technical reading, traders have two possible options going forward. First, wait and see if the H4 candles reclaim 110+ status and attempt to buy either the breakout candle or trade the retest. Second, should the pair retest the current H4 Quasimodo support and the H4 candles produce a bullish candlestick signal, traders may enter off the back of this formation.

Today’s data points: US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

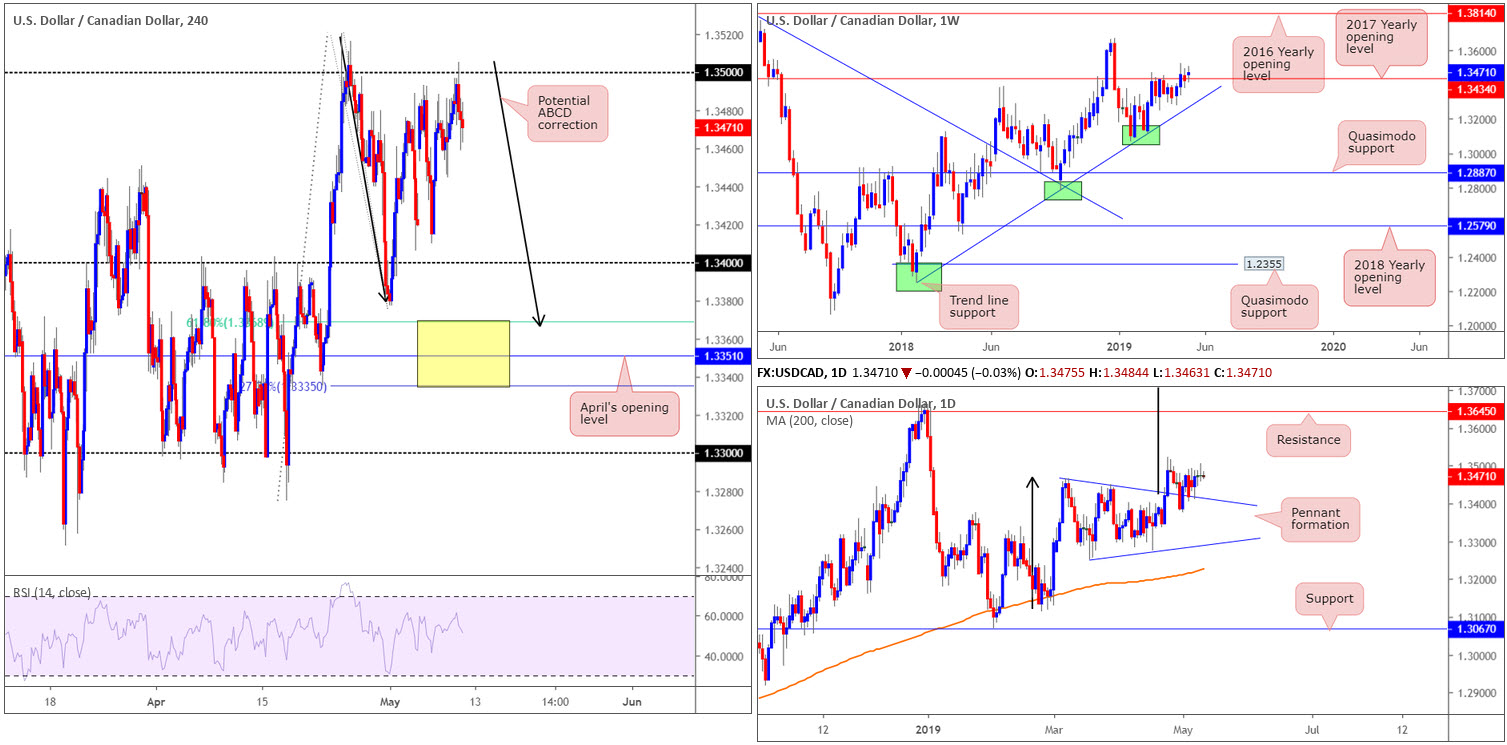

USD/CAD:

Since the beginning of the week, the USD/CAD has been trading within a narrow band, circulating beneath the 1.35 handle on the H4 timeframe. Meanwhile, crude oil prices struggled to build on its recent recovery, posting mild losses sub $62.

In view of another directionless performance, the following piece will echo a large portion of Wednesday’s outlook.

As emphasised in previous reports, 1.34 could hold price action higher should a test be realised, though the more appealing area of support (in terms of H4 confluence) resides lower down on the chart between (yellow) at 1.3335/1.3368. Comprised of April’s opening level at 1.3351 as the centre line, a 61.8% Fibonacci support value at 1.3368 and a potential ABCD (black arrows) 127.2% Fibonacci ext. point at 1.3335, this zone offers reasonably robust local confluence.

On a wider perspective, longer-term flows remain circulating above the 2017 yearly opening level at 1.3434. Beneath this base, traders’ crosshairs are fixed on trend line support taken from the low 1.2247, whereas continued buying could eventually lead to a move materialising in the direction of the 2018 yearly high of 1.3664.

A closer reading of price action shows the daily candles continue to feed off support drawn from the top edge of a pennant pattern (1.3467). Although the traditional price target (calculated by taking the distance from the beginning of the preceding move and adding it to the breakout price) remains on the chart (black arrows), the next upside target from a structural standpoint falls in around resistance at 1.3645.

Areas of consideration:

On account of our technical studies, 1.34 is a level of support to watch today given its close connection with the top edge of the daily pennant pattern.

The yellow H4 zone highlighted above at 1.3335/1.3368 is also likely to offer a bounce, in view of its H4 confluence.

Irrespective of which movement takes shape, traders may want to consider waiting and seeing if the H4 candles chalk up a bullish candlestick signal (entry and risk can then be determined according to the pattern’s rules) before pulling the trigger.

In the event further buying develops before connecting with either of the above said barriers, the market may observe a H4 close form above 1.35. Should this occur, traders have the choice of either buying the breakout candle and placing stop-loss orders beneath its tail, or waiting and seeing if a retest scenario takes shape and entering on the back of the rejection candle’s structure.

Today’s data points: US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

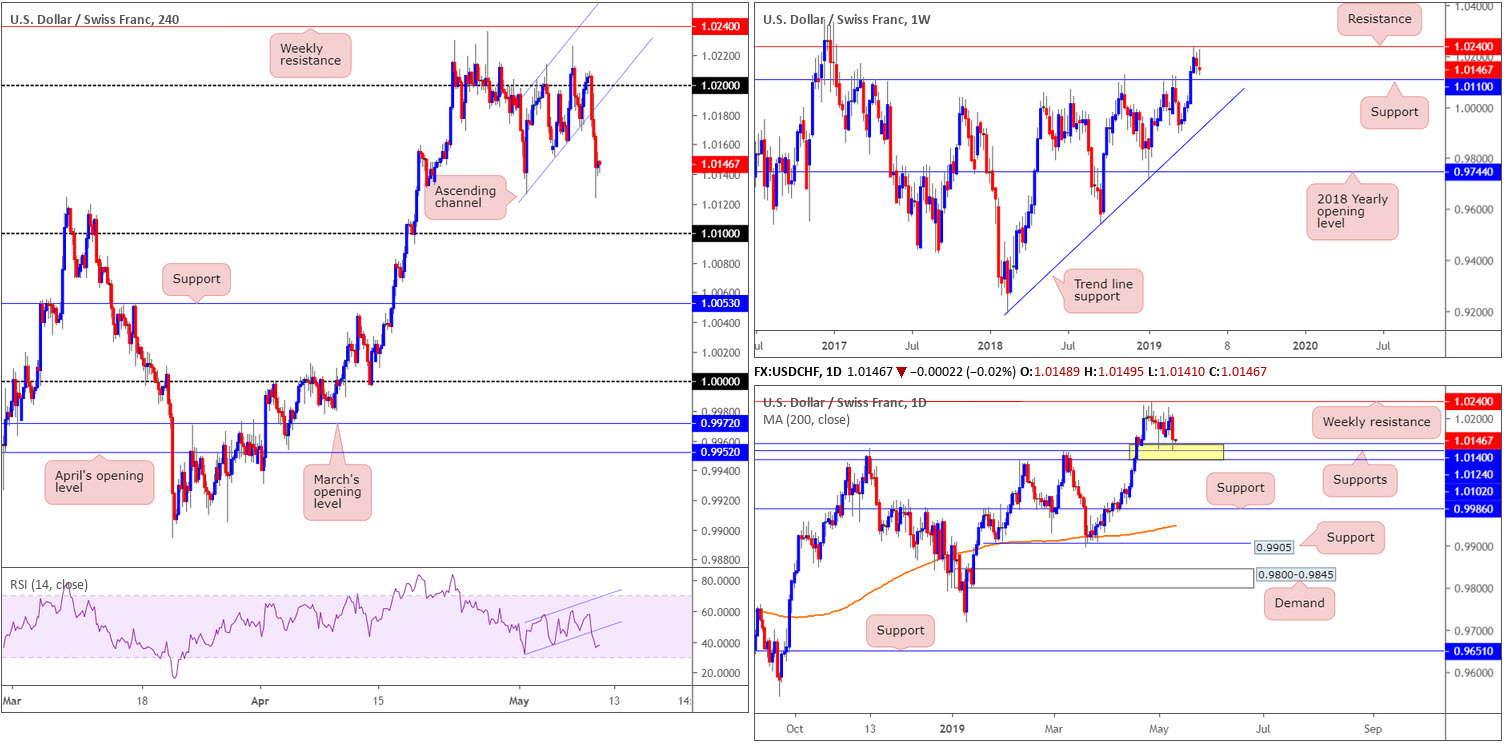

USD/CHF:

Mounting US/China trade tensions underpinned the Swiss franc’s safe-haven demand Thursday, exerting downward pressure on the USD/CHF.

Technically, the H4 candles elbowed their way through the lower edge of an ascending channel formation (1.0126/1.0203), and tested a session low of 1.0123. Although short-term traders likely have their crosshairs fixed on the 1.01 handle as the next support target, daily structure also boasts strong support (yellow) between 1.0102/1.0140. Another important point worth adding is weekly support at 1.0110 is also seen housed within the walls of the said daily support zone.

In light of the support surrounding the 1.01 handle, this figure, should the market test this far south, has the potential to rebound price significantly.

Areas of consideration:

While 1.01 is an incredibly attractive support, traders are urged to consider waiting for additional confirmation before pressing the buy button (entry and risk parameters can be determined according to the confirmation technique selected). This is simply due to the threat of a fakeout emerging through 1.01 (to run stops).

Today’s data points: US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

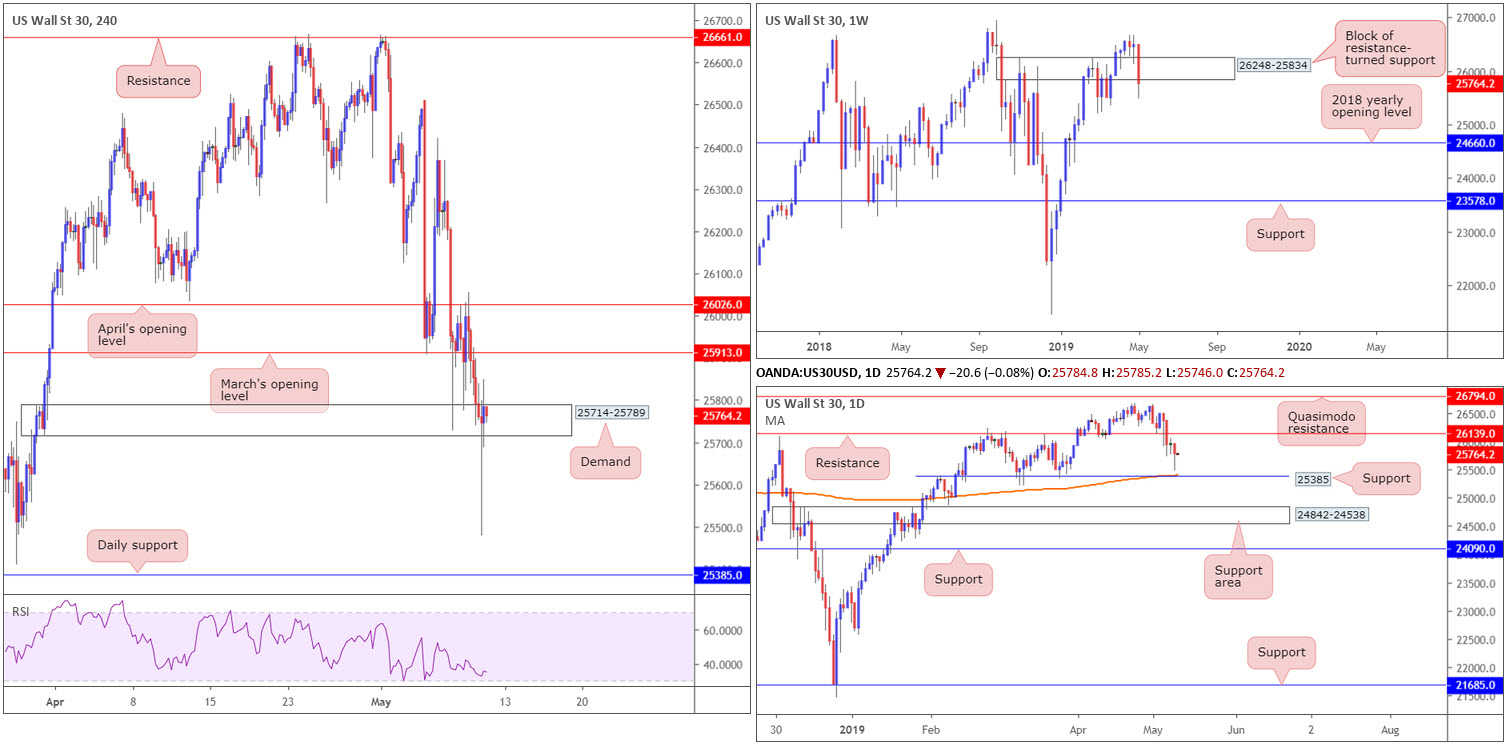

Dow Jones Industrial Average:

US equities declined for a fourth straight session Thursday, though managed to trim a large portion of losses off session lows after US President Donald Trump stated a trade deal with Beijing was still possible this week.

The technical position has weekly flow shaking hands with territory seen beneath its support area coming in at 26248-25834. A decisive break of this zone may call for a long-term target of 24660: the 2018 yearly opening level. The story on the daily timeframe, however, has the index facing a potential test of clear-cut support at 25385, which happens to currently align with the 200-day SMA (orange).

A closer reading of price action on the H4 timeframe displays demand at 25714-25789, which, as you can see, suffered a brutal whipsaw to lows of 25477 yesterday, likely tripping a truckload of stop-loss orders. With area beneath the said demand likely cleared of buyers, the next port of call in view is the daily support level mentioned above at 25385.

Areas of consideration:

Daily support at 25385 is likely an area of interest for many traders, owing to its connection with the 200-day SMA. Therefore, do make sure to keep an eyeball on this base going forward.

In the event our analysis is accurate and price continues to push lower, selling the underside of the current H4 demand on a retest (will be a resistance area at that point) could be an option, targeting the noted daily support. Whether or not additional confirmation is required is down to the individual trader, though it is recommended as weekly price has yet to formulate a close beneath its support area at 26248-25834.

Today’s data points: US CPI m/m; US Core CPI m/m; FOMC Member Brainard and Williams Speak.

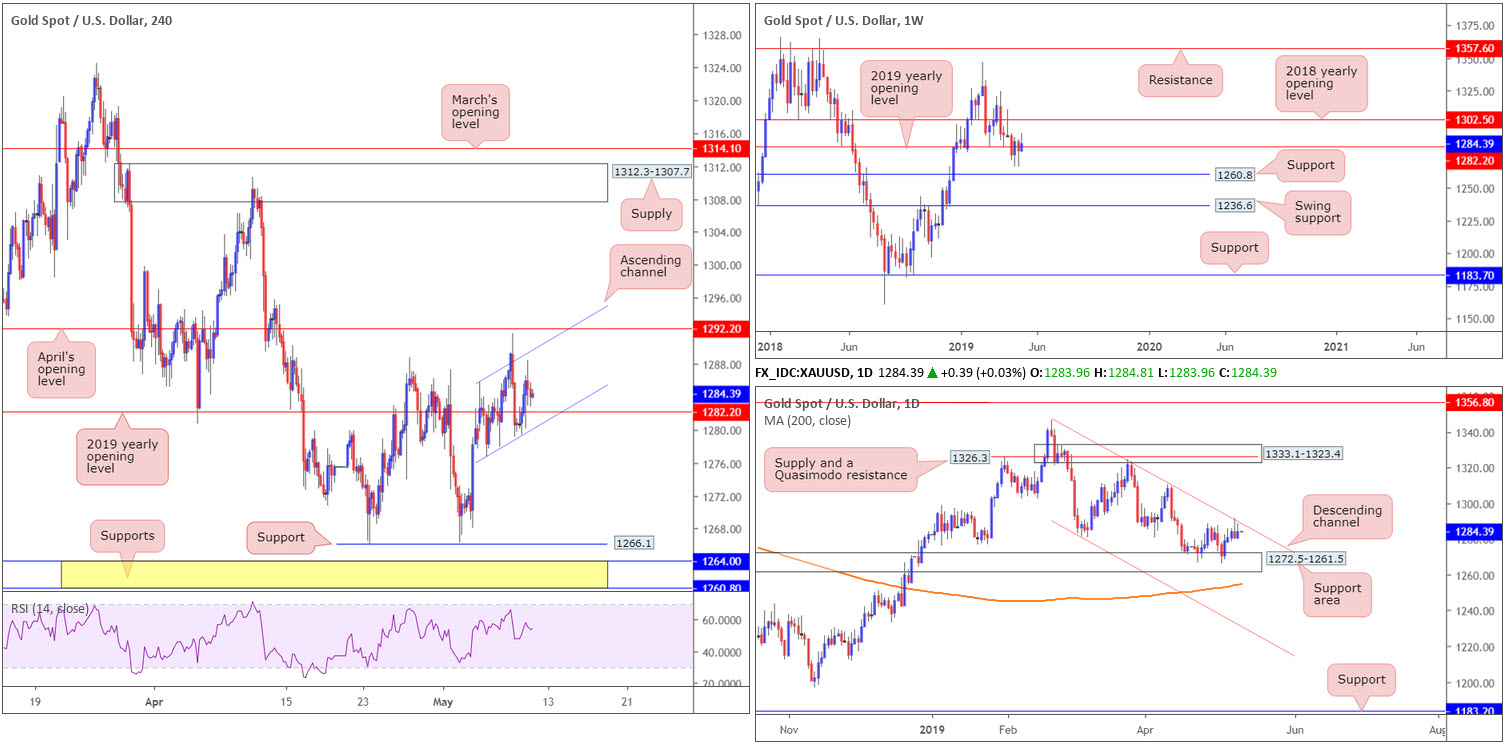

XAU/USD (GOLD):

The price of gold modestly advanced amid risk aversion Thursday, consequently retaining a marginal position above its 2019 yearly opening level at 1282.2. The next upside target to be aware of on the H4 timeframe falls in around April’s opening level at 1292.2. Beyond here, traders’ crosshairs likely fall on supply drawn from 1312.3-1307.7. Below 1282.2, however, support is visible at 1266.1, followed by two more layers of support at 1260.8/1264.0.

Weekly price, in relation to the aforementioned 2019 yearly opening level, has support coming in at 1260.8, whereas a decisive move above 1282.2 may call for an approach in the direction of the 2018 yearly opening level at 1302.5. Daily flow, on the other hand, is seen testing channel resistance taken from the high 1346.7, with a nearby support area plotted at 1272.5-1261.5 positioned as the next downside target.

Areas of consideration:

Traders may have noticed the H4 candles have been compressing within an ascending channel since the beginning of the week (1276.7/1285.8). This formation can be used to confirm potential direction. A break beneath the channel signals the sellers have the upper hand on the daily timeframe and could push lower. However, do remain cognizant of the nearby daily support area which could hamper selling. A break of the H4 channel to the upside, and preferably above April’s opening level, suggests further buying could be in store.

In regards to specific entry techniques, traders could simply look to trade a break/retest play once a direction is in view, targeting H4 supply at 1312.3-1307.7 for longs and the top edge of the daily support area at 1272.5 for shorts.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.