Key risk events today:

Limited data.

(Previous analysis as well as outside sources – italics).

EUR/USD:

For those who read Thursday’s technical briefing you may recall the following (italics):

September’s opening value on the H4 and daily resistance at 1.1940 marks healthy (resistance) confluence to work with.

As evident from the H4 scale, sellers came forward Thursday after establishing a fresh monthly peak of 1.1941, bolstered by September’s opening value on the H4 at 1.1937 and daily resistance priced in from 1.1940. Sellers, as you can see, attempted to overthrow 1.19 to the downside, though found thin air around session lows at 1.1885.

Meanwhile, the weekly timeframe shows the pair can potentially accommodate further upside until shaking hands with the 2018 yearly opening value at 1.2004, closely shadowed by Quasimodo resistance priced at 1.2092.

The daily timeframe, as underlined above, had price test resistance at 1.1940 (fixed beneath Quasimodo resistance from 1.1965) yesterday. Though in light of holiday-thinned trading, sellers have been somewhat reluctant to commit.

Areas of consideration:

- September’s opening value on the H4 and daily resistance at 1.1940 remains healthy (resistance) confluence, despite failing to conquer nearby 1.19 support.

- A decisive H4 close sub 1.19 might interest sellers, due to daily resistance making an appearance and yesterday’s dip beneath the round number likely destroying intraday bids (tripping stops). Possible downside targets fall in at H4 Quasimodo support drawn from 1.1816 and the 1.18 handle.

- Weekly resistance, in the shape of the 2018 yearly opening value, at 1.2004 joins closely with the key figure 1.20 on the H4, consequently representing sturdy resistance.

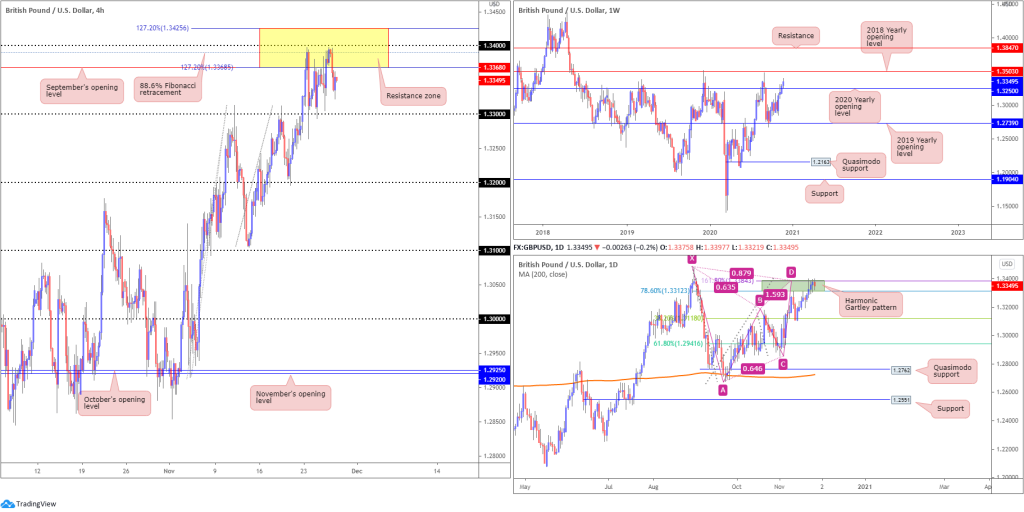

GBP/USD:

Familiar resistance at (yellow) 1.3425/1.3368 (made up of two 127.2% Fibonacci projection points at 1.3425/1.3368, the round number 1.34, an 88.6% Fibonacci retracement ratio at 1.3390 and September’s opening value at 1.3368) is proving stubborn, in particular the 88.6% Fibonacci retracement ratio at 1.3390. However, equally tenacious of late has been the 1.33 handle, serving well as resistance earlier in November and recently as support this week.

From the weekly timeframe, after rejecting the 2019 yearly opening value from 1.2739 in September, buyers eventually mustered enough strength to take on the 2020 yearly opening value at 1.3250 last week and record a third consecutive weekly gain. Additional strength could have the unit knock on the door of the 2018 yearly opening value from 1.3503. Yet, technically, the immediate trend has remained lower since topping in 2014.

Elsewhere, the daily picture is seen testing the resolve of the bearish harmonic Gartley pattern’s PRZ at 1.3384/1.3312. Overthrowing the aforementioned PRZ could be viewed as an early cue we’re headed for the 2018 yearly opening value at 1.3503 on the weekly scale.

Areas of consideration:

- Weekly buyers targeting 1.3503 and daily sellers under pressure within the bearish harmonic Gartley pattern’s PRZ at 1.3384/1.3312, explains (technically) H4 sellers’ reluctance to push through 1.33. Therefore, this positions H4 sellers out of the resistance zone from 1.3425/1.3368 in a vulnerable position.

- Bullish scenarios, in light of the above analysis, may be found off the 1.33 region (in the event of a correction) or north of the 1.34 handle (H4).

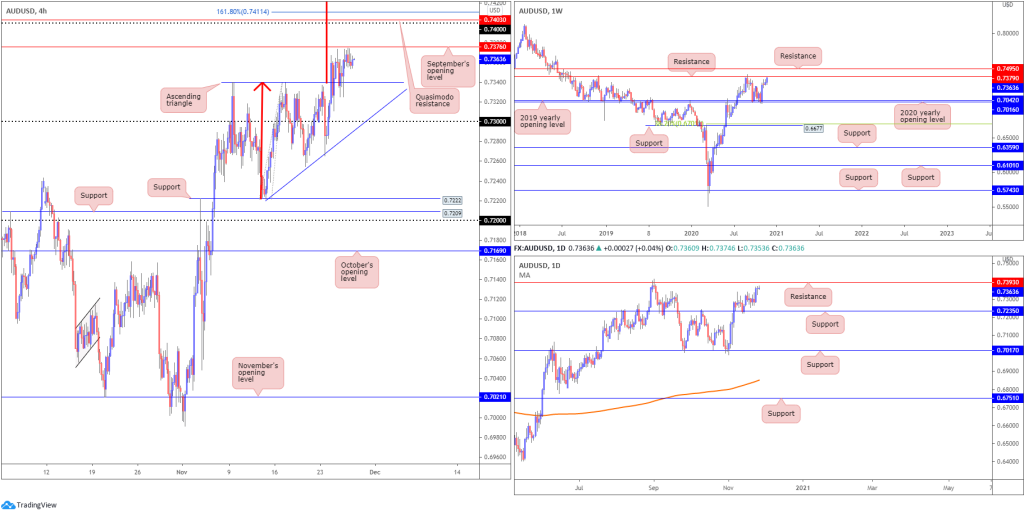

AUD/USD:

AUD/USD entered into a tight sideways grind Thursday amid thin trading conditions. For that reason, the following analysis will echo thoughts aired in Thursday’s technical briefing.

Recent action breached the top side of a H4 ascending triangle pattern (0.7340). This projects a possible target of around 0.7544 (red arrows), implying a break above September’s opening value at 0.7376, the 0.74 handle and Quasimodo resistance at 0.7403.

Buyers, based on the weekly timeframe, are seen extending the 3% showing off the 2020 (0.7016) and 2019 (0.7042) yearly opening values (supports) formed early November, positioning the unit within striking distance of resistance at 0.7379. In view of this market trending higher since early 2020, buyers may also be eyeballing resistance parked at 0.7495.

Following the November 13 retest of support at 0.7235, despite a somewhat lacklustre performance last week, buyers have eventually found some grip and shined the spotlight on resistance at 0.7393 (positioned above weekly resistance).

Areas of consideration:

- Breakout buyers above the H4 ascending triangle have an ultimate target of 0.7544, though could have problems with resistances nearby (see below).

- September’s opening value at 0.7376, weekly resistance at 0.7379 and daily resistance at 0.7393 form an area of resistance to be mindful of.

- 74 on the H4, along with Quasimodo resistance at 0.7403 and a 127.2% Fibonacci projection point at 0.7411, is also an area to be aware of.

USD/JPY:

In observance of the Thanksgiving holiday, thinned liquidity witnessed limited movement on USD/JPY Thursday.

With the DXY hovering a touch off monthly lows, USDJPY moderately extended its bearish presence south of November’s opening value at 104.50 on the H4 yesterday. 104 demands attention should sellers remain in the driving seat, with a break exposing 103.70 lows.

Higher timeframes unchanged:

Weekly price, since connecting with the underside of supply at 108.16-106.88 in August, has gradually shifted lower and developed a declining wedge (106.94/104.18). Quasimodo support at 102.55 is in the picture, with a break revealing support plotted at 100.61. A strong bounce from 102.55 may provide enough impetus for buyers to attempt a breakout above the current declining wedge.

The technical landscape from the daily timeframe, however, reveals scope to close in on trend line resistance, extended from the high 111.71. Nevertheless, sellers taking over could lead price to the 103.17 November 6 low, followed by weekly Quasimodo support at 102.55.

Areas of consideration:

- Retesting 104.50 on the H4 scale today as resistance may be a platform sellers show interest in, targeting at least 104.

USD/CAD:

USD/CAD action enters Friday a touch higher, moderately balancing off the key figure 1.30 on the H4 timeframe. WTI is seen fading nine-month highs (mildly weighing on the Canadian dollar and propping up USD) while the DXY, or US dollar index, posted modest gains off monthly lows.

Despite the mild bullish cheer off 1.30, intraday resistance at 1.3020 remains challenging. Though unseating this area could see buyers make their way towards September’s opening value at 1.3043, with subsequent upside to throw 1.31 back into the pot as possible resistance. Should buyers fail to inspire follow-through action off 1.30, Quasimodo support at 1.2927 is lying in wait.

However, before reaching for the aforementioned H4 Quasimodo, as underlined in yesterday’s technical briefing, traders might want to take into account weekly support resides close by in the form of a 2020 yearly opening value at 1.2975, as well as daily support coming in at 1.2973 (essentially marking the same region).

Areas of consideration:

- Given 1.30 (H4) is a widely watched figure, buyers are unlikely to give up this level without a fight.

- A fakeout through 1.30 to welcome buyers off weekly/daily supports at 1.2975ish could arise. A reaction off higher timeframe supports, fuelled on sell-stop liquidity (from under 1.30), may see buyers close back above 1.30, a move that might attract additional buyers back to September’s opening value at 1.3043 (H4).

USD/CHF:

After strong-arming through 0.91 and H4 support at 0.9075-0.9088 on Wednesday, Thursday extended losses following a failed attempt to retest the underside of 0.91 amid mild risk aversion bolstering CHF demand. Beyond 0.9075-0.9088, bearish scenarios could develop towards September’s opening value at 0.9038, followed by the key 0.90 level.

Further afield, the daily timeframe also exhibits scope to navigate lower ground following a test of resistance at 0.9187 earlier in November, with Quasimodo support at 0.9009 representing a possible downside objective. It’s also worth acknowledging trend line resistance resides close by, taken from the high 0.9901.

Weekly price is seen lingering mid-way between support at 0.9014, a level dovetailing closely with ABCD support at 0.9051 (black arrows), and 0.9255 resistance (a prior Quasimodo support). It should also be noted this market has been trending lower since April 2019, seen clearly from the weekly scale.

Areas of consideration:

- Sellers are likely to pursue bearish themes today, eyeballing September’s opening value at 0.9038 on the H4 scale as an initial target. Should a 0.91 retest materialise, this may also drive activity, perhaps fuelled on buy-stop liquidity residing above yesterday’s peak at 0.9093.

Dow Jones Industrial Average:

Recent hours saw H4 price extend its bearish stance south of the widely watched 30,000 figure. This followed Wednesday’s move to all-time peaks at 30,217, establishing what many technicians will view as an early bull trap.

H4 support at 29,518 is in sight, while digging lower may have sellers make their way towards two Quasimodo supports at 29,202 and 29,240.

Meanwhile, on the bigger picture, weekly support is not expected to make an appearance until around the 2020 yearly opening value at 28,595. Similarly, declining support on the daily timeframe, taken from the high 29,193, also offers support around the 28,595ish area.

Areas of consideration:

Outlook unchanged.

- For many, this will be a difficult unit to sell sub 30,000, having recently witnessed fresh all-time highs.

- Dip-buyers are likely watching H4 support at 29,518 and the two Quasimodo supports at 29,202 and 29,240.

- Crossing back above 30,000, on the other hand, could ignite breakout strategies.

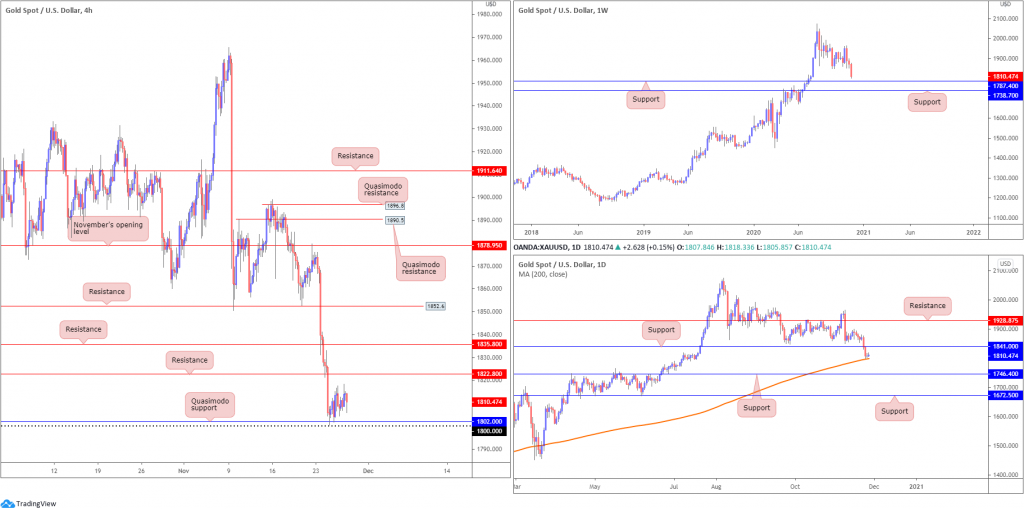

XAU/USD (GOLD):

It was another sluggish day for the precious metal on Thursday amid thin trading conditions due to the Thanksgiving holiday in the US.

H4 price movement remains afloat north of the $1,800 level and H4 Quasimodo support at $1,802. As described in yesterday’s technical briefing, buyers may struggle to find a foothold off $1,800 as daily action reveals a mild fakeout through $1,800 into the 200-day SMA (orange – $1,798) could be in store. Traders may also acknowledge weekly price suggests an extension to the downside towards support coming in at $1,787.

Areas of consideration:

- H4 whipsawing through $1,800 to test the 200-day SMA on the daily timeframe at $1,798 is a possible scenario. Buyers defending the SMA and printing a H4 close back above $1,800 may invite additional buyers into the fight.

- Holding south of $1,800, on the other hand, could fuel a bearish play, with sellers potentially targeting weekly support at $1,787.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property