Friday 30th August: Dollar index on track to test 99.00 ahead of consumer spending data.

The buck firmed Thursday as newswires cited easing tensions between the US and China, consequently weighing on the single currency. The US dollar index extended gains for a second consecutive session, challenging 98.50.

Thursday 29th August: Pound testing 1.22 as no-deal Brexit more likely as UK Parliament heads for prorogation.

Key risk events today: German Prelim CPI m/m; Canadian Current Account; […]

US Labour Day Trading Schedule 2019

Please find our Updated trading schedule and general information for the US Labor Day Holiday on Monday, 2nd September 2019 below. All times mentioned below are Platform time (GMT +3).

Wednesday 28th August: Technical outlook and review.

Europe’s single currency eked out marginal losses versus its US counterpart Tuesday, consequently extending Monday’s losses. On the data front, The US conference board consumer confidence Index declined slightly in August, following July’s rebound.

Tuesday 27th August: Dollar attempting to reclaim 98.00+ status after recouping a large portion of recent losses.

Key risk events today: RBA Deputy Gov Debelle Speaks; MPC Member […]

Monday 26th August: Weekly technical outlook and review.

The US dollar fell sharply across the board Friday amid trade escalations between the US and China. Beijing announced it was slapping tariffs on $75bln of US goods at rates between 5% and 10% in response to the US’ moves to apply tariffs on China in September and December.

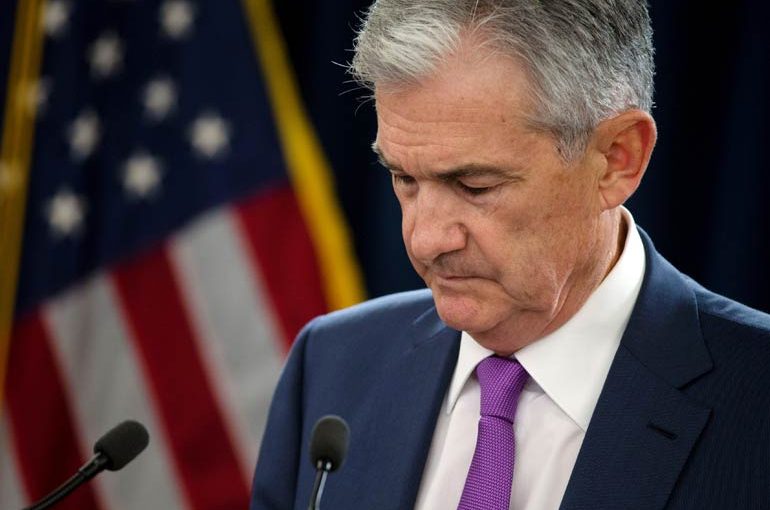

Friday 23rd August: Markets remain subdued as focus shifts to Fed Chairman Jerome Powell’s speech in Jackson Hole, Wyoming.

Europe’s single currency remained within a familiar range Thursday, constrained by August’s opening level at 1.1079 and the 1.11 border on the H4 timeframe. Although Eurozone PMIs firmed, the euro’s dial failed to turn.

UK Summer Bank Holiday Schedule 2019

Please find our updated trading schedule for the UK Summer Bank Holiday Schedule on 26th - 27th August, 2019.

Thursday 22nd August: Focus shifts to Jackson Hole Symposium amid mild dollar recovery.

Minutes for the July FOMC stated Federal Reserve officials viewed their interest-rate cut last month as insurance against too-low inflation and the risk of a deeper slump in business investment stemming from uncertainty over President Donald Trump’s trade war.