Wednesday 13th November: Technical analysis and review.

Despite kicking off the week strongly, GBP/USD movement entered a reasonably narrow consolidation Tuesday, between 1.2873/1.2815. On the data front, unemployment in the UK ticked lower by 3.8% vs. 3.9%, while average earnings reported a 3.6% decline vs. 3.7%, revised from 3.8%.

Tuesday 12th November: Dollar snaps five-day winning streak; a retest of 98.00 likely in store.

Key risk events today: UK Average Earnings Index 3m/y; UK Claimant […]

Friday 8th November: Dollar index closes above 98.00 though faces weekly trend line resistance.

The European shared currency traded lower against the buck Thursday, erasing more than 0.15% and recording its fourth successive losing session. The dollar index firmed yesterday, breaching 98.00 to the upside as US Treasury yields rose sharply – 10-year note trades at 1.919% – amid positive US/China trade headlines that triggered safe-haven outflows.

Thursday 7th November: Havens gather momentum on news November’s phase one deal signing could be delayed to December.

Europe’s shared currency shifts into Thursday a shade lower against the buck, retreating from Wednesday’s high at 1.1092. Tier-1 macroeconomic data was limited Wednesday, though better-than-expected Eurozone services PMIs did provide fresh impetus.

Wednesday 6th November: Dollar circulates below 98.00; eyes weekly trend line resistance.

Key risk events today: Crude Oil Inventories. EUR/USD: In recent sessions, […]

Tuesday 5th November: Havens wane on positive trade-deal hopes.

Key risk events today: RBA Rate Statement and Cash Rate; UK […]

Monday 4th November: Weekly technical outlook and review.

The headline seasonally adjusted UK manufacturing purchasing managers’ index (PMI) rose to 49.6 in October, up for the second successive month but remaining below the neutral 50.0 mark separating expansion from contraction, according to Markit.

Friday 1st November: Dollar records successive losses ahead of US non-farm payrolls.

Europe’s common currency finished unmoved against the buck Thursday, unresponsive to European growth and unemployment indicators.

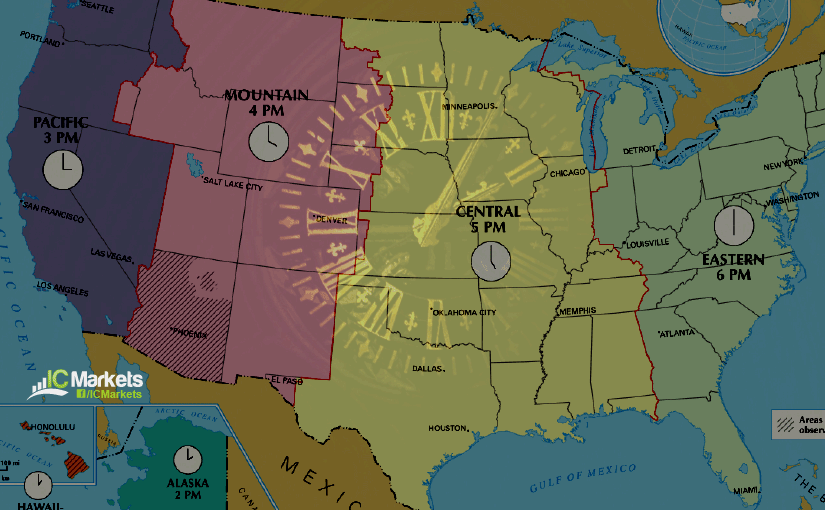

US Daylight Savings : Updated Trading Schedule 2019

Please find our updated Trading schedule as US will enter Daylight Savings Time on Sunday, 03rd November, 2019.