Key risk events today:

Eurozone Flash Manufacturing/Services PMIs; UK Flash Manufacturing PMI and Flash Services PMI; Canada Core Retail Sales m/m and Retail Sales m/m; US Flash Manufacturing PMI.

(Previous analysis as well as outside sources – italics).

EUR/USD:

EUR/USD concluded Thursday pretty much unchanged, but did manage to chalk up a bearish outside formation on the daily timeframe. The US dollar index continued to reign supreme, weighing on the euro and picked to approach 100.00.

The H4 candles continue to echo a bearish stance, capped at the underside of the 1.08 handle and forming what appears to be a broadening pattern (blue lines). Technically, we now also have weekly price crossing paths with channel support, taken from the low 1.1109, after engulfing the 2016 yearly opening level from 1.0873 last week. Daily flow, on the other hand, has price trading below support priced in at 1.0832, now a serving resistance. The next port of call, in terms of supportive structure on the daily timeframe, falls in at 1.0677.

The H4 timeframe, as briefly highlighted above, shows the unit gripping the underneath of 1.08. While the next support on the H4 scale can be found at 1.0735, traders need to acknowledge the prospect of a move forming off weekly channel support. Indicator-based traders may also want to note the relative strength index (RSI) began ascending from oversold waters, where it has remained since February 6th.

Areas of consideration:

Those who read recent technical briefings may recall the following:

A dip through 1.08, triggering sell-stop liquidity, to the aforementioned channel support on the weekly timeframe is certainly a scenario worth keeping an eye out for. A test at the weekly channel support followed up with a close above 1.08 would, for most price-action based traders, be considered a reliable countertrend signal, with daily resistance at 1.0832 positioned as the initial upside target.

The above post remains intact, therefore, a decisive H4 close back above 1.08 is eyed today.

While it may be tempting to sell on the back of yesterday’s daily bearish outside candle, the threat of weekly buyers defending the current channel support is likely too much for sellers to take on, despite the pair’s strong underlying offer right now.

GBP/USD:

Early London Thursday had the pound bid north of the 1.29 handle amid upbeat UK retail sales in January, clocking a high at 1.2926. Optimism, however, was short-lived, pulling GBP/USD through 1.29 on the back of healthy USD upside across the board. Underneath 1.29, the 1.2872 February 10th low was taken, with appealing support residing around 1.2824. Also interesting was the relative strength index (RSI) digging into oversold soil, testing lows at 19.30.

On a wider perspective, we have the weekly timeframe languishing beneath long-standing trend line resistance, pencilled in from the high 1.5930, though demand around the 1.2939 region is also still in motion (black arrow). Continued downside may imply a break of the said demand, tripping sell stops and testing the 2019 yearly opening level at 1.2739. A break higher, on the other hand, could see the 2018 yearly opening level enter the fight at 1.3503.

Sellers maintained a downside presence over the course of the week, extending losses south of a trend line support-turned resistance, taken from the low 1.2768, which entered view last week on the daily timeframe. Further selling may set the stage for a run to support fixed at 1.2769, a 127.2% Fibonacci extension at 1.2738 and the 200-day SMA (1.2688). Note the said SMA has been flattening since mid-October 2019.

Areas of consideration:

Ultimately, the higher timeframes suggest we could be in for more losses, with daily support at 1.2769 in line as the initial downside target.

A H4 retest at 1.29 today, therefore, could be a worthy contender for shorting opportunities. Traders then have the option of selling, based on the rejection candle’s framework, which could form a bearish candlestick signal, initially targeting H4 support mentioned above from 1.2824.

AUD/USD:

A mixed labour market report, released in the early hours of Thursday, along with relentless USD upside, drove the Australian dollar to lows at 0.6610 against the US dollar, levels not seen since 2009. The H4 candles now have eyes for the 0.66 handle, reinforced by a 161.8% Fibonacci extension at 0.6596 and the relative strength index (RSI) elbowing its way deeper into oversold ground. Moving through 0.66 may lead to channel support surfacing, taken from the low 0.6850.

Further afield, the story on the weekly timeframe has the current candle twirling within close proximity of a long-term rising wedge take-profit target at 0.6599 (black arrows – calculated by taking the height of the base and adding it to the breakout point), followed by support at 0.6359 (not visible on the screen). Note the round number 0.66 on the H4 converges with the current weekly base.

The key observation on the daily timeframe, nonetheless, is the recent taking of support coming in at 0.6677. The next support target beyond 0.6677, in the event of further selling, falls in around 0.6508 (not visible on the screen).

Areas of consideration:

Key focus this morning is the 0.66 handle and its aligning 161.8% Fibonacci extension at 0.6596, as well as the weekly rising wedge take-profit target at 0.6599.

Although entering long from 0.66 is considered a countertrend trade, the level, owing to its surrounding confluence, likely contains enough juice to prompt at least intraday short covering. Conservative traders who wish to add a little more confirmation to the mix may consider waiting for additional candlestick confirmation before pulling the trigger. This not only identifies buyer intent; it provides entry and risk levels to work with.

USD/JPY:

Despite the lack of fresh fundamental catalysts, USD/JPY buyers entered a strong offensive phase Thursday, punching through Quasimodo resistance at 111.55 on the H4, now a serving support, and in recent hours, firming above 112, levels not seen since April 2019. Traders may also want to acknowledge the relative strength index (RSI) is seen deep within overbought territory, hovering just south of 90.00.

As much as H4 price is attempting to hold north of 112 right now, breakout buyers may be entering long into a strong wave of higher-timeframe selling here. The daily timeframe has eyeballs on Quasimodo resistance at 112.19. Converging closely with the said Quasimodo is another layer of Quasimodo resistance on the weekly timeframe at 112.14, seen circling a few points below the 2018 yearly opening level plotted at 112.65.

Areas of consideration:

Between 112.65 and 112.14 is a region technical research anticipates selling activity. With upside incredibly robust, though, traders are urged not to take any chances. It is recommended to wait and see if the H4 candles can win back 112 and close lower before considering bearish scenarios.

A close south of 112, together with higher-timeframe resistances in motion right now, would likely be enough to encourage a run to H4 support 111.55, the 111 handle and daily support priced in at 110.89. Conservative traders will likely want to see a retest at the underside of 112 before committing (entry and risk can then be calculated based on the rejecting candlestick’s structure).

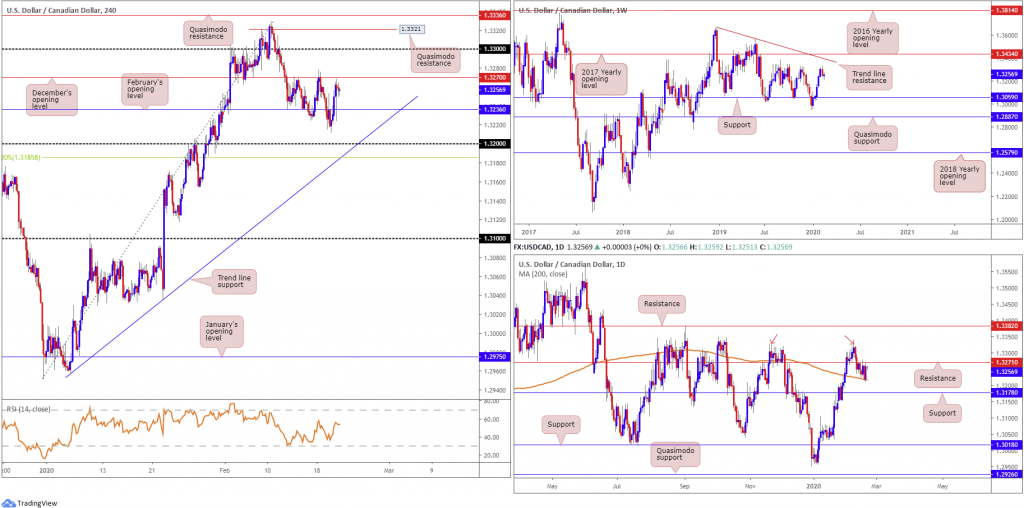

USD/CAD:

Thursday had WTI ease from multi-week highs and elbow back below $54/bbl. This, as well as the US dollar index marching to fresh highs a few points south of 100.00, weighing on the Canadian dollar, lifted USD/CAD higher. February’s opening level on the H4 timeframe at 1.3236 represents support, while December’s opening level at 1.3270 echoes a familiar resistance. North of here we can see the 1.33 handle as the next layer of resistance, closely shadowed by Quasimodo resistance at 1.3321.

Further out on the weekly timeframe, price remains pretty much unchanged, in terms of structure. Price halted just south of tops around 1.3340 last week. Additional resistance resides at a trend line formation (1.3661) and the 2017 yearly opening level at 1.3434. Support can be found around the 1.3059 neighbourhood.

Price action on the daily timeframe has buyers and sellers battling for position between resistance at 1.3271 and the 200-day SMA (orange – 1.3217). A break to the upside has tops around 1.3329 to target (red arrows), while moves lower perhaps unlocks the trapdoor to a well-rounded support from 1.3178.

Areas of consideration:

The combination of December’s opening level on the H4 timeframe at 1.3270 and daily resistance at 1.3271 could entice selling today, targeting February’s opening level at 1.3236 as the initial support.

A break of 1.3270 clears the path for intraday buying to 1.33, followed by H4 Quasimodo resistance at 1.3321 and then daily tops at 1.3329. The best course of entry is trader dependent, though conservative traders likely seek a retest at 1.3270 as support before committing.

USD/CHF:

Outlook remains unchanged due to lacklustre movement.

USD/CHF modestly built on Wednesday’s upside Thursday, extending recovery gains off the 0.98 retest, based on the H4 timeframe. Early US did witness a pop to lows at 0.9815, though losses were swiftly pared to the top edge of the daily range.

From the weekly timeframe, traders can see trend line support-turned resistance, drawn from the low 0.9187, is under pressure. Trend line resistance, etched from the high 1.0236, is next in line in terms of long-term resistance targets.

On to the daily timeframe, broad-based USD bidding lifted the pair to resistance at 0.9843 in recent trade, positioned a few points beneath the 200-day SMA (orange – 0.9860). This follows last week’s break of resistance at 0.9771, now a serving support base. Continued bidding through the said resistances may encourage additional US dollar upside to a resistance area coming in at 1.0010/0.9986.

Back to the H4 timeframe, the next port of call, with respect to resistances can be seen at November’s opening level from 0.9864. What’s interesting is this level also comes with a 61.8% Fibonacci retracement at 0.9867 and the said 200-day SMA on the daily timeframe. Indicator-based traders may also wish to note we still view the relative strength index (RSI) as producing bearish divergence (blue level).

Areas of consideration:

Traders long the 0.98 retest on the H4 timeframe have likely reduced risk to breakeven after price tested daily resistance at 0.9843. Ultimately, though, the next upside target on the H4 timeframe rests at 0.9864.

Not only is 0.9864 an upside target for any longs in this market, the level represents a potential sell zone. Aligning closely with the 200-day SMA and a H4 61.8% Fibonacci retracement, a pullback from here is considered high probability, targeting at least 0.9830ish as the initial downside base, followed by 0.98.

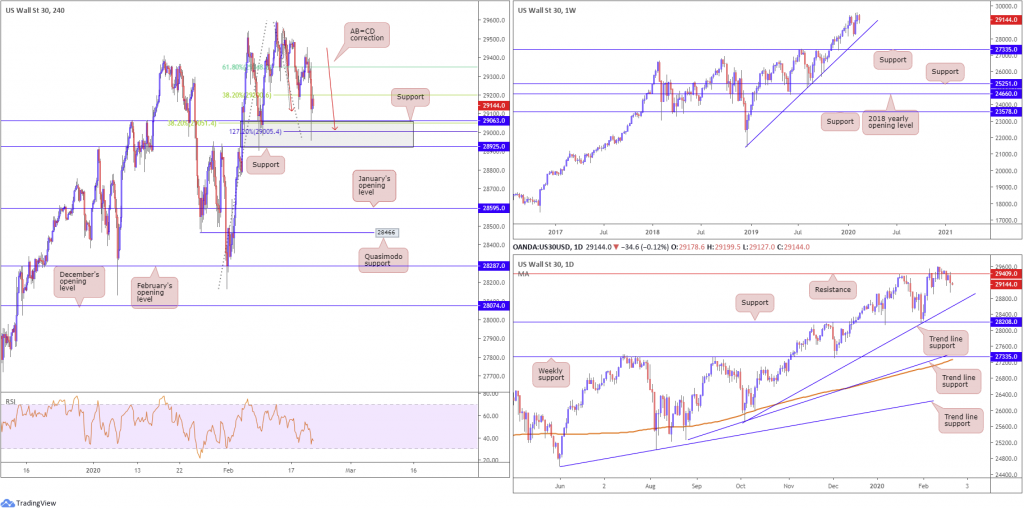

Dow Jones Industrial Average:

Major US benchmarks slid Thursday amid uncertainty regarding the impact of China’s coronavirus epidemic. The Dow Jones Industrial Average lost 128.05 points, or 0.44%; the S&P 500 declined 13.95 points, or 0.41% and the tech-heavy Nasdaq 100 ended lower by 90.90 points, or 0.94%.

For traders who read Thursday’s technical briefing you may recall the following (italics):

Technical developments on the H4 timeframe remain focused on a support area coming in at 28925/29063 (grey), which houses a 38.2% Fibonacci value at 29051. Recent activity also underlined a possible 127.2% AB=CD (red arrows) correction at 29005. South of 28925/29063, January’s opening level at 28595 is in the offing, as is Quasimodo support at 28466.

Further out, the weekly candles remain in a healthy position north of trend line support, taken from the low 21452. Outside of the aforementioned trend line, support rests at 27335.

Closer analysis of price on the daily timeframe has current action retesting the lower boundary of a recently broken support at 29409. Should sellers strengthen their grip, trend line support, extended from the low 25710, may enter view, with a break possibly clearing the pathway to support coming in at 28208. Yet, a jump back through the said level may be interpreted as an early cue we’re heading to all-time highs at 29595.

As evident from the H4 timeframe this morning, 28925/29063 welcomed a test during US hours yesterday, approached in the form of the said AB=CD correction. Price has so far respected the zone, and tested the 38.2% Fibonacci retracement of legs A-D at 29202 (usually considered the first take-profit target for AB=CD patterns). The second take-profit target can be seen at the 61.8% Fibonacci retracement at 29352, also taken from legs A-D.

Areas of consideration:

Well done to any readers who managed to secure a long position out of 28925/29063. Reducing risk to breakeven at this point may be an idea, given the current 38.2% Fibonacci retracement may hinder upside. The 61.8% Fibonacci retracement at 29352, as stated above, is the next upside target, closely followed by daily resistance mentioned at 29409.

XAU/USD (GOLD):

XAU/USD spot advanced for a third successive session Thursday, adding more than $8, or 0.51%. Fading equity markets and soft US Treasury yields, along with mounting concerns regarding the coronavirus outbreak, provided fresh impetus to the yellow metal.

The technical picture on the weekly timeframe has price trading north of supply at 1616.8-1592.2, with bullion poised to cross swords with nearby resistance at 1636.0.

Closer analysis of price movement on the daily timeframe reveals we recently cleared the 1611.3 January 8th high, exposing the resistance level on the weekly timeframe mentioned above at 1636.0.

Activity on the H4 timeframe recently firmed above channel resistance, taken from the high 1593.9, following a to-the-point retest in early Europe. A continuation to the upside from here has a 161.8% Fibonacci extension point to target at 1630.0, sited just a few points south of the weekly resistance highlighted above at 1636.0.

Areas of consideration:

Traders who read Thursday’s analysis you may recall the following (italics):

With weekly supply having its upper limits tested, and the primary trend strongly facing north, longs off the current H4 channel support could be an option today, targeting the 161.8% Fibonacci extension point at 1630.0. Aggressive trade management is recommended, however; weekly sellers may still reside within the current supply zone – getting caught on the wrong side of this could be horrid.

Well done to any readers who managed to secure a long position yesterday. The 161.8% Fibonacci extension point at 1630.0 on the H4 rests as the initial upside target, closely followed by weekly resistance at 1636.0.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.