Key risk events today:

US ISM Manufacturing PMI

(Previous analysis as well as outside sources – italics).

EUR/USD:

Weekly gain/loss: +1.86%

Weekly close: 1.1101

Weekly perspective:

Europe’s single currency journeyed to a peak of 1.1145 against its US counterpart last week, adding more than 200 pips into Friday’s close.

Should we continue to echo an enthusiastic tone north of the 2016 yearly opening level at 1.0873 this week, price may eventually collide with the 2020 yearly opening level at 1.1222 (regarded as strong resistance), closely followed by Quasimodo resistance at 1.1239.

With respect to the long-term trend, the pair has remained under pressure since topping in early February 2018.

Daily perspective:

After resistance at 1.0995 and the 200-day SMA (orange – 1.1010) did little to turn the dial mid-week, buyers changed gears Thursday and challenged an interesting area of resistance at 1.1157-1.1099 Friday, shaped in the form of a notable bearish candle wick (comprised of a 161.8% Fibonacci extension point at 1.1157, a 127.2% Fibonacci extension point at 1.1099 and a ABCD correction pattern [black arrows] at 1.1115).

A turn from 1.1157/1.1099 this week positions 1.0995 on the hit list as support; alternatively, additional upside has resistance at 1.1239 calling for attention (essentially the same base as weekly QM).

H4 perspective:

As evident from the H4 chart on Friday, early London tackled 1.11 and latched onto a healthy bid to highs at 1.1145. Heading into US trading, however, optimism waned, returning the H4 candles south of 1.11 into support at 1.1088, a prior Quasimodo resistance level.

Space under 1.1088 has March’s opening level at 1.1045 in sight, closely followed by April’s opening level at 1.1023. Assuming buyers re-enter the fight this week, however, aside from the 1.1147 March 27 high and the 1.1189 March 17 high, Quasimodo resistance rests as the next upside target from 1.1199.

Areas of consideration:

Despite weekly price exhibiting scope to push for 1.1222 this week, a pullback is not out of the question, according to daily resistance between 1.1157/1.1099.

Bearish strategies are an option sub 1.1088 on the H4 timeframe, targeting March’s opening level at 1.1045, April’s opening level at 1.1023 and the 1.10 key figure (converges closely with daily support at 1.0995). Alternatively, reclaiming ground north of 1.11 this week places Quasimodo resistance at 1.1199 in the firing line, followed by weekly resistance (2020 yearly opening level) at 1.1222.

GBP/USD:

Weekly gain/loss: +1.52%

Weekly close: 1.2345

Weekly perspective:

Sterling chalked up a solid performance against the buck last week, extending recovery gains to a peak of 1.2394.

Support on the weekly timeframe positions itself at 1.1904. Resistance, on the other hand, falls in at 1.2739, the 2019 yearly opening level, and a 61.8% Fibonacci retracement ratio at 1.2718, sited a handful of pips under trend line resistance, extended from the high 1.5930.

Daily perspective:

The daily window has buyers and sellers battling for position around range lows at 1.2279, with buyers communicating a somewhat stronger position into the close.

Bidding from current price may lead an attack to range tops around 1.2627 this week, along with the 200-day SMA at 1.2657. Moves lower, assuming a breach of the 1.2075 May 18 low, may seek support at 1.2014, joined by a 50.0% retracement ratio at 1.2022.

H4 perspective:

For traders who read Friday’s technical briefing you may recall the following (italics):

April’s opening level at 1.2395 draws attention due to its surrounding confluence: the 1.24 handle, the ABCD correction (black arrows) at 1.2408, a 127.2% Fibonacci extension point at 1.2420, a 161.8% Fibonacci extension point at 1.2427 and a 61.8% Fibonacci retracement ratio at 1.2428 (upper green).

Although traders may witness H4 Quasimodo resistance at 1.2352 cap upside, the area between 1.2428/1.2395 on the H4 timeframe, technically speaking, emphasises a stronger base due to the number of technical resistances making up the zone.

As can be seen from the H4 chart, early US hours Friday made a run for 1.2428/1.2395, topping a pip ahead of the base before collapsing to 1.23.

Lack of support off 1.23 this week draws 1.22 into vision, followed by Quasimodo support at 1.2185.

Areas of consideration:

Leaving 1.2428/1.2395 unchallenged Friday, albeit by a pip, the resistance base, therefore, remains an area of focus this week.

Alternatively, a close underneath 1.23 may have breakout sellers make a stand, primarily targeting 1.22. Conservative breakout strategies, though, may call for a retest at 1.23 before sellers commit.

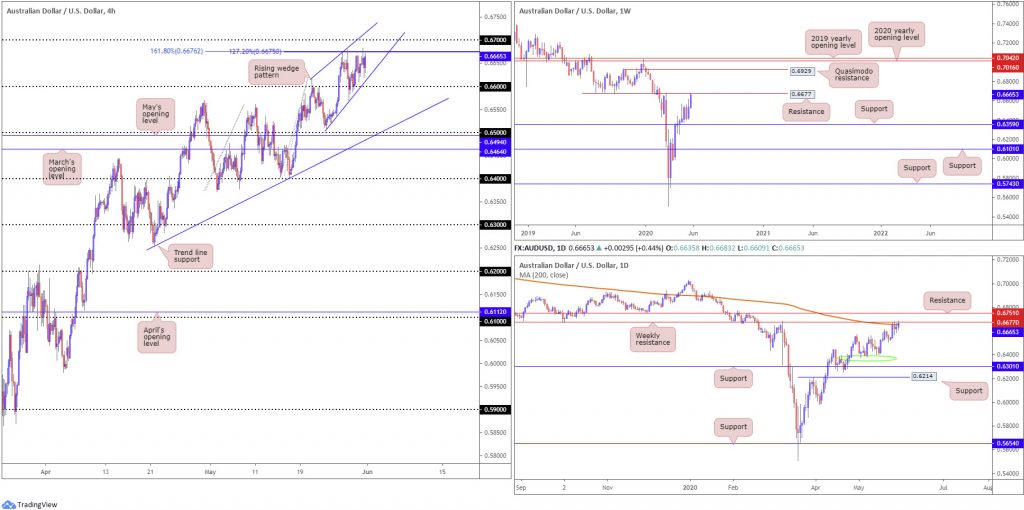

AUD/USD:

Weekly gain/loss: +2.01%

Weekly close: 0.6665

Weekly perspective:

The Australian dollar held onto the bulk of its gains against the US dollar last week, consequently extending gains for a second consecutive session and inviting an approach to resistance at 0.6677.

A rotation from this angle has support at 0.6359 to target; breaching current resistance, nonetheless, could have the pair journey to Quasimodo resistance at 0.6929.

Daily perspective:

Price action on the daily timeframe currently has its 200-day SMA (orange – 0.6654) rubbing shoulders with weekly resistance highlighted above at 0.6677.

Elbowing through 0.6677 on the daily chart unlocks nearby resistance priced in at 0.6751. Owing to the hesitation seen (via candlestick analysis) from the sellers mid-week, a pop to 0.6751 is certainly in the offing.

However, flipping lower could see 0.6370 make an appearance (green oval) as well as support at 0.6301.

H4 perspective:

Intraday activity recently crossed swords with resistance comprised of a 161.8% Fibonacci extension point at 0.6676 and a 127.2% Fibonacci extension point at 0.6675. Although sellers display interest here, clearing 0.66 is proving problematic.

Circling above the aforementioned resistances is the 0.67 handle, a widely watched figure.

Another constructive development on the H4 timeframe is a rising wedge pattern, created between 0.6505 and 0.6616.

Areas of consideration:

A couple of scenarios are possible this week, both directed at sellers given weekly resistance in motion at 0.6677

- We continue holding south of the H4 Fibonacci levels and eventually conquer the rising wedge pattern /0.66, sparking a wave of selling to 0.65/trend line support, extended from the low 0.6253.

- Bulls push for 0.67, maybe engulfing the number in favour of filling the H4 rising wedge and testing daily resistance at 0.6751. Testing the daily base may prompt a downside break out of the H4 rising wedge for a high-probability sell.

USD/JPY:

Weekly gain/loss: +0.16%

Weekly close: 107.77

Weekly perspective:

Action concluded the week eking out a third consecutive gain, swimming in close proximity to the 2020 yearly opening level at 108.62, a notable port of resistance.

Ousting sellers at 108.62 this week shoves the 2019 yearly opening level at 109.68 into sight. A rotation to the downside from current price, nevertheless, has the 105.98 May 6 low in view, followed by support at 104.70.

Daily perspective:

Candle action, albeit relatively stationary last week, maintains a bid north of support at 106.95.

Although we dipped to lows at 107.07 Friday, movement has been kicking its heels within striking distance of the 200-day SMA (orange – 108.30), with a break exposing the 109.38 April 6 high. Quasimodo support at 106.35 represents a reasonably significant ‘floor’ in the event we tunnel through 106.95 this week, with a violation shining the spotlight on support at 105.05.

H4 perspective:

Sell-stops south of March’s opening level at 107.38 were filled Friday after knocking on May’s opening level at 107.12 heading into London. As can be seen from the chart, buyers came out swinging as we transitioned into US hours, reclaiming 107.38+ status and closing the week within reaching distance of 108.

Above 1.08 we have an ABCD bearish pattern (green arrows) at 108.37ish, followed by Quasimodo resistance at 108.70.

Areas of consideration:

A fakeout through 108 into the 200-day SMA at 108.30 is a potential scenario possibly interesting sellers this week. Buy-stops contained above 108 may provide enough fuel to sell. Conservative traders, however, may seek a H4 close back beneath 108 before committing.

The H4 ABCD correction at 108.37 also marks an interesting reversal zone, an area boasting a relatively close relationship with H4 Quasimodo resistance at 108.70 and weekly resistance at 108.62 (the 2020 yearly opening level).

To the downside, 107 is a particularly interesting support given its relationship with daily support at 106.95.

USD/CAD:

Weekly gain/loss: -1.69%

Weekly close: 1.3767

Weekly perspective:

In the shape of a near-full-bodied bearish candle, last week’s action welcomed the 2016 yearly opening level at 1.3814. With price dipping a toe in waters south of the said level and buyers so far displaying little sign of recovery, this perhaps sets the stage for an approach to support at 1.3520 this week (prior Quasimodo resistance level), a base sited just above the 2017 yearly opening level at 1.3434.

Daily perspective:

Since April, price action has been carving out a descending triangle pattern between 1.4349 and 1.3855, with Tuesday breaking out to the downside in impressive fashion and also taking on nearby support at 1.3807.

1.3807 currently holds as resistance, threatening a dip to support at 1.3653, followed by weekly support at 1.3520. Under here we have the 200-day SMA (1.3458) as well as the descending triangle’s take-profit base at 1.3332 (black arrows) on the radar.

H4 perspective:

Following Tuesday’s precipitous decline, downside momentum subsided considerably into the week, hugging the underside of 1.38, which, as you can probably see, boasts a close connection to daily resistance at 1.3807.

This turns attention to 1.37 and a 161.8% Fibonacci extension point at 1.3695, along with two channel supports, taken from the low 1.3855 and 1.3850.

Areas of consideration:

Assuming buyers take a back seat at the 2016 yearly opening level drawn from 1.3814, sellers may remain in the driving seat this week.

The retest at 1.38 as resistance could be sufficient to tempt sellers towards 1.37, followed by the H4 161.8% Fibonacci extension point at 1.3695 as well as the two H4 channel supports, taken from the low 1.3855 and 1.3850.

Beyond H4 targets, daily support at 1.3653 warrants attention.

USD/CHF:

Weekly gain/loss: -1.04%

Weekly close: 0.9608

Weekly perspective:

Following a number of upside attempts at 0.9732, the 2018 yearly opening level, buyers lost their flavour last week and closed below the 2020 yearly opening level at 0.9671.

Technical structure above 0.9732 is seen at the 2019 yearly opening level drawn from 0.9838 and trend line resistance, taken from the high 1.0226. Should we remain starved of support this week, nonetheless, this could eventually draw the candles to a point of support at 0.9447.

Daily perspective:

Since early April, price action on the daily timeframe has consolidated between 0.9802/0.9597, with the week wrapping up at the lower boundary of the range.

Traders may also want to acknowledge the 200-day SMA (orange – 0.9780) joins the upper border of the aforementioned consolidation. Outside, traders will note resistance rests at 0.9848 and support from 0.9542.

H4 perspective:

Buyers staged an intraday recovery Friday off trend line support, extended from the low 0.9665, though failed to sustain gains south of trend line support-turned resistance from 0.9638. Friday concluded marginally under April’s opening level at 0.9618, highlighting 0.96 as possible support today/early week. Note this boundary has capped downside since April – a decisive break reveals daily support at 0.9542 and the 0.95 handle based on the H4.

Areas of consideration:

The broader focus, thanks to weekly price unseating the 2020 yearly opening level at 0.9671, places sellers in the brighter light this week. However, before sellers can stretch their legs, engulfing 0.96 on the H4 and the daily range low at 0.9597 is required.

Bearish strategies under 0.96, therefore, may be a consideration this week. Conservative players may opt to wait for a retest at 0.96ish before engaging. This helps avoid a fakeout scenario through 0.96, which is common viewing around psychological figures.

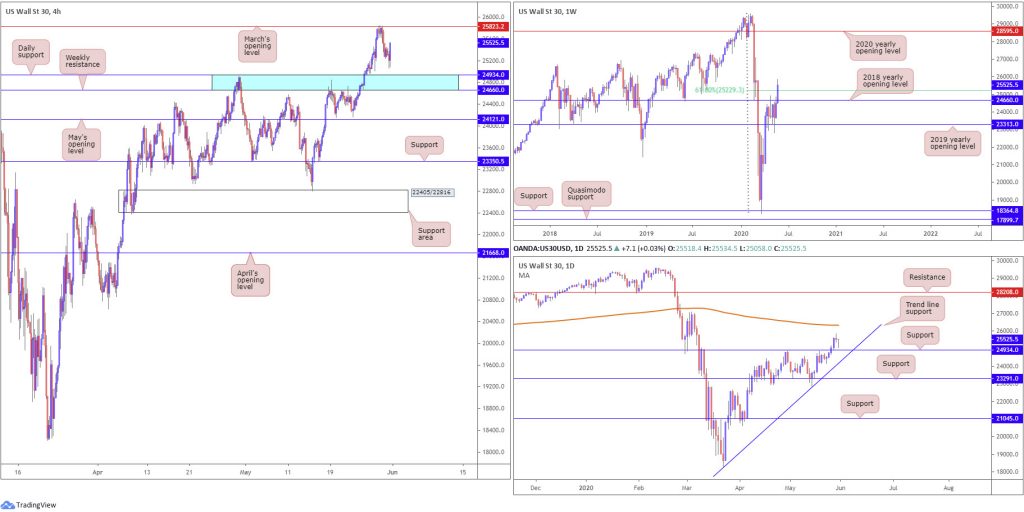

Dow Jones Industrial Average:

Weekly gain/loss: +4.10%

Weekly close: 25525

Weekly perspective:

After buyers stepped in from the 2019 yearly opening level at 23313, DJI, so far, has put up two near-full-bodied weekly bullish candles, a move that conquered the 2018 yearly opening level at 24660 and a 61.8% Fibonacci retracement ratio at 25229.

Sustained upside could eventually have the 2020 yearly opening level at 28595 emerge.

Daily perspective:

Tuesday shouldered through resistance at 24934 (now a serving support), sparking healthy buying Wednesday.

Interestingly, into the closing stages of the week, price action broadcasted a hammer candlestick pattern north of 24934 and trend line support, taken from the low 18213. The 200-day SMA (orange – 26336) is seen as the next upside target.

H4 perspective:

Major US benchmarks mostly booked healthy gains Friday after US President Trump refrained from touching on the subject of China tariffs during his press conference. The Dow Jones Industrial Average dropped 17.53 points, or 0.07%; the S&P 500 added 14.58 points, or 0.48%, and the tech-heavy Nasdaq 100 concluded higher by 138.81 points, or 1.47%.

After overwhelming orders at a resistance zone plotted between 24934/24660, an area comprised of a daily support level at 24934 and the 2018 yearly opening level on the weekly timeframe at 24660 (blue), March’s opening level at 25823 made an appearance on Thursday. This guided the candles to lows at 25058 Friday before staging a swift comeback into the close.

Areas of consideration:

24934/24660, now representing support, is in position for a possible retest play this week, with particular emphasis placed on daily trend line support, extended from the low 18213.

Having seen both weekly and daily price in position to climb this week, its unlikely we’ll see much selling occur off March’s opening level at 25823 on the H4 timeframe. Buying north of the level could be an option, targeting a resistance area at 26885/26515, a zone located just above the 200-day SMA.

XAU/USD (GOLD):

Weekly gain/loss: -0.29%

Weekly close: 1729.3

Weekly perspective:

The technical landscape on the weekly timeframe has, from mid-April, seen buyers and sellers battle for position around the underside of Quasimodo resistance at 1739.6.

In view of last week’s strong buying tail, clearance of 1739.6 may take shape, underlining another layer of Quasimodo resistance at 1787.4.

It may also interest some traders to note the trend on gold has faced a northerly trajectory since 2016.

Daily perspective:

The bullish pennant configuration on the daily timeframe, established from a high of 1747.7 and a low coming in from 1658.1, remains in play.

Mid-week, as you can see, had price retest the pattern’s upper edge as support. Though dipping to lows at 1693.9, buyers are seen attempting to make a comeback here. Take-profit targets out of pennant patterns are measured by taking the preceding move (black arrows) and adding the value to the breakout point. This offers a sizeable take-profit, coming in at 1909.4.

H4 perspective:

For those who read Friday’s technical outlook you may recall the following (italics):

H4 trend line resistance-turned support, taken from the high 1739.1, which joins with a 61.8% Fibonacci retracement ratio at 1704.7 and a 127.2% Fibonacci extension point at 1706.7, contained downside in recent trading. However, as emphasised in Thursday’s technical briefing, H4 trend line resistance, extended from the high 1765.1, could hamper upside from here.

Traders long current H4 support will be watching for H4 price to drive through H4 trend line resistance, perhaps regarded as a cue to reduce risk to breakeven and bank partial profits. H4 trend line support-turned resistance, taken from the low 1668.0, fits as the next hurdle to the upside, which actually intersects closely with weekly Quasimodo resistance mentioned above at 1739.6.

As evident from the H4 chart, we did indeed cross through H4 trend line resistance from 1765.1 on Friday and tested waters just south of H4 trend line support-turned resistance, taken from the low 1668.0, before mildly turning lower and forming a bearish outside candle pattern by the close.

Areas of consideration:

Traders long current H4 supports have likely reduced risk to breakeven and banked a large base of their position ahead of the close. Leaving a small portion of the position to run is an idea. Granted, we do have weekly Quasimodo resistance in play, though at the same time we also have a daily bullish pennant in motion, too.

Fresh buyers will likely commit this week should we print a daily close above weekly Quasimodo resistance at 1739.6, targeting weekly Quasimodo resistance at 1787.4.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.