EUR/USD:

On the H4 timeframe, prices are holding above the 1.1383 support level where we could see a limited push up to our resistance level at 1.14490.

Further afield, we see weekly price recently trekked above long-term trend line resistance, extended from the high 1.2555, and shook hands with the 2019 yearly opening level at 1.1445. With respect to the overall trend, the pair remains southbound until breaking the 1.1495 March 9 high.

A closer reading of price action on the daily timeframe reveals the pair topped ahead of a 161.8% Fibonacci extension point at 1.1464, positioned nearby channel resistance, extended from the high 1.1147.

Areas of consideration:

Prices closed above the 1.1383 support level on our H4 timeframe and it opens room for more upside to test our resistance level at 1.14490. However, we caution the limited upside on the larger timeframes, which showed that prices are near key resistance levels and faced with bearish pressure from our descending trend line as well.

Sellers short weekly resistance now face support at 1.1383 on the H4, which may have some traders reduce risk to breakeven. A break below the 1.1383 key support level could see a further drop to test the 1.1300 level which is also a round number.

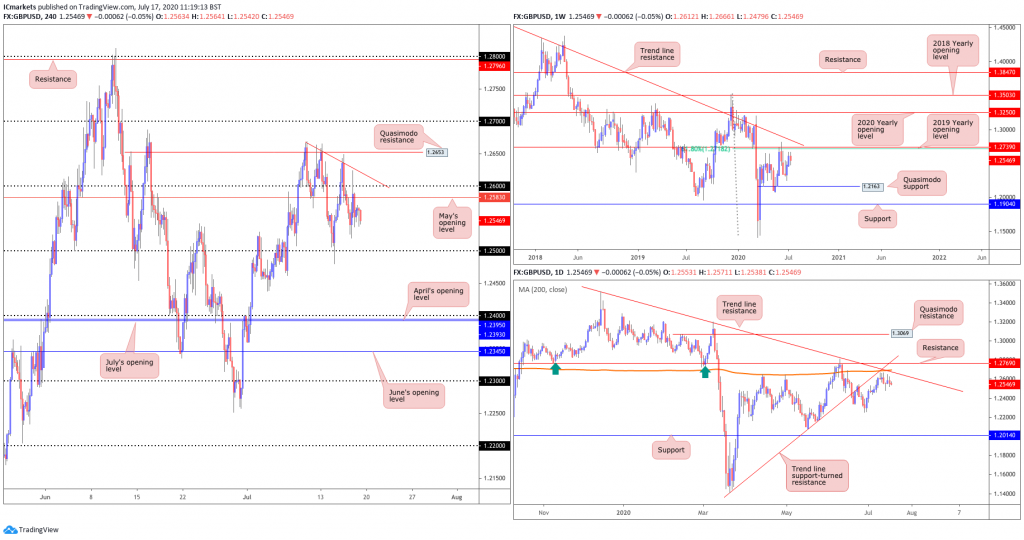

GBP/USD:

GBP/USD has been tracking lower after a reversal off our Quasimodo resistance at 1.2653 on the H4 timeframe.

From the weekly timeframe, following two consecutive weeks of gains, we can see the unit has price located within touching distance of considerable resistance, made up of a 61.8% Fibonacci retracement ratio at 1.2718 and the 2019 yearly opening level at 1.2739.

Movement on the daily timeframe, meanwhile, consolidates just south of substantial resistance, made up of trend line support-turned resistance, taken from the low 1.1409, another trend line resistance, extended from the high 1.3514, the 200-day SMA (orange – 1.2692) and resistance at 1.2769. This resistance combination also boasts a connection to the aforementioned weekly resistances.

Across the page, H4 price is crossing swords with the upper edge of May’s opening level at 1.2583, after peaking a few pips ahead of Quasimodo resistance at 1.2653 before we saw a strong reversal below that level. Note the round number 1.26 lurks just north of current action. Prices are still holding below the throws an intraday bearish tone into the mix, targeting 1.25 as the next support level.

Areas of consideration:

Prices remain under bearish pressure from our 1.2583 resistance, in line with the May’s opening level and descending trend line on our H4 timeframe. A solid retest at the underside of 1.26/1.2583 could see a further drop to our 1.2500 support level.

AUD/USD:

Stalking risk sentiment, AUD/USD drifted sideways.

AUDUSD is still holding below 0.70 key level. However a break above this key level should see sellers exiting the market and buyers coming in to push price higher towards the 0.7042 Quasimodo resistance level.

On the Weekly, resistance, forged in the shape of a 2020 yearly opening level and a 2019 yearly opening level, at 0.7016 and 0.7042, respectively, took hold in recent trading. It might also interest some traders to note just above the said resistances we have a 61.8% Fibonacci retracement ratio sited at 0.7128 (green). In terms of support on the weekly timeframe, crosshairs remain fixed on 0.6677.

A closer reading of candle action on the daily timeframe shows price recently tested levels just south of Quasimodo resistance positioned at 0.7049, a level linking with trend line support-turned resistance, taken from the low 0.6670. Another level worth noting is support coming in at 0.6751 and the 200-day SMA (orange – 0.6677).

Areas of consideration:

With price now below the 0.70 key figure, and no near term support levels to hold the drop, we can expect more sellers, effectively adding more shorts after the breakout candle’s close. A H4 retest at 0.70 as resistance, preferably in the form of a H4 bearish candlestick, would also likely see additional shorts join the party to possibly push price down towards H4 support around 0.6930 zone (green)

USD/JPY:

The US dollar gained strength against the Japanese yen Friday, mostly tracking the US dollar index as it responds to risk sentiment.

USD/JPY leapt through May’s opening level at 107.12 on the H4 timeframe and the 107 handle, clearing the pathway for familiar Quasimodo support coming in at 106.66. But price failed to break above previous swing high and went back to retest the 107 handle. If price breaks below the 107 handle, the Quasimodo support will be the next target.

Further out on the weekly timeframe, price is seen consolidating beneath the 2020 yearly opening level at 108.62. Support, on the other hand, can be derived from the 105.98 6th May low, with a break uncovering long-term support plotted at 104.70. Technical structure on the daily time frame remains focused on Quasimodo support from 106.35 and the 200-day SMA (orange – 108.36), assuming we get past the 108.16 July 1st high.

Areas of consideration:

With respect to technical confluence, the 107 handle, aside from nearby support at 107.12 (May’s opening level [H4]) is somewhat lacking. While this support looks vulnerable, price could go lower towards the Quasimodo support at 106.66.

USD/CAD:

USD/CAD failed to close above 1.36 key level and is still holding at July’s opening level. This is mostly due to the strengthening of the USD on the back of better than expected retail sales data despite disappointing jobless claims data coupled with Friday’s dip in oil prices causing the CAD to weaken as well.

As things stand, price is currently testing July’s opening level. A break above key level 1.36 could see price come back to retest Quasimodo resistance at 1.3631 and possibly even the next Quasimodo resistance at 1.3670. Otherwise, should price fail to break above 1.36, we might see the pendulum swing back towards 1.35 level on the H4.

Action on the weekly timeframe is currently stationed north of the 2017 yearly opening level at 1.3434. Beyond 1.3434, channel support, taken from the low 1.2061, can be viewed as the next potential floor. A USD/CAD bid throws the 2016 yearly opening level at 1.3814 in the pot as feasible resistance, with follow-through buying to try and tackle a dense block of supply between 1.4190/1.3912.

Technical movement on the daily timeframe shows price moving sideways however still holding above the 200-day SMA (1.3507). Should price recover, take-profit targets out of a falling wedge pattern can be measured by taking the base value and adding this figure to the breakout point (black arrows), which as you can see in this case, meets closely with resistance at 1.3807, followed by another layer of resistance at 1.3867.

Areas of consideration:

We continue to watch closely key level resistance at 1.36 on the H4. A break above this resistance could possibly see a price run up to the next resistance at 1.3631 and possibly even towards the next key level at 1.37. Conservative traders, owing to the threat of fakeouts around psychological levels, may seek additional confirmation before pulling the trigger.

Otherwise, a failure to break above 1.36 could possibly see sellers make a showing and push price back down to 1.35 or even weekly support at 1.3434 (2017 yearly opening level) to target, followed by 1.34 on the H4.

USD/CHF:

USD/CHF dropped sharply from recent July’s opening level at 0.9470 and broke below the 0.9400 handle as USD weakened. Price is approaching the previous horizontal swing low support at 0.9363 which could provide some support.

Price action, based on the higher time frames,has dropped below 0.9447 weekly resistance level and is now retesting the level.

Areas of consideration:

As the initial downside target at 0.9400 was reached on Friday, price might see some consolidation as it approaches the previous swing low at 0.9363. If this level is broken below, the next target will be the Quasimodo support at 0.9324..

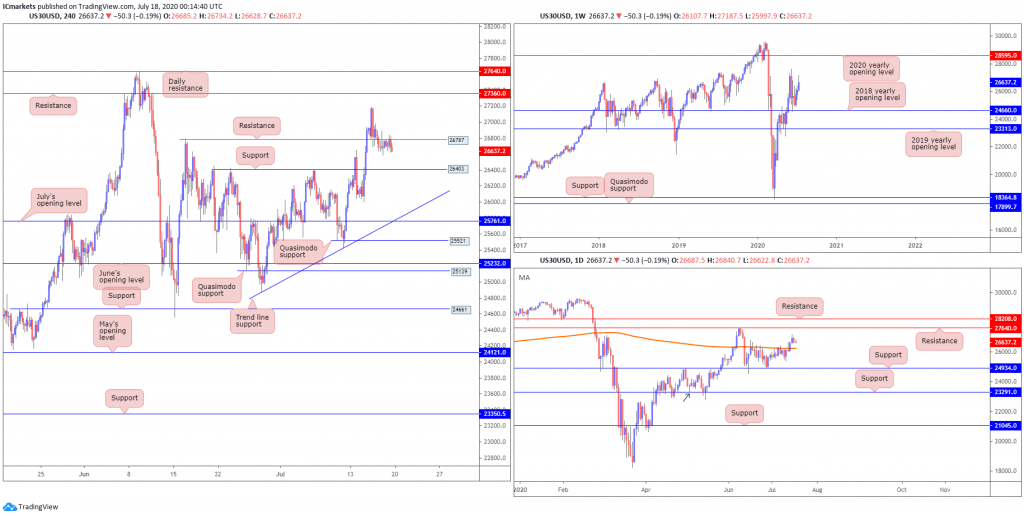

Dow Jones Industrial Average:

US equities finished Friday mixed.The Dow Jones Industrial Average dropped 62.76 points, or 0.23%; the S&P 500 went higher 9.16 points, or 0.28%, and the tech-heavy Nasdaq concluded higher by 29.36 points, or 0.28%.

In recent sessions, traders observed price action retest 26787 on the H4 (June 16 high), after dropping from fresh weekly pinnacles around 27187.

The story on the daily timeframe reveals the 200-day SMA (orange – 26249) recently gave way, a dynamic value capping upside since mid-June. The move higher shifts interest towards resistance at 27640. From the weekly timeframe, the 2018 yearly opening level at 24660 remains an important base of support. In the event traders manage to keep their head above water here, we are likely to pull in the 27638 high, followed by the 2020 yearly opening level at 28595.

Areas of consideration:

Though price recently closed above the 200-day SMA, but on the H4 chart, price went down to retest the 26787 overlap resistance level. As price is reversing off the 26787 resistance, next target will be at the 26403 support level.

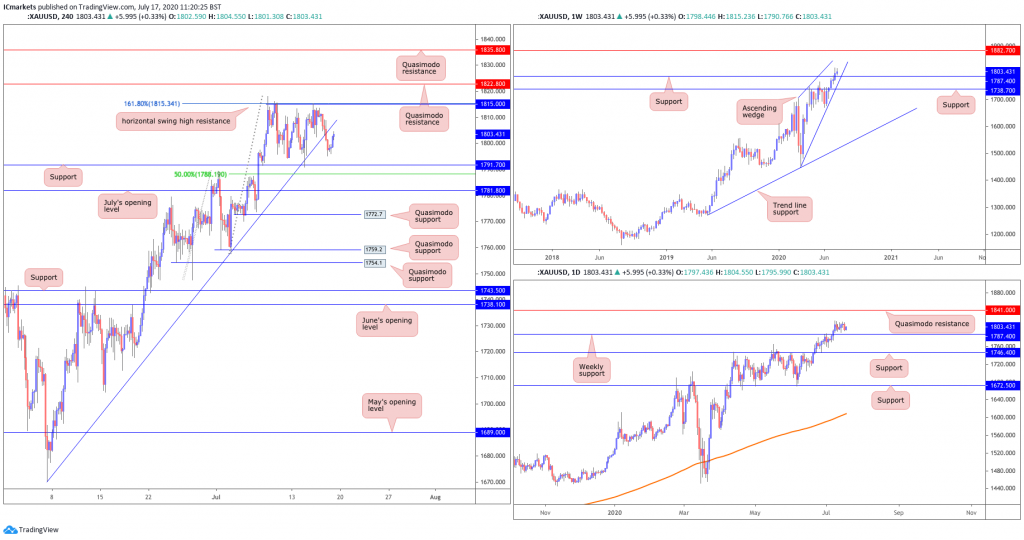

XAU/USD (GOLD):

On our H4 chart, XAU/USD prices dipped and broke our ascending trend line after a strong reversal off our horizontal swing high resistance at 1815.00. The next support level that we are looking at would be at 1791.70.

As a reminder, here’s where we stand on the higher timeframes:

From the weekly timeframe, bulls elbowed above Quasimodo resistance at 1787.4 (now a serving support) in recent trading. In line with the underlying trend, the break higher has perhaps laid the foundation for continuation buying to resistance stationed at 1882.7. Also of interest on the weekly timeframe is a potential ascending wedge pattern, forming between 1451.4/1818.20. In addition, given that the higher time frames view are showing bullish pressure, clearing our 1815.00 horizontal swing high resistance on the H4 timeframe stresses a possible run to daily Quasimodo resistance at 1841.00.

Areas of consideration:

We could be seeing further downside in prices to test our next support area at 1791.70, in line with the weekly ascending trend line and 50% fibonacci retracement on the H4 timeframe before a bounce above this support area.

With the higher time frames pointing to further upside, as underscored in recent writing, additional buying opportunities might be found above 1791.70.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.