Key risk events today:

Eurozone, UK and US Flash Manufacturing and Services PMIs.

(Previous analysis as well as outside sources – italics).

EUR/USD:

Weekly gain/loss: +0.18%

Weekly close: 1.1855

Weekly perspective:

Despite healthy interest off support at 1.1621 early November, recent weeks exhibited an uninspiring tone.

Should buyers regain consciousness this week, the 2018 yearly opening value at 1.2004, closely shadowed by Quasimodo resistance priced at 1.2092, are on show.

Traders may also want to acknowledge July’s trend line resistance break, taken from the high 1.2555, on top of the break of the 1.1495 March 9 swing high, consequently placing long-term buyers in a reasonably healthy position.

Daily perspective:

November 9 witnessed fresh highs form (red arrow), following a spike to lows ahead of support at 1.1594 and a 50.0% retracement ratio from 1.1582. For some, this may be understood as bullish confirmation. In terms of resistance, however, 1.1940, followed by Quasimodo resistance from 1.1965, is seen nearby.

Traders may also recognise that just beyond the aforementioned resistances, weekly resistance at 1.2004 is seen (2018 yearly opening value).

H4 perspective:

Since early last week, short-term flow has been capped just south of Quasimodo resistance at 1.1895 and the 1.19 handle. Landscape north of 1.19 shifts light towards September’s opening value at 1.1937.

1.1820, as you can see, proved efficient support over the course of the week, rebounding price on Monday and again Thursday. Space below 1.1820 highlights the round number 1.18, followed by Quasimodo support priced in at 1.1779.

Areas of consideration:

- 18 is likely watched in this market this week. Sell-stop liquidity resting south of this round number (protective stop-loss orders and breakout sellers’ orders) may also tempt a fakeout lower to draw in fresh buyers from H4 Quasimodo support at 1.1779.

- 19 and H4 Quasimodo resistance at 1.1895 may come forward. Although this area will contain pending sell orders, higher timeframe resistance is not observed around this region.

- Possible breakout buying north of 1.19 on the H4, targeting September’s opening value at 1.1937.

- September’s opening value on the H4 and daily resistance at 1.1940 marks healthy confluence to work with if a breach of 1.19 occurs.

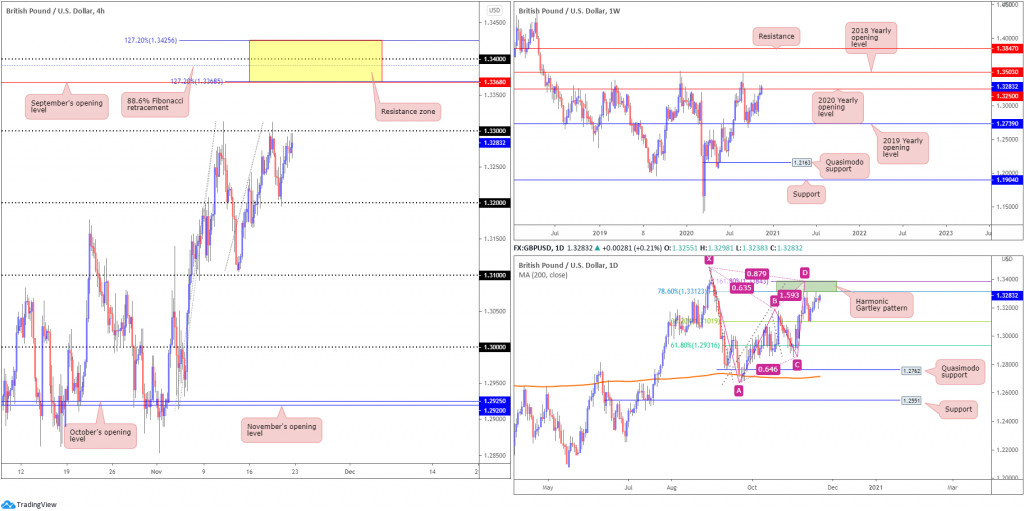

GBP/USD:

Weekly gain/loss: +0.69%

Weekly close: 1.3283

Weekly perspective:

After rejecting the 2019 yearly opening value from 1.2739 in September, buyers eventually mustered enough strength to take on the 2020 yearly opening value at 1.3250 last week and record a third consecutive weekly gain.

Additional strength could have the unit knock on the door of the 2018 yearly opening value from 1.3503 this week.

Technically, however, the immediate trend has remained lower since topping in 2014.

Daily perspective:

Sellers welcomed the bearish harmonic Gartley pattern’s PRZ at 1.3384/1.3312 on Wednesday for a second time this month, establishing a shooting star pattern.

Unlike earlier in the month, however, sellers have so far failed to deliver much downside, with 38.2% Fibonacci support at 1.3101 lying in wait, commonly read as an initial take-profit target (arranged from legs A-D of the Gartley).

Overthrowing the aforementioned PRZ could be viewed as an early cue we’re headed for the 2018 yearly opening value at 1.3503 on the weekly scale.

H4 perspective:

Although cable presented indecisive posture Friday, the pair, overall, remains underpinned as EU and UK officials echo an optimistic tone surrounding a possible Brexit deal.

Friday’s narrow range kept price shelved sub 1.33, with neither side willing to commit. Absorbing offers around 1.33 this week shines the spotlight on a particularly interesting base of resistance (yellow), made up of two 127.2% Fibonacci projection points at 1.3425/1.3368, the round number 1.34, an 88.6% Fibonacci retracement ratio at 1.3390 and September’s opening value at 1.3368.

Areas of consideration:

- 33 remains a key level on the H4 scale, tied in closely with the lower edge of the daily bearish harmonic Gartley pattern’s PRZ at 1.3384/1.3312. Sellers from this area will likely be eyeing the 1.32 base as an initial target.

- Above 1.33 this week demonstrates a relatively clear path to H4 resistance drawn from 1.3425/1.3368. Conservative breakout strategies, however, may call for a 1.33 retest to form before buyers consider pulling the trigger.

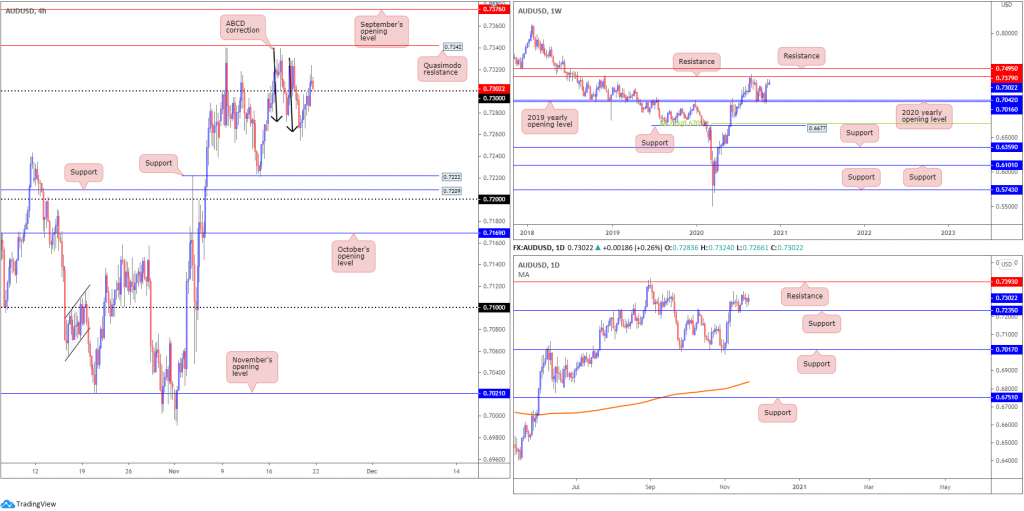

AUD/USD:

Weekly gain/loss: +0.53%

Weekly close: 0.7302

Weekly perspective:

A substantial 3% showing off the 2020 (0.7016) and 2019 (0.7042) yearly opening values (supports) early November has positioned the unit within striking distance of resistance at 0.7379 this week.

In view of this market trending higher since early 2020, buyers may also be eyeballing resistance parked at 0.7495.

Daily perspective:

The November 13 retest of support at 0.7235, despite a somewhat lacklustre performance last week, adds weight to increased interest to the upside this week.

This may also sweet-talk buyers to attempt to take a run at resistance at 0.7393 (positioned above weekly resistance).

H4 perspective:

Salvaging Thursday’s losses, Friday had AUD/USD bulls make an appearance north of ABCD support at 0.7263 (black arrows) to overturn 0.73 and throw a Quasimodo formation at 0.7342 in the mix as possible resistance this week.

Absorbing 0.7342, on the other hand, turns attention towards September’s opening value coming in at 0.7376.

Areas of consideration:

- Buyers long from H4 ABCD support at 0.7263 appear to be in a healthy position, with partial profits likely banked ahead of last week’s close.

- Conquering 0.73 has perhaps intrigued breakout buyers, targeting H4 Quasimodo resistance at 0.7342, closely followed by September’s opening value at 0.7376.

- Although the trend in this market has faced higher since early 2020, long-term resistance falls in between weekly resistance at 0.7379 and daily resistance from 0.7393.

- H4 supports at 0.72, 0.7209 and 0.7222 are levels to be aware of should sellers make an appearance this week.

USD/JPY:

Weekly gain/loss: -0.70%

Weekly close: 103.82

Weekly perspective:

Since reconnecting with the underside of supply at 108.16-106.88 in August, weekly candles have gradually shifted lower and developed a declining wedge (106.94/104.18).

Quasimodo support at 102.55 is in the picture, with a break exposing support plotted at 100.61. A strong bounce from 102.55 may provide enough impetus for buyers to attempt a breakout above the current declining wedge.

Daily perspective:

Sliding south of support at 104.06 last week helps validate the pair’s bearish position, particularly as the level served well as resistance Thursday. Burrowing through this level shines the headlights on weekly Quasimodo support at 102.55.

H4 perspective:

Friday, following Thursday’s animated attempt to overthrow 104, entered a sideways consolidative phase south of the 104 mark.

Ultimately, with 104 representing resistance, moves to Quasimodo support at 103.21 will likely be eyed by sellers this week. However, additional 104 retests are not out of the question before sellers enter play.

Areas of consideration:

Outlook unchanged.

- Bearish scenarios south of 104 remain on the table this week, targeting H4 Quasimodo support at 103.21.

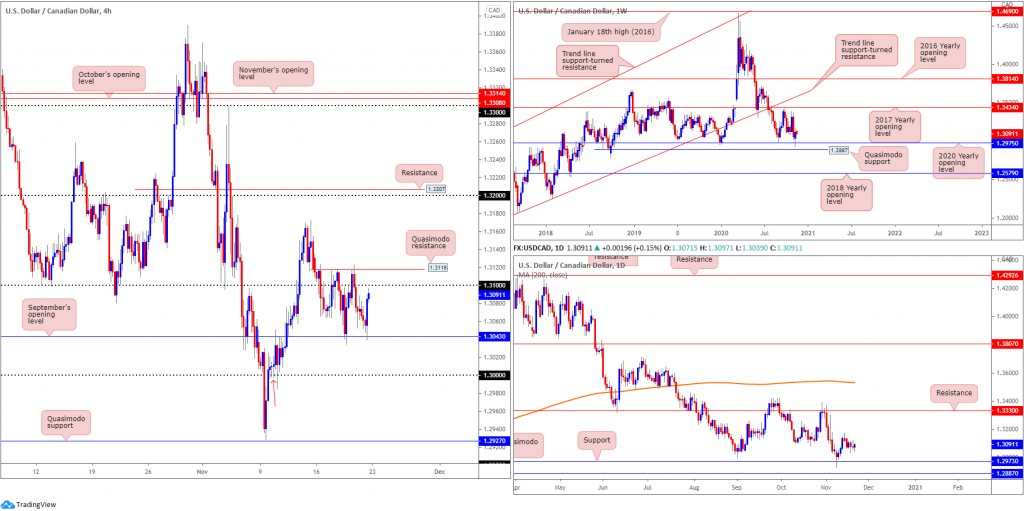

USD/CAD:

Weekly gain/loss: -0.21%

Weekly close: 1.3091

Weekly perspective:

The 2020 yearly opening value at 1.2975, arranged north of Quasimodo support priced in at 1.2887, recently triggered a wave of buying though lacked follow-through last week. Increased interest to the upside this week, nevertheless, could eventually fuel a test of the 2017 yearly opening value at 1.3434, sheltered under trend line support-turned resistance, taken from the low 1.2061.

Given this market has traded lower since topping at 1.4667 in early 2020, though, breaking the aforementioned supports remains an option, consequently swinging the pendulum in favour of further weakness towards the 2018 yearly opening value at 1.2579.

Daily perspective:

With weekly price rebounding from support at 1.2975 as well as daily price also recently coming off support at 1.2973 (essentially marking the same area), flow on the daily chart, despite the tame movement of late, reveals room to rally as far north as 1.3330 this week.

H4 perspective:

Since the beginning of last week, the candles constructed a well-defined range between micro Quasimodo resistance at 1.3118 (located just above the 1.31 handle) and September’s opening value at 1.3043.

Areas of interest outside of this newly formed consolidation are the key figure 1.30 (a widely watched level in this market that’s joined by a Quasimodo support [red arrow] around 1.2997) and the 1.3172 November 13 high, followed by the 1.32 base.

Areas of consideration:

- Range traders may be drawn to the H4 scale early week, monitoring range limits for bullish/bearish scenarios.

- A H4 close north of 1.3118/1.31 may nudge breakout buyers. Reinforced on the back of higher timeframe supports recently entering the fray, buyers may attempt to lift the pair towards the 1.3172 November 13 high and 1.32 region. Conservative traders may seek a 1.31 retest before committing.

- 30, with the level sited 25 pips above weekly support at 1.2975 (2020 yearly opening level), is an area to be aware of this week.

USD/CHF:

Weekly gain/loss: FLAT

Weekly close: 0.9109

Weekly perspective:

The prior week witnessed buyers strongly rebound from support at 0.9014, a level dovetailing closely with ABCD support at 0.9051 (black arrows). Bid/offers, however, were even last week, finishing unmoved.

0.9255 resistance (a prior Quasimodo support) is next in the firing range should buyers support this market, with a 38.2% Fibonacci retracement ratio forged at 0.9388 to target should further buying emerge (an initial take-profit zone associated with the ABCD support mentioned above).

It should also be noted this market has been trending lower since April 2019.

Daily perspective:

From the daily timeframe, price remains languishing south of resistance at 0.9187. While Quasimodo support at 0.9009 represents a possible downside objective on this chart, it’s worth acknowledging trend line resistance also resides close by, taken from the high 0.9901.

H4 perspective:

Early last week had price surpass the 0.91 handle and test an area of support at 0.9075-0.9088 (orange). Since then, as you can see, buyers have maintained a presence above 0.91, though so far has failed to reach trend line resistance, extended from the high 0.9295, and November’s opening value at 0.9161.

Removing the aforementioned support areas this week unearths possible selling in the direction of September’s opening value at 0.9038 and key psychological figure 0.90.

Areas of consideration:

- 91/H4 support at 0.9075-0.9088 is an area buyers may continue to watch for bullish themes this week.

- Bearish scenarios may arise should 0.9075-0.9088 cede ground.

Dow Jones Industrial Average:

Weekly gain/loss: -0.89%

Weekly close: 29232

Weekly perspective:

Modestly fading all-time peaks at 30097, the unit finished last week on the backfoot and established a shooting star formation. In itself, this may inspire further selling to retest the 2020 yearly opening value from 28595.

28595, therefore, could be an area dip-buyers make an appearance from this week.

Daily perspective:

A closer reading of price action on the daily timeframe reveals the unit could confront declining support, taken from the high 29193, this week. Should a break of here come to pass, support at 27640 is seen, followed by trend line support, etched from the low 18213.

H4 perspective:

Three major US equity benchmarks finished Friday lower, with the Dow Jones snapping a two week-bullish phase. The Dow Jones Industrial Average lost 219.75 points, or 0.75% Friday, the S&P 500 traded lower by 24.33 points, or 0.68%, and the Nasdaq also ended lower by 49.74 points, or 0.42%.

Technically on the H4 scale, the 30000 level represents resistance while 28847 continues to signify support. A break lower exposes September’s opening value at 28369.

Areas of consideration:

- Although recently forming fresh all-time highs will likely excite buyers, a retest at the 2020 yearly opening value from 28595 is possibly on the cards before a bullish theme emerges.

- September’s opening value at 28369, alongside the 2020 yearly opening value from 28595 and daily declining support (29193), forms interesting support to be mindful of, marked on the H4 chart (yellow).

XAU/USD (GOLD):

Weekly gain/loss: -0.98%

Weekly close: $1,870

Weekly perspective:

Weekly flow hovers within striking distance of channel resistance-turned support, taken from the high $1,703.

Testing the aforementioned support this week may have long-term traders’ crosshairs shift towards the all-time peak $2,075. Moving beyond support, however, sheds light on another layer of support at $1,787.

Traders may also want to bear in mind the price of gold remains in a decisive uptrend.

Daily perspective:

A closer examination of price action on the daily timeframe reveals the yellow metal bottoming ahead of support at $1,841. Another prominent structure on this chart is resistance at $1,928.

It is also worth highlighting a possible declining falling wedge pattern between $2,015/$1,862. Although welcoming a false breakout signal in early November to peaks north of current resistance, this remains pattern structure to be mindful of this week.

H4 perspective:

Friday extended recovery gains off Quasimodo support at $1,852, enough to make contact with November’s opening value at $1,878. Clearance of the latter this week moves two Quasimodo resistances into view at $1,890 and $1,896, with a break perhaps drawing light towards another resistance at $1,911.

Areas of consideration:

- November’s opening value at $1,878 on the H4 scale, although delivering a mild end-of-day correction into Friday’s close, has failed to offer little in terms of resistance since the beginning of November and boasts little connection with higher timeframe levels. Therefore, charts studies suggest sellers may struggle to hold things lower here.

- The two H4 Quasimodo resistances at $1,890 and $1,896 may draw interest this week, an area aligning with the upper boundary of the daily declining wedge.

- H4 Quasimodo support from $1,852 remains a strong base to keep an eye on, though a modest fakeout through the level should not surprise due to weekly channel support resting nearby.

- H4 support priced in at $1,835 is another level to be aware of, having seen the line merge closely with daily support at $1,841.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property