Key risk events today:

US ISM Manufacturing PMI.

(Previous analysis as well as outside sources – italics).

EUR/USD:

Weekly gain/loss: +1.04%

Weekly close: 1.1775

Weekly perspective:

In the shape of six consecutive bullish candles, EUR/USD recently powered through Quasimodo resistance at 1.1733 and engulfed the Quasimodo head at 1.1815, the September 24 high 2018. This, despite an end-of-week pullback from 1.1909, perhaps unblocks the path north to the 2018 yearly opening level at 1.2004 this week.

Traders, however, are urged to pencil in the possibility of a 1.1733 retest before the unit attempts to unearth higher ground.

Daily perspective:

Although Friday welcomed highs of 1.1909, Quasimodo resistance at 1.1840 toughed it out heading into the month’s end and directed action slightly beneath support at 1.1789, a prior Quasimodo resistance level. The move lower was likely weighed by the US dollar index reclaiming 93+ status in strong fashion and touching gloves with 93.50, forming a clear-cut bullish engulfing candle (body/body).

Absorbing 1.1789 this week effectively unfastens the door to further downside this week, targeting support as far south as 1.1594, stationed nearby channel resistance-turned support, extended from the high 1.1147. Renewed interest to the upside, nonetheless, could eventually bring light to resistance priced in at 1.1940.

H4 perspective:

Against the backdrop of higher timeframe structure, the 1.19 handle elbowed its way into the spotlight Friday, sending price sharply lower heading into the London session. Losses, as you can see, were extended amid US hours, taking on the 1.18 handle and tripping any sell-stop liquidity.

Local trend line support, taken from the low 1.1681, can be viewed as the next potential hurdle south of 1.18, while abandoning this support could have buyers and sellers meet at support from 1.1723 and the 1.17 base.

Areas of consideration:

The break of weekly trend line resistance (July 13), taken from the high 1.2555, and violation of the 1.1495 March 9 high, reflects a long-term (potential) technical trend change.

With weekly trend structure pointing to additional bullish sentiment, and daily price crossing swords with support at 1.1789, the whipsaw through 1.18 may, therefore, actually turn out to be a deep fakeout. A test of local H4 trend line support, followed up with a H4 close back above 1.18, could trigger a wave of strong buying this week, fuelled on the back of higher timeframe buying and H4 sell-stop liquidity.

Breaking the local trend line base, on the other hand, signals weakness to the upside and indicates a run to the 1.17ish region. Intraday countertrend sellers may still struggle, though, owing to weekly support nearby at 1.1733.

GBP/USD:

Weekly gain/loss: +2.24%

Weekly close: 1.3077

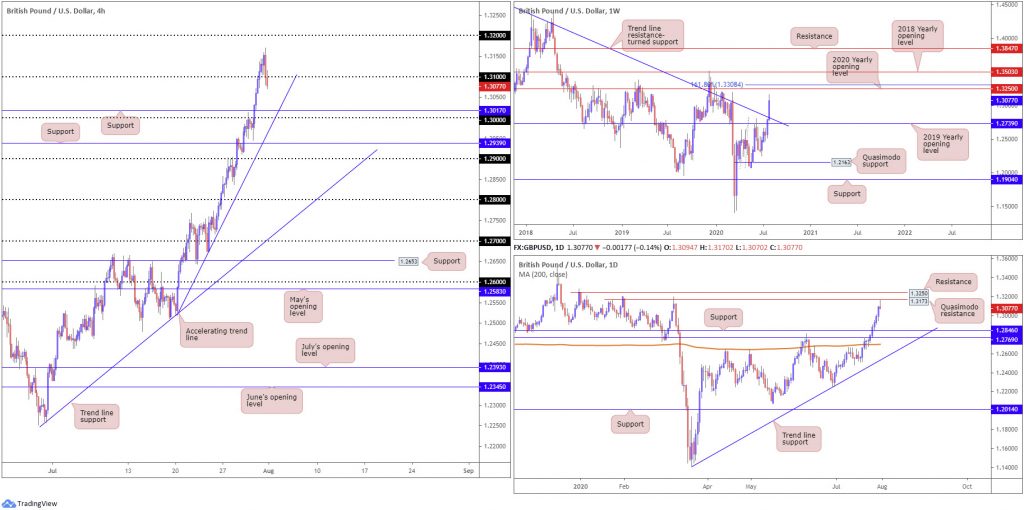

Weekly perspective:

Weekly flow, after engulfing long-term trend line resistance, extended from the high 1.5930, and adding more than 280 pips last week, could invite the 2020 yearly opening level at 1.3250 into the frame this week. Technical readers will also acknowledge additional resistance by way of a 161.8% Fibonacci extension point at 1.3308.

Daily perspective:

Friday finished the session off best levels, modestly snapping a ten-day bullish phase. Candlestick traders will also acknowledge a shooting star candlestick pattern emerged (bearish signal) just south of Quasimodo resistance at 1.3173.

According to technical drawings, support structure is seen at 1.2846, whereas 1.3250 resistance could make an appearance if 1.3173 breaks this week.

H4 perspective:

Friday witnessed 1.31 give way to the upside in early trading, which technically speaking unlocked the trapdoor to 1.32. However, things turned sour around the 1.3150 neighbourhood with price responding in the form of a bearish engulfing candle that brought the pair back through 1.31.

Kicking things under 1.31 exposes steep trend line support, extended from the low 1.2518, support at 1.3017 and the key figure 1.30.

Areas of consideration:

The recent trend line resistance break on the weekly timeframe, despite the 1.3514 December 9 high (2019) still intact (a break of here also signals trend change to the upside), may have long-term traders consider bullish positions.

Removing 1.31 into the close puts forth intraday bearish scenarios back to the 1.30ish base early week, in line with the daily shooting star candlestick pattern.

Another scenario is a H4 close back above 1.31, which may push bullish impetus, having weekly price recently shift focus to 1.3250 (and reveal the possibility of an uptrend) and daily price yet to tackle Quasimodo resistance at 1.3173.

AUD/USD:

Weekly gain/loss: +0.48%

Weekly close: 0.7139

Weekly perspective:

The current uptrend favours buyers. The break of the 0.7031 December 30 high (2019), visible on the weekly timeframe, shows this.

Buyers and sellers, nevertheless, spent the week battling for position around resistance at 0.7147. Although managing to chalk in a sixth consecutive weekly gain, price movement formed an average shooting star candlestick pattern, emphasising upside movement may be fading.

Holding under 0.7147 this week could swing the 2020 and 2019 yearly opening levels into the mix at 0.7016 and 0.7042 as feasible support. Focus, however, shifts to resistance at 0.7308 in the event we climb 0.7147.

Daily perspective:

Snapping a five-day bullish phase, Friday reflected a bearish stance a few pips ahead of Quasimodo resistance coming in at 0.7235. Assuming weekly action holds 0.7147, daily support at 0.7049 could slide into view this week.

H4 perspective:

Following a dominant whipsaw above the 0.72 handle, missing daily Quasimodo resistance at 0.7235 by a hair, sellers moved a local trend line support, taken from the low 0.7063, in view.

The key thing to note is that although the aforementioned trend line support is considered local structure, it does hold standing. A rejection signifies we could be looking at 0.72 giving up ground; a break lower, however, helps confirm higher timeframe resistance and may bring in 0.71 on the H4, followed by H4 trend line support, extended from the low 0.6832, daily support at 0.7049, along with 0.7042 and 0.7016 on the weekly (note 0.7042 also denotes H4 support).

Areas of consideration:

Sinking H4 trend line support today, as underlined above, could highlight intraday bearish themes, while a H4 rejection candle could equally see buyers make a stand. The latter, of course, is the more favourable in terms of trend studies this week, though concerning technical structure, higher timeframe resistance may hamper upside and guide things to lower levels.

USD/JPY:

Weekly gain/loss: -0.21%

Weekly close: 105.85

Weekly perspective:

After grappling with support coming in from 104.70, buyers strengthened their grip and finished the week considerably off worst levels. This, according to candlestick analysis, formed a hammer pattern, which is generally considered a bullish signal at troughs.

Noticeable upside targets on this timeframe rest at the 2020 yearly opening level from 108.62, with a break unmasking the 2019 yearly opening level at 109.68.

Daily perspective:

While weekly traders, particularly candlestick enthusiasts, may cheer the possibility of further upside this week, daily technical action (after rebounding from weekly support accompanied by a daily ABCD correction [red arrows]) is fast approaching resistance at 106.35ish.

North of 106.35, supply rests at 107.54/106.67 (yellow), followed by daily Quasimodo resistance at 107.64 and then the 200-day SMA (orange – 108.23).

H4 perspective:

As the US dollar index reclaimed 93.00 to the upside, this kept the US dollar on the winning side of the table against the Japanese yen Friday.

Leaving Quasimodo support at 104.08 unchallenged, bulls cleared a number of notable resistances, including the 105 handle and the 105.71 level (both now serving supports). As you can see, this landed price at the 106 handle, containing upside into the closing bell. Breaking to higher territory this week clears things for daily resistance mentioned above at 106.35 to make its presence known.

Areas of consideration:

Governed by the weekly timeframe rebounding from support at 104.70 and forming a bullish candlestick signal, daily is likely to welcome resistance at 106.35 sometime this week. This implies a break of 106 on the H4.

A retest at H4 support from 105.71, therefore, is possible in early trade. A reaction here is likely to deliver enough force to overthrow 106 and head for 106.35.

USD/CAD:

Weekly gain/loss: -0.04%

Weekly close: 1.3406

Weekly perspective:

While we cannot rule out fresh upside attempts this week, the 2017 yearly opening level at 1.3434 appears to have let go.

Below 1.3434, channel support, taken from the low 1.2061, can be viewed as the next potential floor, indicating bearish themes could be on the cards. A break to the upside, on the other hand, could eventually throw the 2016 yearly opening level at 1.3814 back into the pot.

Daily perspective:

In terms of where we’re positioned on the daily timeframe, support can be found at 1.3303 and resistance in the shape of the 200-day SMA (orange – 1.3522). Should we follow sentiment on the weekly timeframe this week and navigate deeper waters, a break of 1.3303 could be seen, eyeing Quasimodo support at 1.3225 as the next possible base.

H4 perspective:

Friday ended things a shade lower, following Thursday’s session high a touch under Quasimodo resistance at 1.3466 and trend line resistance, stretched from the high at 1.3646.

Price movement, as you can see, chalked up a break back under 1.34 to lows at 1.3372. This likely made intraday dip buyers nervous and at the same time refocused the spotlight on Quasimodo support at 1.3343, the origin of recent upside.

Areas of consideration:

The longer-term technical position shows sellers growing in confidence, with daily price likely to take aim at support drawn from 1.3303. A decisive H4 close sub 1.34 would help confirm this and perhaps pull in fresh sellers, targeting H4 Quasimodo support at 1.3343, followed by the 1.33 handle, which conveniently aligns with daily support plotted at 1.3303. Therefore, not only is 1.33 a logical downside target for sellers to work with this week, the level could also form a platform for buyers to make an entrance from. However, do be aware a dip through the 1.33 region could emerge having noted weekly price perhaps wanting to grip channel support (currently circles the 1.32ish neighbourhood).

USD/CHF:

Weekly gain/loss: -0.72%

Weekly close: 0.9132

Weekly perspective:

Traders recently witnessed clearance of support at 0.9151, moving to lows at 0.9056 and recording a sixth consecutive weekly decline. Having observed an end-of-week pullback materialise, 0.9151 remains a support. However, in the event we make another play for lower levels this week, support at 0.9014 could eventually swing itself into reality. A USD revival this week, nevertheless, has resistance at 0.9255 to target, a prior Quasimodo support.

Daily perspective:

After support at 0.9187 put up little fight (now a serving resistance), we greeted support coming in at 0.9072 Friday and snapped an eight-day bearish phase in the shape of a bullish engulfing candle.

H4 perspective:

Friday’s reaction from daily support highlighted above at 0.9072, in line with the US dollar index climbing above 93.00, saw the H4 candles invade and engulf the 0.91 handle and close a few pips south of resistance priced in at 0.9161.

Above 0.9161 this week, buyers face daily resistance from 0.9187 and the 0.92 handle (H4), with a break shining the spotlight on weekly resistance at 0.9255.

Areas of consideration:

The weekly timeframe is on precarious ground right now as buyers and sellers battle for position around support at 0.9151. Across the page, though, daily price staged a notable offensive play off support at 0.9072. While the move, structured in the form of a bullish engulfing candle, boasts appeal this week, buyers are likely to be nervous given daily resistance at 0.9187 threatening to make an appearance, along with the 0.92 handle on the H4.

0.9187/0.92 combined, along with clear downside action observed over recent weeks, could be enough to contain buyers and offer sellers a base to consider bearish scenarios. Failure to hold, traders may seek weekly resistance at 0.9255 for potential shorts.

Dow Jones Industrial Average:

Weekly gain/loss: +0.17%

Weekly close: 26492

Weekly perspective:

The 2018 yearly opening level at 24660 remains intact heading into a fresh week, capping downside since a mid-June retest. Last week exhibited a non-committal tone from both sides of the market, hence the indecisive candle close.

Longer-term action is likely to eventually pull in the 27638 high, despite recent hesitation, followed by a plausible run to the 2020 yearly opening level at 28595.

Daily perspective:

Taking the form of two back-to-back hammer candlestick patterns, both penetrating the 200-day SMA (orange – 26244), might have buyers attempt to strengthen their position this week and take on resistance coming in at 27640.

Technicians will also acknowledge 27640 is stationed just under another slice of resistance parked at 28208. The inability to sustain gains this week, nonetheless, may throw things under the aforementioned 200-day SMA and make a play for support coming in at 24934.

H4 perspective:

Equity benchmarks in the US finished Friday higher amid an advance in technology stocks. The Dow Jones Industrial Average climbed 114.67 points, or 0.44%; the S&P 500 rallied 24.90 points, or 0.77%, and the tech-heavy Nasdaq 100 concluded higher by 190.37 points, or 1.78%.

Viewing H4 action through a technical lens, we ended Friday pretty much in the same location as Thursday: around the underside of a channel resistance, extended from the high 26712. Trend line support, extended from the low 24881, also remains in the frame despite another sizeable intraday spike to lows ahead of 26000.

Eclipsing the upper limit of the aforementioned channel resistance signals a bullish market, at least until crossing swords with H4 Quasimodo resistance at 27033.

Areas of consideration:

Much like Friday’s technical briefing, all three timeframes point to the possibility of price swerving to the upside, assuming we take on H4 channel resistance (26712). Above here, breakout buyers will likely eye H4 Quasimodo resistance fixed from 27033 as an initial upside target, given nearby technical H4 supply appears consumed (red arrows).

XAU/USD (GOLD):

Weekly gain/loss: +3.91%

Weekly close: 1975.9

Weekly perspective:

XAU/USD bulls continue to reign supreme last week, adding more than $74 and stamping out fresh all-time peaks at 1983.1.

With the yellow metal navigating unchartered territory at the moment, this remains a buyers’ market. In the event a pullback occurs this week, traders will likely be eyeballing 1921.0, the all-time peak formed in September 2011, as possible support.

Daily perspective:

In similar fashion to the weekly timeframe, dips this week are likely to be welcomed at 1921.0, followed closely by support coming in at 1911.9.

H4 perspective:

Friday, as you can see, reclaimed Thursday’s feeble attempt to draw things lower, forming the fresh all-time peak underlined above at 1983.1. The main upside target beyond the latter remains fixed at the widely watched 2000.0 base.

Additional selling, on the other hand, could pull in local trend line support, taken from the low 1907.0, and perhaps provide a base for traders to consider bullish strategies. A break of the said trend line, however, pushes forward the possibility of a dip back to 1921.0.

Areas of consideration:

Further buying remains likely in this market.

Responding from local H4 trend line support this week is likely sufficient to ignite dip-buying strategies, targeting 2000.0, while moves back to 1921.0 may also encourage dip-buying.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.