USD/JPY:

The current general bias for USDJPY on the H4 chart is bullish. To add to this bias, the price is currently trading above the Ichimoku cloud, indicating a bullish market. Price has maintained its strong bullish momentum and crossed the key level at 149.00 with price currently above the 1st support at 149.313 where the 161.8% Fibonacci extension is located. If this strong bullish momentum continues, expect price to continue towards the 1st resistance at 151.629 where the -27.2% Fibonacci expansion is located.

Areas of consideration:

- H4 time frame, 1st resistance at 151.629

- H4 time frame, 1st support at 149.313

DXY:

On the H4 chart, prices failed to break the ichimoku cloud and are moving in an ascending trend signalling bullish momentum. if bullish momentum continues it will bring price to 114.759 and if it breaks this level, bullish momentum will carry price to 115.717 where the 78.6% projection. Alternatively prices can move towards the first support at 110.084 where the swing low sits. if it breaks this level, bearish momentum will bring price to second support at 107.669.

Areas of consideration:

- H4 time frame, 1st resistance at 114.759

- H4 time frame, 1st support at 110.084

EUR/USD:

On the H4, price is moving within the descending trendline in a descending manner, with the price moving below ichimoku cloud- we are still overall bearish biased. Price has pulled back slightly and it looks like bearish momentum might bring price to 0.9695 where the 78.6% retracement sits. if it breaks this level, price would test the second support at 0.9545 where the swing low and 161.8% extension sit. Alternatively, price might test the first resistance at 1.0047 where the 78.6% retracement sits. If price breaks this level, it may test the second resistance at 1.0194, where the previous swing high sits.

Areas of consideration :

- H4 1st resistance at 1.0047

- H4 2nd resistance at 1.0194

GBP/USD:

On the H4, price has rejected the resistance and is moving in a descending trend hence we are slightly bearish bias- price looks like its moving toward the first support at 1.0915 where the 50% retracement sits, bearish momentum will bring price to the second support at 1.0355 where the previous swing low sits. Alternatively, price could test the first resistance at 1.1437 where the 78.6% retracement and overlap resistance sit. If it breaks this level, it should test the second resistance at 1.1739.

Areas of consideration:

- H4 1st support at 1.0915

- H4 1st resistance at 1.1437

USD/CHF:

USDCHF is in a strong bullish trend on the H4 chart. Price is trading above the Ichimoku cloud signalling a bullish trend. Price is testing the first resistance at 1.0046 where the previous swing high sits. Bullish momentum could potentially drive prices up to 1.0220. Alternatively, bearish momentum could bring price to test the first support at 0.9857 where the overlap support and 38.2% retracement sits then the second support at 0.9757 where the 50% retracement sits

Areas of consideration

- H4 1st support at 0.9868

- H4 1st resistance at 1.0046

XAU/USD (GOLD):

On the H4 chart, the overall bias for XAUUSDis bearish. To add confluence to this, price is below the Ichimoku cloud which indicates a bearish market. Overnight, price has continued it’s bearish momentum downwards. Expecting price to reach the 1st support at 1614.925 where the previous low and 0% Fibonacci line is located.

Areas of consideration:

- H4 time frame, 1st support at 1614.925

- H4 time frame, 1st resistance at 1688.526

AUD/USD:

On the H4, the price is dropping from the 1st resistance at 0.63411, with the price is below the descending channel and ichimoku cloud, we can expect the price test the 1st support at 0.61921, where the previous swing low, 61.8% fibonacci projection and 200% fibonacci extension are. Alternatively, the price may retest the 1st resistance and then rise to the 2nd resistance at 0.65323, which is in line with the overlap resistance.

Areas of consideration

- H4, 1st resistance at 0.63411

- H4, 1st support at 0.61921

NZD/USD:

On the H4, the price is below the ichimoku cloud and descending trendline, we can expect the price to drop to the 1st support at 0.55544, where the swing low support is. Alternatively, the price may rise to the 1st resistance at 0.57127, where the previous swing high is. If the 1st resistance level is broken, the 2nd resistance level is at 0.58022, where the previous swing high, 100% fibonacci projection and 38.2% fibonacci retracement are.

Areas of consideration:

- H4 time frame, 1st resistance at 0.57127

- H4 time frame, 1st support at 0.55544

USD/CAD:

The overall bias for USDCAD on the H4 chart is bullish. Price has a weak bullish momentum upwards overnight. If the bullish trend continues, price might head towards the first resistance level at 1.3967, where the previous high is located.

Areas of consideration:

- H4 time frame, 1st resistance at 1.3967

- H4 time frame, 1st support at 1.36751

OIL:

Looking at the H4 chart, the current overall bias for Oil is bearish. To add confluence to this bias, the price is currently below the Ichimoku cloud which indicates a bearish market. Overnight, price had a slight bullish momentum back up towards the 1st resistance line at 93.381 where the 38.2% and 78.6% Fibonacci lines are located. Expect the price to tap onto the 1st resistance today if this short term bullish momentum continues.

Areas of consideration:

- H4 time frame, 1st resistance at 93.381

- H4 time frame, 1st support at 88.186

Dow Jones Industrial Average:

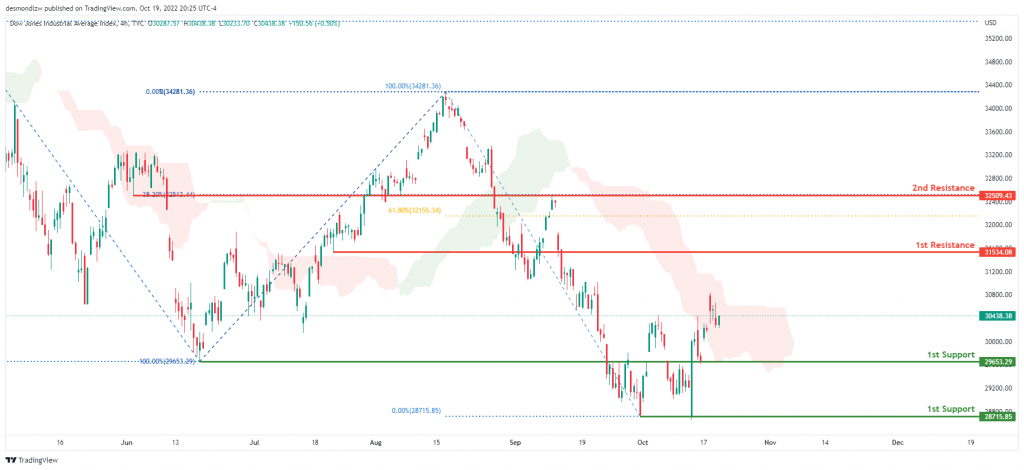

According to the H4 chart, DJI now has a bearish overall bias. Price maintained its bullish upward momentum overnight. Expect the price to potentially move toward the first resistance at 30982.97, where the 38.2% Fibonacci line is placed, if this short-term bullish momentum persists.

Areas of consideration:

- H4 time frame, 1st support at 29653.29

- H4 time frame, 2nd support at 28715.85

- H4 time frame, 1st Resistance at 30982.97

DAX:

On the H4, as the price is crossing the ichimoku cloud, we can expect the price to break the 1st resistance at 13490.91, where the overlap resistance and 78.6% fibonacci retracement are. If the 1st resistance is broken, the 2nd resistance is at 14717.44, which is in line with the previous swing high. Alternatively, as the price is below the descending trendline, the price may drop to the 1st support at 11874.07, which is in line with the swing low.

Areas of consideration:

- H4 time frame, current price

- H4 time frame, 1st resistance at 12668.06

ETHUSD:

Looking at the H4 chart, the current overall bias for ETHUSD is bearish. However overnight, price has closed above the Ichimoku cloud which might indicate a short term bullish momentum. For the past 1 month, price has been consolidating between the 1st resistance at 1405.86 and 1st support at 1405.86. Expecting price to continue consolidating in this area with no clear signs of direction.

Areas of consideration:

- H4 time frame, 1st resistance of 1405.86

- H4 time frame, 1st support at 1220.00

BTCUSD:

On the H4, price is crossing ichimoku cloud, and Stoch is dropping from the resistance, we have a bearish bias that the price may drop to the 1st support at 18220.96, which is in line with the previous swing lows and if the 1st support is broken, the 2nd support is at 17556.55, where the previous swing low is. Alternatively, the price may rise to the 1st resistance at 20427.23, where the overlap resistance and 50% fibonacci retracement are.

Areas of consideration:

- H4 time frame, current price

- H4 time frame, 1st support at 18220.96

S&P 500:

Based on the H4 chart, the S&P500 is still within the bearish channel and has retraced from the the 1st resistance of 3800, which is in line with the 38.2% fibonacci retracement level and previous swing high. We have a short term bearish bias that price could trade lower towards the 1st support of 3492.42 which is in line with the previous swing low.

Areas of consideration:

- H4 time frame, 1st support at 3492.42

- H4 time frame, 1st resistance at 3800

- H4 time frame, 2nd resistance at 4007.4

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.