EUR/USD:

Looking at the weekly chart, we can see that prices are testing the support area of our ascending channel at 1.200, which coincides with the 50% Fibonacci retracement and 78.6% Fibonacci extension. We could see a further upside to test our resistance area at 1.2300, in line with the graphical swing high resistance and 78.6% Fibonacci extension. On the daily time frame, prices are holding nicely above the ascending trend line and support area at 1.200 which can also be found on the weekly time frame.

On the H4 timeframe, prices are facing upside pressure from our support area at 1.2080, which coincides with the graphical overlap resistance and 38.2% fibonacci retracement. This would be an interesting level for buyers and recent price action around that area suggests it is a strong area of demand flowing, where we could see a further upside to our short term resistance level at 1.2180, in line with the graphical swing high resistance on the H4 time frame.

Areas of consideration:

- 2080 support area found on H4 time frame

- 2180 resistance level found on H4 time frame

GBP/USD:

Looking at the weekly chart, we can see that prices are holding nicely above our ascending trend line and weekly support area at 1.3500 where we could see a further upside to the weekly resistance level at 1.4300, in line with the graphical swing high area and 78.6% Fibonacci extension. On the daily time frame, our support area at 1.3500 – 1.3600, which is also found on the weekly time frame, coincides with the 23.6% Fibonacci retracement, where we could see further upside in prices above this area.

On the H4 timeframe, prices are facing bullish pressure from our ascending trend line and support area at 1.3860, in line with the 23.6% Fibonacci retracement. We could see a further upside above this level to our short term resistance area at 1.400, in line with the 78.6% Fibonacci extension.

Areas of consideration:

- 400 resistance area resistance area found on H4 timeframe

- 3860 support level found on H4 timeframe

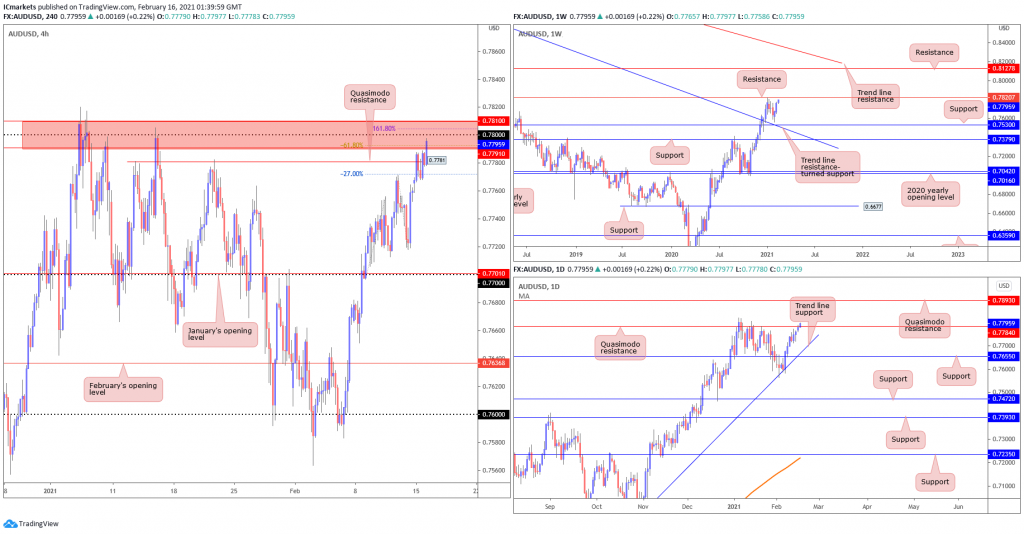

AUD/USD:

From the Weekly timeframe, we can see that price is approaching the previous high at 0.78207, from the week of 4 January (2021), we may witness a longer-term continuation of bullish trend into the next resistance at 0.81278, a retested swing-high level since 11 May (2015). On the Daily timeframe, price is currently testing the Quasimodo resistance at 0.7784 level. On H4, we could see that AUDUSD showed a small pullback when it reached the 0.7781 level as well as the -27% retracement. And currently, price is testing the major level of 0.78, in a resistance zone that includes -61.8% and 161.8% retracement. A wiser action to take, would be to watch how price breaks out of this area whether bullish or bearish before considering a port of call.

Areas of consideration:

- H4 still within resistance area inclusive of major level 0.78, Fibonacci retracement of -61.8% and 161.8%.

- Daily and Weekly still showing bullish momentum, while approaching key resistance levels.

USD/JPY

The US dollar continued its advance up north on Tuesday, where it is now approaching the 105.768 level in line with the 61.8% Fibonacci retracement and horizontal swing high resistance. If price breaks above this level, we could see buyers step in further and push price higher up to the 106.110 resistance level.

Against the backdrop of the H4 timeframe, price broke out of the weekly declining wedge (106.94/104.18) and saw a slight pullback, before pushing up higher again. On the daily chart, we see that price is now pushing up to test the MA (200) again after making a slight pullback. This shows us room for bullish momentum upwards to test the resistance level at 106.060 level. However, before that on the H4 chart, we couldn’t ignore the support at 104.58 where the horizontal pullback support is.

Areas of consideration:

- 06 resistance on the Daily timeframe is a possible upside target

- 768 level in line with the 61.8% Fibonacci retracement and horizontal swing high resistance

USD/CAD:

Looking at the weekly chart, prices have respected the descending trendline drawn from 13 April (2020) high and is approaching the 2018 Yearly opening level at 1.2579. It is important to note that the long-term picture has pointed the direction down (trend) since March (2020). In the daily time frame, USD/CAD has made a strong bearish candle following the graveyard doji-like candle made on 12 February (2021), which is within stone’s throw distance from the weekly support in line with the 2018 Yearly opening level of 1.2579. And on the H4 timeframe, the strong bearish move is clear as the price has run lower for the fourth consecutive day. We could see price make a beeline towards the major figure of 1.26, in line with -27% retracement and 161.8% extension level.

Areas of consideration:

- H4 shows light support area at major figure 1.26, Weekly support level of 1.2579, Fibonacci -27% retracement, and 161.8% extension.

- Weekly and Daily both showing strong bearish momentum as price approaching Weekly support level and 2018 Yearly opening level of 1.2579.

USD/CHF:

USD/CHF is still showing strong bearish pressure on Tuesday, with price holding below the descending trendline resistance and major resistance at 0.90140, in line with our 61.8% Fibonacci retracement and 78.6% Fibonacci extension. Price is now testing the support level at the 0.88850 level, which is in line with our 61.8% Fibonacci retracement. A break below this level could provide further bearish momentum for further downside.

The daily timeframe reinforces our bearish bias, where we see price making a further push down towards our support level at 0.8834, in line with our 78.6% Fibonacci retracement. With price holding below both the descending trendline and moving average resistances, we expect a further push down below this level towards our Quasimodo support level at the 0.86830 level.

Looking to the H4 timeframe, we see that price has made a lower high, and is looking to make a lower low in line with our bearish bias. With price breaking below the 0.8900 level, we can expect price to push further down south, towards the 0.88450 level in line with our -27.2% Fibonacci retracement and 61.8% Fibonacci retracement, and finally to January’s opening level at 0.88240 which is also in line with our 78.6% Fibonacci extension level. Otherwise, should price fail to break below these levels, we can expect a pullback to the 0.89000 level instead.

Areas of consideration:

- USD/CHF continues to show strong bearish pressure, as price holds below the trendline and moving average resistances.

- Price is now testing the 0.88874 weekly support level.

- 88450 and 0.88240 levels on the H4 timeframe are possible downside targets to watch out for.

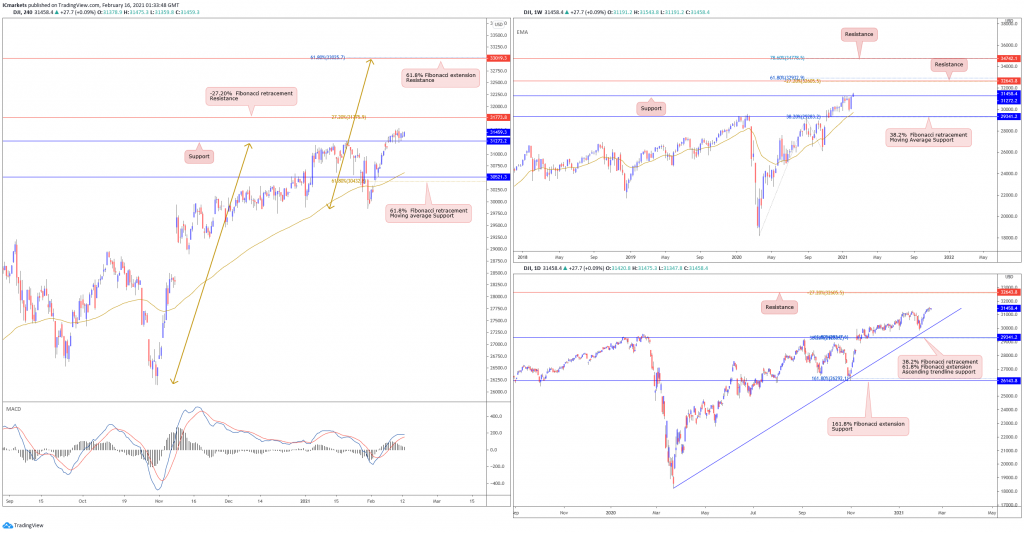

Dow Jones Industrial Average:

On the weekly chart, price continues to hold above 31272 as markets made a new high. Traders can expect to see price pushing even higher towards the next resistance at 32643. Otherwise, failure to hold above 31272 could mean that this is a fake out and probably pull back towards 29341 support. With no change for the Daily, price continues to hold very strongly above ascending trendline support. Traders should be careful when deciding to trade any short term pullbacks as the bullish momentum on the longer term is very strong.

No change on the H4 as price continues to hold above 31272 support level and is currently drifting sideways. Technical indicators continue to show room for further bullish upside. 31272 is the level where we may possibly see buyers pile in and add to their longs with a possible resistance target at 31773.8. Otherwise, failure to hold above 31272 could see price swing back and come back to the 61.8% Fibonacci retracement level and moving average support at 30521.

Areas of consideration:

- 31272 key support to watch

- Bullish momentum on both the weekly and H4 chart is very strong.

XAU/USD (GOLD):

On the weekly timeframe, gold is still holding above long term moving average support. Traders could possibly see price drift towards 1764 support showing any chance of a bounce reaction above this level. On the daily chart, price drifting sideways between 1764 support and 1875 resistance. Price could still very well be drifting sideways between these two levels until a clear break of the daily descending channel shows any confirmation of a directional bias.

On the 4H timeframe, we prefer to remain neutral, watching resistance at 1834 and support at 1810. Technical indicators are mixed as well. Price is holding below moving average whilst stochastics is testing support where price bounced in the past. Failure to hold below 1834 could see price push higher towards next resistance at 1855. Otherwise, breaking below 1810, price could drop towards 1799.

Areas of consideration:

- Technical indicators are giving mixed signals on the short term

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.