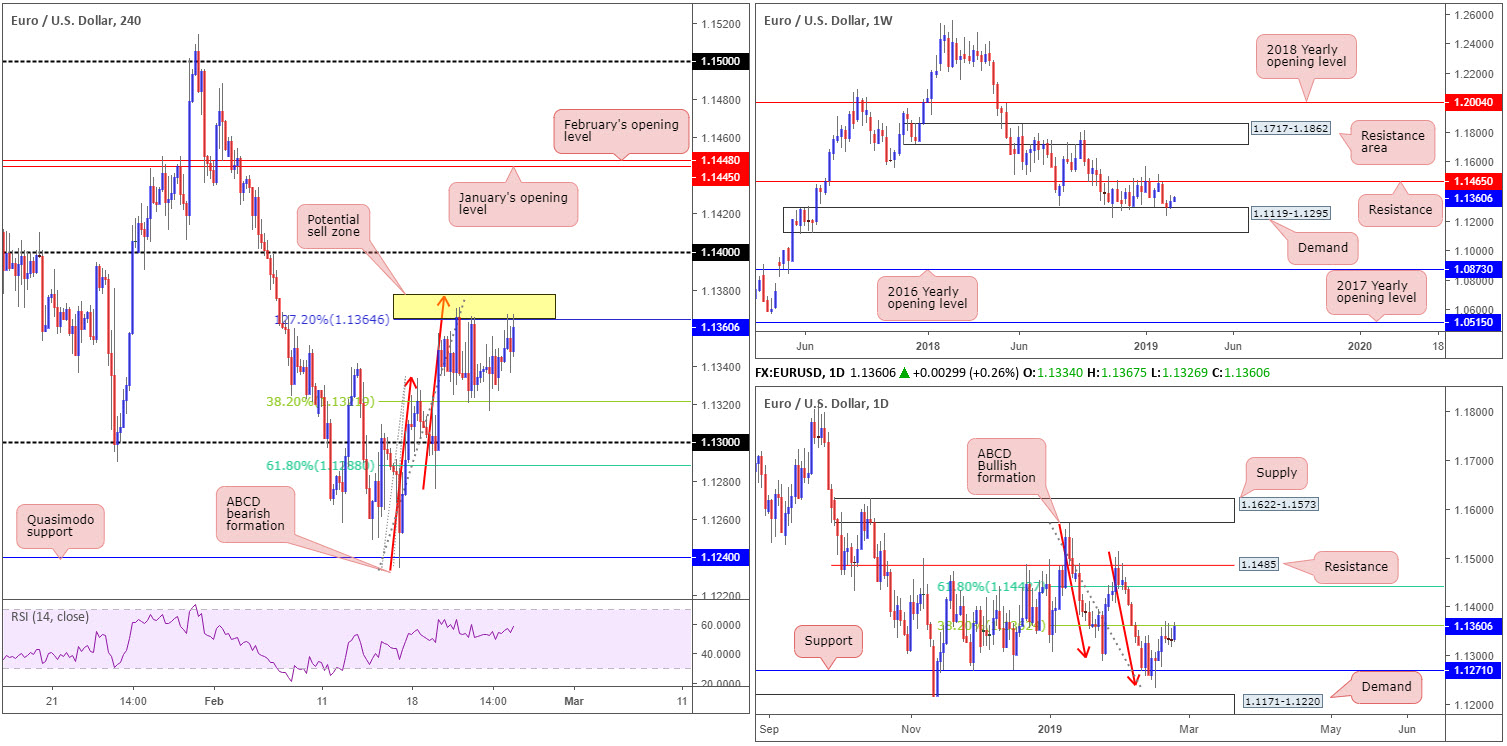

EUR/USD:

Although EUR/USD bulls explored higher ground Monday, technical structure remains unchanged.

From the weekly timeframe, buyers and sellers have been battling for position between a long-standing support/resistance at 1.1465 and a notable demand area coming in at 1.1119-1.1295 since October 2018. As of late, the market tested the lower edge of this range and positioned the buyers in reasonably good stead for a push higher this week.

Daily flow, thanks to recent buying, is seen revisiting its 38.2% Fibonacci resistance value at 1.1362. This level, as highlighted in previous reports, is the first take-profit target for many traders long the daily ABCD bullish completion point (red arrows) around 1.1240. Any sustained move above 1.1362 this week places the 61.8% Fibonacci resistance value at 1.1442 in the spotlight – considered the second take-profit target. A move lower, nonetheless, has support at 1.1271 in sight.

H4 action remains capped by the yellow zone marked at 1.1377/1.1364: a H4 127.2% ABCD (red arrows) pattern and a 38.2% Fibonacci support value at 1.1322: measured as the first take-profit target for harmonic traders.

Areas of consideration:

Overall, the research team is marginally biased to the upside this week. The combination of weekly price striking demand and daily action showing room above 1.1362 towards its second take-profit target (from its ABCD support) at 1.1442.

Despite a possible rally emerging this week, buying based on H4 structure is challenging. Not only do we have 1.1377/1.1364 in play, we also have nearby 1.14 resistance to consider as well. Therefore, unless you fancy your chances buying into H4 and daily structure, in the hope weekly buyers prevail, opting to stand on the side lines may be the better path to take once again.

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

GBP/USD:

Sterling marginally breached 1.31 to the upside Monday and tested February’s opening level plotted nearby at 1.3108 (H4), following news UK Labour would support a second referendum should the Brexit deal be rejected this week, though follow-up comments appeared to cast doubt.

From current price, it might also be worth pencilling in the H4 Quasimodo resistance at 1.3145. All three of the H4 zones are sited within the walls of the current daily supply area, pictured at 1.3160-1.3097. Beyond 1.3145, 1.32 is in sight which is not only positioned 17 pips below a daily Quasimodo resistance at 1.3217; it marks the underside of weekly supply at 1.3472-1.3204.

Areas of consideration:

On account of the above, as highlighted in Monday’s report, the research team feel sellers may enter the fray this week.

A short from the H4 Quasimodo resistance at 1.3145 is appealing. Not only is it located within the upper boundary of the current daily supply, the level may be used to help facilitate a fakeout (or stop run) above 1.31 this week (red arrows – round numbers attract a huge amount of orders).

Failing a response from 1.3145, the 1.32 handle is the next logical barrier for shorts given its connection with weekly supply mentioned above at 1.3472-1.3204.

For conservative traders wishing to add a little more confirmation to the mix from either 1.3145 or 1.32, waiting for an additional bearish candlestick signal to emerge on either the H1 or H4 is an option (entry/stop parameters can be defined according to this structure).

Today’s data points: UK Inflation Report Hearings; US CB Consumer Confidence; Fed Chair Powell Testifies.

AUD/USD:

Amid the early hours of Monday’s segment, US President Trump busied himself on Twitter, stating he will be delaying the US increase in China tariffs, and assuming US and China make additional progress, Trump will be planning a Summit with Chinese President Xi at Mar-a-Lago. This, alongside a modest USD selloff, provided a firm floor for AUD/USD buyers yesterday.

The H4 candles, as you can see, rallied to highs of 0.7184, though failed to maintain its upside presence beyond Quasimodo resistance at 0.7176 in the form of back-to-back selling wicks. 0.7176 is followed closely by the 0.72 handle which fuses with 0.7199 on the weekly timeframe (merging trend line resistance [taken from the 2018 yearly high of 0.8135]), and also has nearby resistance possibly offered on the daily scale around its channel resistance (taken from the high 0.7295).

Areas of consideration:

Despite selling wicks emerging from 0.7176 on the H4 scale, selling from here is considered low probability, according to our technical studies. The 0.72 neighbourhood stands a greater chance of producing a meaningful correction lower. As underlined above, 0.72 holds weekly resistance nearby at 0.7199 along with a trend line resistance, and nearby channel resistance out of the daily chart.

Should price shake hands with 0.72 and chalk up a H4 or H1 bearish candlestick formation (entry/stop parameters can be defined according to this structure), a sell in this market is high probability, targeting a move beyond 0.7176 (will be support at this point). The reason for requiring an additional candlestick signal is simply due to the threat of a fakeout forming through 0.72, which is common viewing around psychological numbers.

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

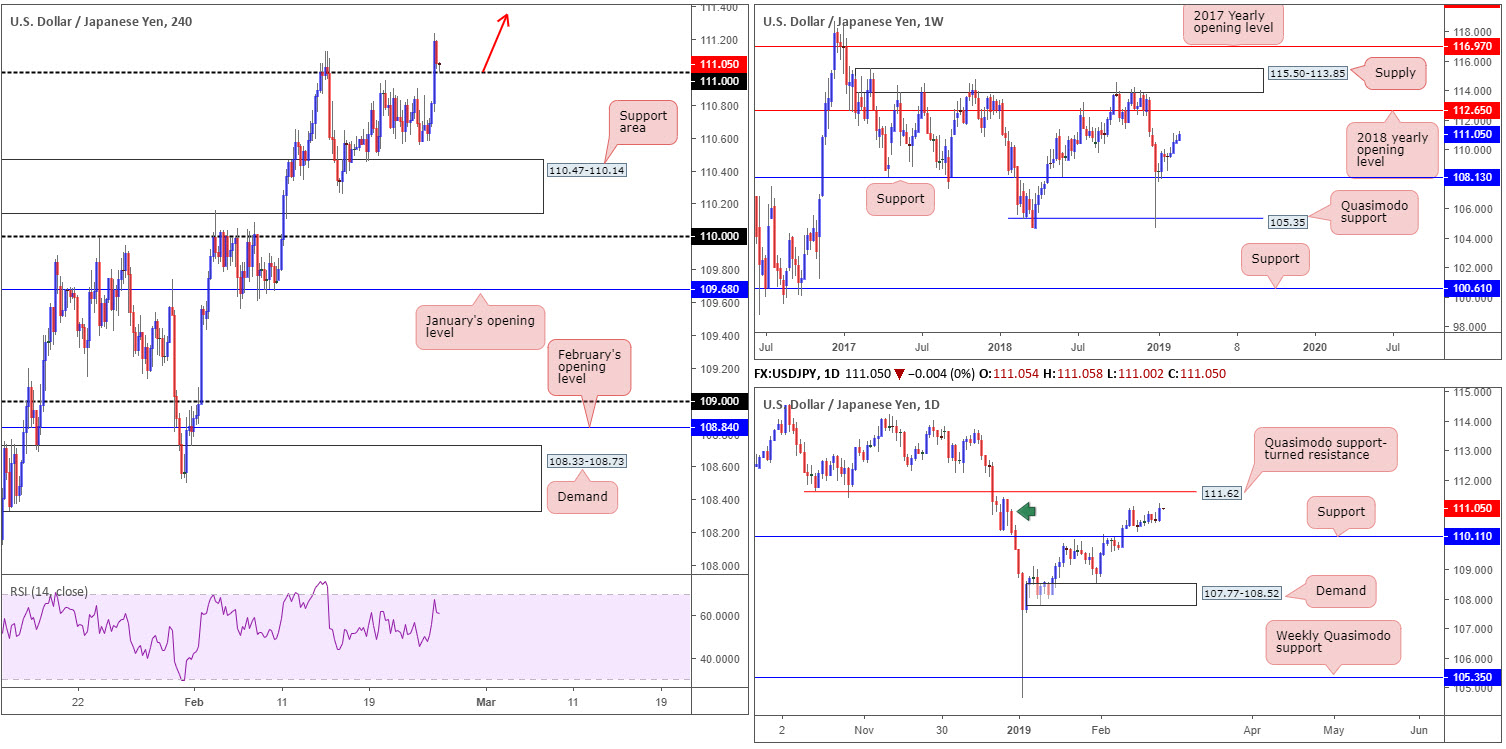

USD/JPY:

Hopes of the US and China reaching a trade deal increased Monday, following a Tweet from US President Trump announcing he delayed the increase in tariffs on Chinese imports. As a consequence, this allowed traders to step away from safe-havens.

After consolidating for a large portion of last week, H4 action advanced northbound and reclaimed 111+ status, reaching fresh 2019 highs of 111.23. As we write, it appears this number is likely to be retested as support during Asia today.

On more of a broader perspective, weekly price, as long as the unit remains above support drawn from 108.13, upside on this timeframe is relatively free until linking with its 2018 yearly opening level at 112.65. Structure on the daily timeframe, however, consists of a supply area at 111.40-110.27 (green arrow), a support level coming in at 110.11 and a Quasimodo support-turned resistance at 111.62.

Areas of consideration:

Having witnessed 111 overthrown in recent trading, along with both weekly and daily structure displaying room to move north, a possible long opportunity off the retest of 111 this morning could be worthy of the trade list. A bounce off this number by way of a H4 bullish pin-bar formation (entry/stop levels to be defined by the candlestick structure) has 111.62 to target as the initial take-profit zone (the daily resistance level).

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

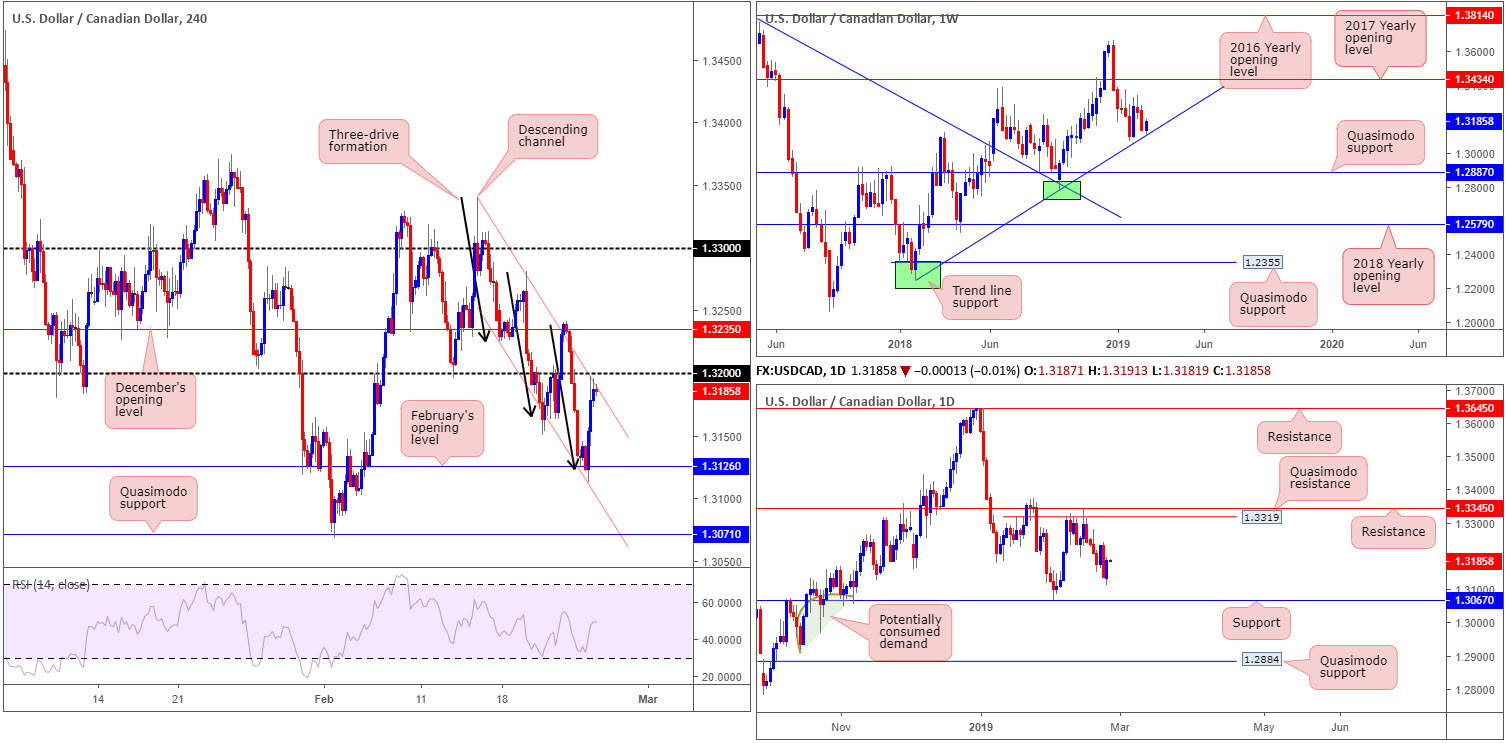

USD/CAD:

The US dollar advanced strongly against its Canadian counterpart Monday, bolstered by a sharp decline witnessed in oil markets – WTI crossed beneath its $55.50 threshold.

As weekly price neared its trend line support (extended from the low 1.2247), H4 action, as underlined in Monday’s briefing, was visibly approaching February’s opening level at 1.3126. It was also mentioned this barrier merged closely with a channel support (taken from the low 1.3225) and a three-drive bullish pattern (etched in black arrows from a high of 1.3340). Well done to any of our readers who managed to pin down a position long from here, as the unit comfortably reached the opposing channel extreme, sited a few pips south of its 1.32 handle.

Areas of consideration:

With the aforementioned weekly trend line support in motion, entering short at the noted H4 channel resistance, or even at the nearby 1.32 handle, is precarious.

With this in mind, higher levels are potentially in store.

Folks who managed to secure a long from 1.3126 might consider reducing risk to breakeven and taking some profit off the table at current price. The remainder of the position can be left to run as both weekly and daily structure show limited resistance nearby.

Those who missed the run from 1.3126 may be offered a second chance to enter long above 1.32, though nearby H4 resistance in the shape of December’s opening level at 1.3235 may temporarily hinder upside. Therefore, although directional flow from higher-timeframe structure points to the upside, tread carefully above 1.32.

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

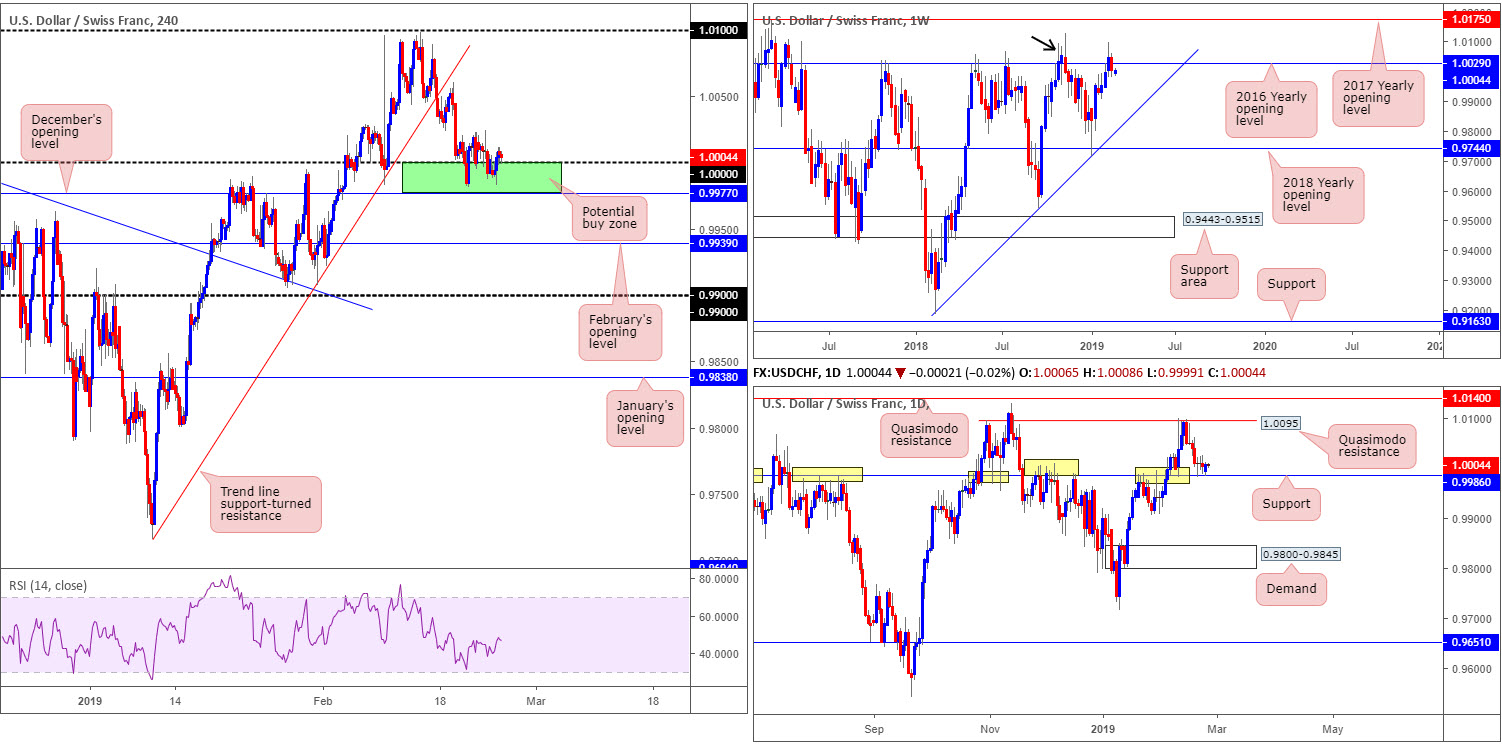

USD/CHF:

Since Wednesday last week, the USD/CHF has been relatively sedated, flipping between gains/losses around 1.0000 (parity). With that being the case, much of the following piece will bring forward thoughts echoed in Monday’s briefing.

Weekly buyers struggled to gain a foothold above its 2016 yearly opening level at 1.0029 last week, consequently clawing back prior week gains and breaking a three-week bullish run. As highlighted in the previous weekly briefing, the barrier’s history as a resistance may still draw in sellers as it did in November 2018 (black arrow).

A closer look at price action on the daily timeframe turns the spotlight towards notable support seen at 0.9986. The level’s history (yellow) is a prominent feature on this chart, and therefore could hinder weekly sellers from 1.0029 this week.

Alongside 1.0000 on the H4 timeframe, December’s opening level at 0.9977 as well as daily support coming in at 0.9986, collectively forms an appealing range of support (green). As highlighted in previous analysis, while 0.9977/1.0000 may be a tempting location to consider buying this market from in view of its construction, traders are urged to take into account weekly price trading beneath its 2016 yearly opening level at 1.0029.

Areas of consideration:

The combination of daily support mentioned above at 0.9986, December’s opening level at 0.9977 and 1.0000 has likely enticed buyers into the market, despite the threat of weekly sellers residing above.

For those currently long this market, with stop-loss orders likely tucked underneath December’s opening level, the initial upside target around 1.0050 appears a reasonably logical starting point, followed by the daily Quasimodo resistance at 1.0095 (the next upside target on the daily scale).

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

Dow Jones Industrial Average:

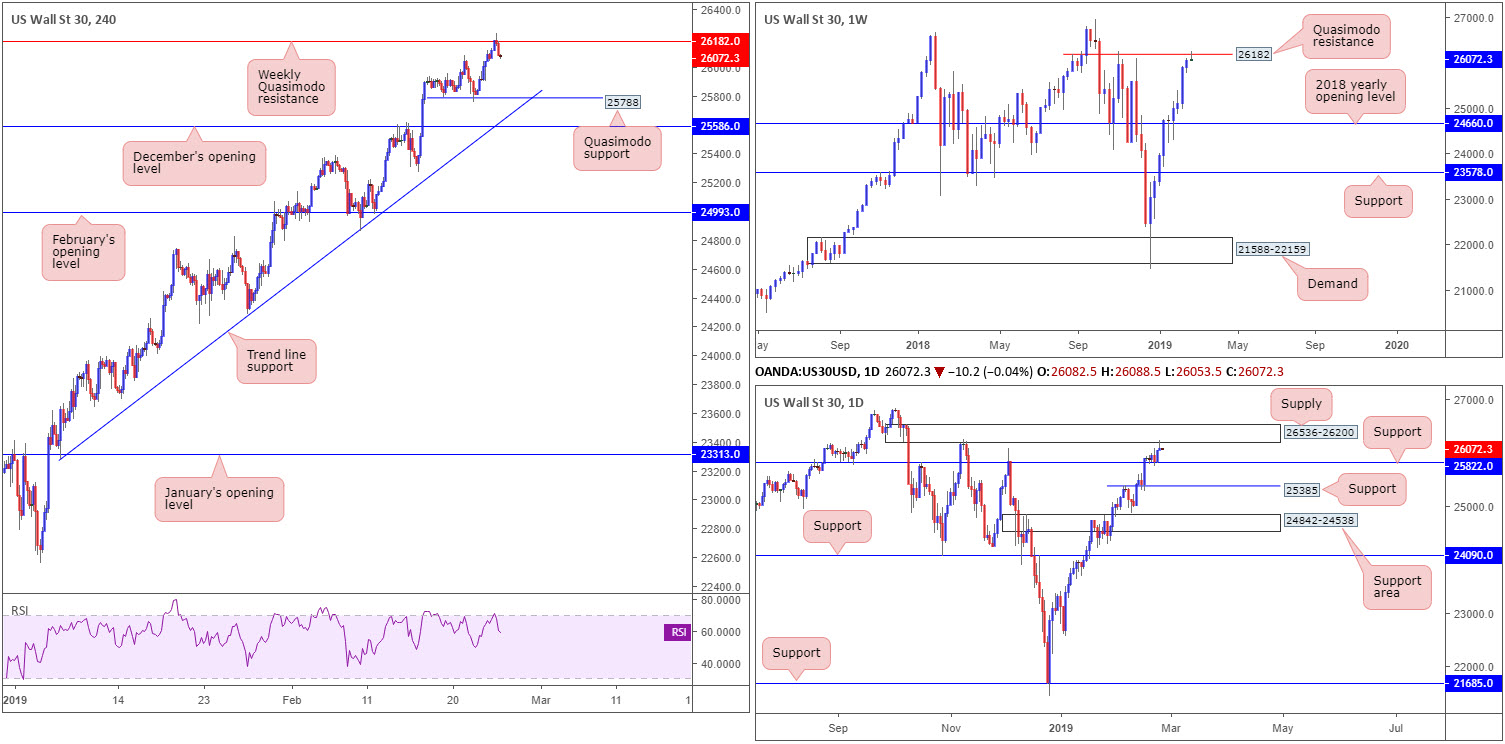

Kicking things off from the top this morning, Monday observed weekly action cross swords with Quasimodo resistance at 26182, which could potentially hamper upside in this market.

Further adding to the above, we can also see daily flow connecting with the underside of supply coming in at 26536-26200. It may also be of interest to candlestick traders the response from this area came by way of a bearish pin-bar formation. The next downside target on the daily scale falls in around support at 25822.

There’s not much to add in terms of structure on the H4 timeframe, aside from the next support target on this scale can be seen a few points south of daily support at 25788: a Quasimodo support level.

Areas of consideration:

Keeping things simple, a short in this market is considered high probability, according to our technical reading. Basing entry and stop levels off the daily bearish pin-bar formation, traders have more than a 1:1 risk/reward ratio to the daily support level mentioned above at 25822.

Today’s data points: US CB Consumer Confidence; Fed Chair Powell Testifies.

XAU/USD (GOLD):

The yellow metal was little changed Monday, ranging no more than $7. As is evident from the H4 timeframe this morning, the candles are enveloped between a supply drawn from 1337.3-1333.2 and a rather interesting area of support (yellow) at 1315.5/1321.0 (comprised of H4 support at 1315.5, the 61.8% H4 Fibonacci support value at 1319.4 and February’s opening level at 1321.0).

Higher up on the curve, weekly flow left resistance at 1357.6 unchallenged last week and faded highs of 1346.7, concluding the week by way of a bearish pin-bar formation. This has likely caught the eye of candlestick traders, and could potentially entice sellers into the market this week towards the 2018 yearly opening level at 1302.5.

A notch lower, on the other hand, daily price is seen hovering ahead of support at 1322.1 that is currently housed within an ascending channel support (1196.4/1298.5). Therefore, this may hinder downside activity on the weekly timeframe this week.

Areas of consideration:

With the above in mind, traders may find use in the yellow zone marked on the H4 timeframe at 1315.5/1321.0 as a possible buy zone today. Note this area is also seen a few pips south of daily support at 1322.1.

Despite 1315.5/1321.0 housing reasonably attractive confluence, do bear in mind weekly price shows room to potentially press beyond this area. For that reason, waiting for additional forms of confirmation to take shape out of the zone is recommended before pulling the trigger. One such example is a H4 bullish candlestick signal. An alternative to this is drilling down to the lower timeframes and trading a resistance-turned support setup.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.