Key risk events today:

RBA Gov. Lowe Speaks; US CB Consumer Confidence; Richmond Manufacturing Index; RBNZ Financial Stability Report.

EUR/USD:

(Italics – previous analysis).

Europe’s shared currency finished Monday mostly unmoved against the US dollar. In terms of risk events, sentiment among German executives has improved a little, according to the IFO Institute for Economic Research. The IFO Business Climate Index rose from 94.7 points in October to 95.0 points in November. Manufacturing, however, is still stuck in recession.

Technically, H4 concluded within striking distance of the key figure 1.10, which boasts additional layers of support nearby in the form of a 61.8% Fibonacci retracement at 1.0994 and September’s opening level at 1.0989. Below this base, nevertheless, scope for a run towards Quasimodo support at 1.0957 is visible. Indicator-based traders may also want to note the relative strength index (RSI) trades at its oversold value.

Longer-term flow retains a bearish tone, languishing south of a long-standing weekly resistance area at 1.1119-1.1295. Further selling has the lower boundary of a weekly descending channel to target (extended from the low 1.1109), merging closely with the 2016 yearly opening level at 1.0873. Concerning trend direction, the primary downtrend has been in motion since topping in early 2018 at 1.2555.

Despite several upside attempts, daily resistance at 1.1072 – boasts reasonably significant history since the beginning of August – maintained its presence in recent trade. The 50-day SMA (blue – 1.1041) gave way Friday, consequently exposing the 1.0989 November 14 low, followed by daily demand at 1.0851-1.0950. Note the said demand base holds the 2016 yearly opening level at 1.0873 within its lower boundary.

Areas of consideration:

The area between September’s opening level at 1.0989 and the 1.10 figure on the H4 likely commands interest this week as a potential buy zone. However, whipsaws are common viewing around psychological levels; waiting for additional candlestick confirmation to form before pulling the trigger is, therefore, an idea worth considering (entry/risk can be defined according to the selected candlestick pattern).

A decisive close beneath 1.0989 opens the door to an intraday bearish theme, targeting H4 Quasimodo support at 1.0957 as the initial downside take-profit area. Do bear in mind, though, weekly price suggests the 2016 yearly opening level at 1.0873 could eventually make an appearance, so keeping a portion of the position open is certainly an idea.

GBP/USD:

(Italics – previous analysis).

An outperformer on the day, the British pound navigated higher ground vs. the buck Monday, consequently reclaiming much of Friday’s downside move and crossing swords with the underside of 1.29. The move came about following weekend polls, demonstrating we could see a Conservative majority in the critical Brexit-focused election.

From a technical standpoint, the H4 candles continue to trade rangebound between resistance at 1.2967 and the 1.28 handle (grey). Within the range falls the 1.29 handle and November’s opening level at 1.2938. Outside of the consolidation, traders may want to acknowledge the key figure 1.30, and an interesting area of support in green comprised of weekly support (2019 yearly opening level) and daily support at 1.2739 and 1.2769, respectively.

Structurally, the view on the weekly timeframe remains optimistic, exhibiting scope to extend north until crossing swords with supply at 1.3472-1.3204 and long-term trend line resistance etched from the high 1.5930. However, before a move higher materialises, a retest at the 2019 yearly opening level 1.2739 is certainly a scenario to keep a tab on this week, having seen the barrier boast reasonably significant history (red arrows). Regarding the immediate trend, the market faces a downward trajectory from 1.4376, with a break of the 1.1904 low (labelled potential support) confirming the larger downtrend from 1.7191.

Since mid-October, candle action on the daily timeframe has been carving out a consolidation between a resistance area plotted at 1.3019-1.2975 and a well-placed support level at 1.2769. Beyond this range, Quasimodo resistance lies at 1.3102, whereas south of 1.2769, the 200-day SMA (orange – 1.2699) and 50-day SMA (blue – 1.2689) offer support and are, at the time of writing, seen closing in on each other for a possible cross higher (sometimes referred to as a ‘Golden Cross’).

Areas of consideration:

Currently, the technical landscape symbolises an uncertain market, with all three highlighted timeframes emphasising a ranging motion.

The 1.30 handle based on the H4 timeframe is likely of interest to sellers this week, knowing a violation of the upper H4 range limit at 1.2967 potentially trips a number of buy stops to sell into. The same can be said for the weekly and daily support levels at 1.2739 and 1.2769 (green), upon viewing a fakeout beyond the lower H4 range limit, 1.28.

AUD/USD:

(Italics – previous analysis).

Largely a function of a somewhat sturdier dollar, AUD/USD movement ceded further ground Monday and tested lows of 0.6768, levels not seen since mid-October.

Technical research on the H4 timeframe remains capped south of the 0.68 boundary, aided by trend line resistance extended from the high 0.6913. October’s opening level at 0.6750 represents the next downside target, closely shadowed by September’s opening level at 0.6724 and then the 0.67 handle.

On a wider perspective, recent movement hauled weekly price deeper into its current range between 0.6894/0.6677 (light grey). With a primary downtrend in play since early 2018, breaking through the lower edge of the said range is likely, with the next support target not visible until around 0.6359.

In terms of the daily timeframe, price continues to explore ground beneath the 50-day SMA (blue – 0.6806). Although support may develop around the 0.6728ish region, traders likely have their crosshairs fixed on support pencilled in from 0.6677.

Areas of consideration:

For those who read the technical reports last week may recall the following piece:

A decisive H4 close beneath 0.68 that’s followed up with a retest, preferably in the shape of a H4 bearish candlestick configuration (entry and risk can [trader dependent] be set according to this structure), would likely be viewed as a potential short, targeting October’s opening level at 0.6750 on the H4 scale as an initial take-profit zone.

In light of the strong close sub 0.68 and retest at the underside of the figure Friday, shaped by way of a reasonably strong H4 selling wick (upper shadow), a short position may be considered at the open with a protective stop-loss order plotted north of trend line resistance etched from the high 0.6913.

Traders who remain short this market, as highlighted above, have 0.6750, 0.6724 and 0.67 as potential downside targets to work with.

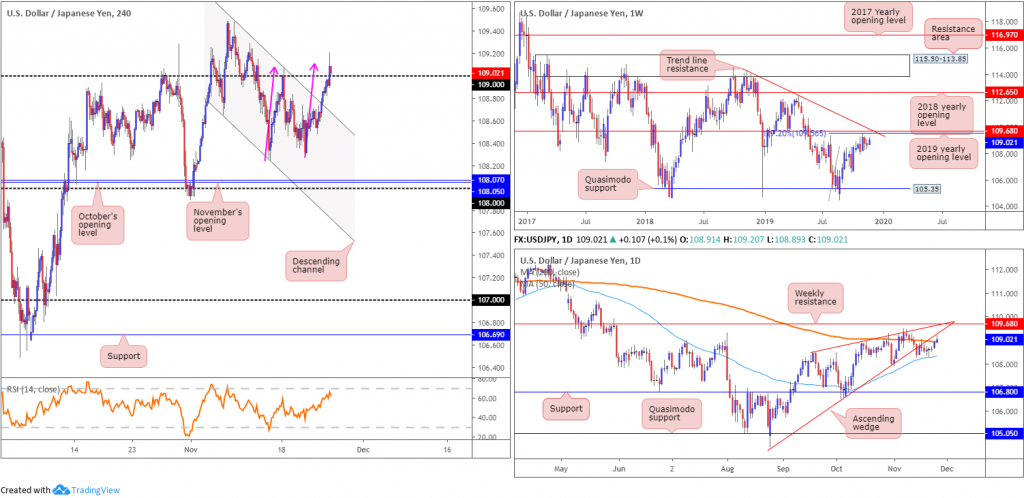

USD/JPY:

(Italics – previous analysis).

USD/JPY bulls went on the offensive Monday, as market participants remained attuned to developments in the US/China trade relationship.

Recent activity witnessed H4 action breach the upper boundary of a descending channel formation, extended from the high 109.47. Upside remained unabated in early Asia this morning, driving through orders at 109 and reaching highs of 109.20. As of current price, the unit is poised to retest the top edge of 109. Holding above 109 will naturally draw in additional buyers, though the H4 ABCD formation (pink arrows – 109.11) and higher-timeframe resistances could pose a problem.

Technical research based on the weekly timeframe had the USD/JPY contained within the prior week’s range (109.29/108.24) last week. Structurally, resistance is seen close by in the form of the 2019 yearly opening level at 109.68 and a 127.2% Fibonacci ext. point at 109.56 (taken from the low 104.44). Also sited nearby is trend line resistance extended from the high 114.23. In regards to the market’s primary trend, the pair has been entrenched within a range since March 2017, spanning 115.50/105.35.

A closer reading of price action on the daily timeframe shows the candles trade just south of the lower edge of a recently broken ascending wedge formation (104.44). A daily close beneath the nearby 200-day SMA (orange – 108.93) here would potentially be viewed as a bearish indicator.

Areas of consideration:

On account of the above analysis, further upside north of 109 is unlikely. The fact H4 action recently completed an ABCD pattern around 109.11, and daily price came within striking distance of testing the underside of a broken wedge pattern as well as weekly price continuing to languish south of strong resistance, sellers appear to have the upper hand at the moment.

Therefore, a H4 close south of 109 serves as an initial cue to weakness in this market. A daily close below the said 200-day SMA would further confirm the bearish theme and open the possibility of selling, targeting the top edge of the H4 descending channel (109.47)/the 50-day SMA (blue – 108.32).

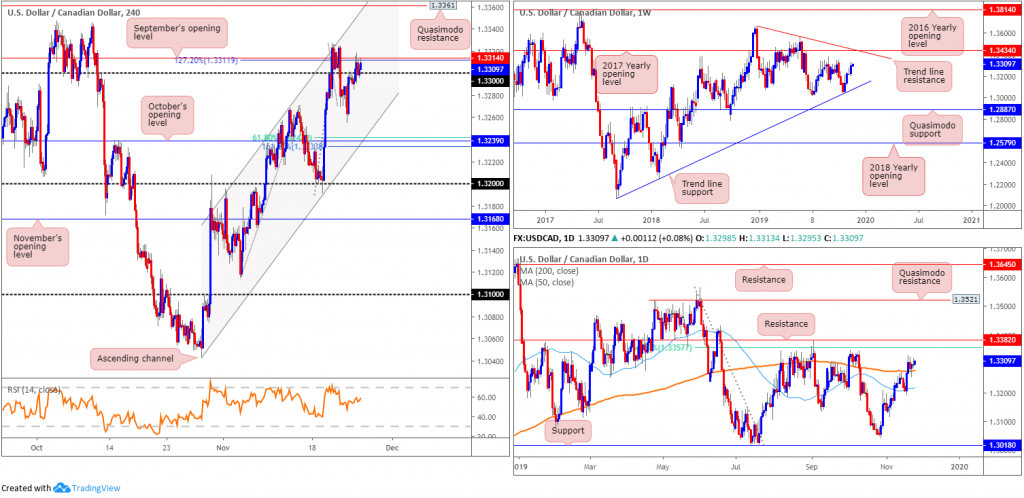

USD/CAD:

(Italics – previous analysis).

Chart studies reveal H4 action claimed 1.33+ status in recent trade, though remains hampered by September’s opening level at 1.3314 and a 127.2% Fibonacci ext. point at 1.3311. Further upside from here, nonetheless, exposes H4 Quasimodo resistance at 1.3361/H4 channel resistance (extended from the high 1.3196), which is a level for potential shorts this week.

With respect to the bigger picture, the weekly timeframe chalked up a healthy bullish candle last week. Adding more than 75 points, the new week has tops around 1.3342 in sight, closely followed by the 2017 yearly opening level at 1.3434 and trend line resistance taken from the peak at 1.3661. Overall, the immediate trend faces north since bottoming in September 2017, though this move could also be considered a deep pullback in a larger downtrend from the 1.4689 peak in early January 2016.

Last Wednesday observed daily price overthrow the 200-day SMA (orange – 1.3275) in reasonably robust fashion, potentially gearing up for a continuation move to around the 1.3382 neighbourhood/61.8% Fibonacci retracement ratio at 1.3357. Interestingly, Friday also witnessed a hammer candlestick pattern form at the top edge of the said 200-day SMA, considered a bullish signal at troughs. As you can see, the hammer candlestick formation is currently holding ground.

Areas of consideration:

H4 Quasimodo resistance at 1.3361 is a vital level for potential shorts this week. Note the line boasts a strong connection with H4 channel resistance and daily resistances mentioned above at 1.3382 and 1.3357. In fact, the apex of the H4 Quasimodo resistance is based at the daily resistance 1.3382, therefore protective stop-loss orders can be sited above here, though this is trader dependent.

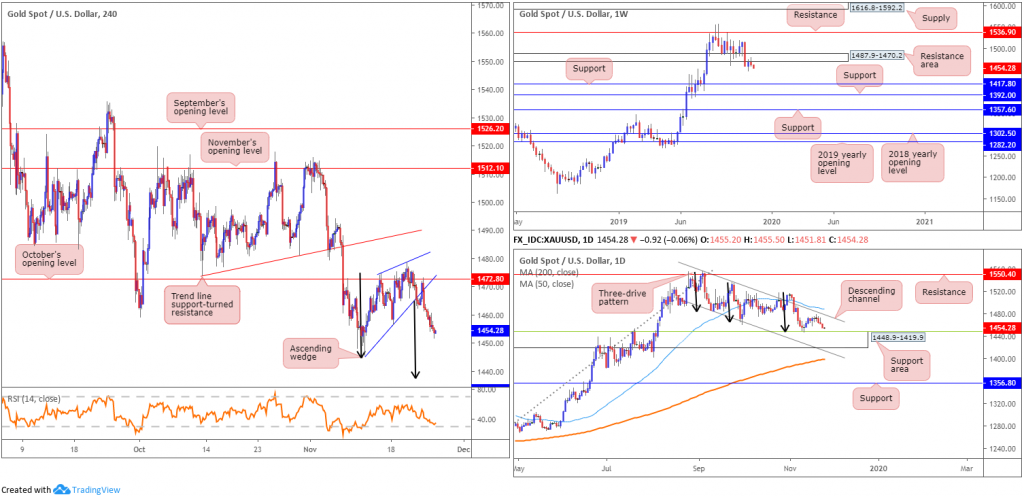

XAU/USD (GOLD):

Monday had bullion lower against the greenback, down more than $6, or 0.46%.

For traders who read Monday’s technical briefing you may recall the following pieces (italics):

The weekly timeframe:

After price recently tunnelled through a notable support area at 1487.9-1470.2, shaped by way of a near-full-bodied bearish candle, XAU/USD retested the underside of the said base and has so far remained firm. Further rejection off the underside of 1487.9-1470.2 potentially sets the long-term stage for a move towards two layers of support at 1392.0 and 1417.8.

Daily timeframe:

With respect to daily positioning, the candles remain confined within a descending channel formation (taken from the high 1557.1 and a low of 1484.6). Price also continues to defend the top edge of a support area coming in at 1448.9-1419.9 (aligns closely with a 38.2% Fibonacci retracement ratio at 1448.5), bolstered by the completion of a three-drive pattern (black arrows).

H4 timeframe:

The H4 ascending wedge, formed since bottoming at 1445.5, had its lower edge give way in recent trade, suggesting a run lower may be on the cards. The take-profit target for an ascending wedge can be measured by taking the size of the base and applying the value to the breakout point (black arrows); in this case, 1437.7.

Friday concluded the week outside of the said wedge configuration, though not before retesting the underside of October’s opening level at 1472.8.

Areas of consideration:

In addition to the above, the report also highlighted the following:

Shorts at current price remain an option. Stop-loss placement, however, depends on risk appetite. Ultimately, structure on the H4 scale recommends stop-loss placement either above October’s opening level at 1472.8 or beyond the upper edge of the wedge pattern.

The top edge of the daily support area: 1448.9 is considered an initial take-profit target, followed by 1437.7.

Well done to any readers who managed to take advantage of recent movement, as price closes in on its first take-profit target: the top edge of the daily support area at 1448.9.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.