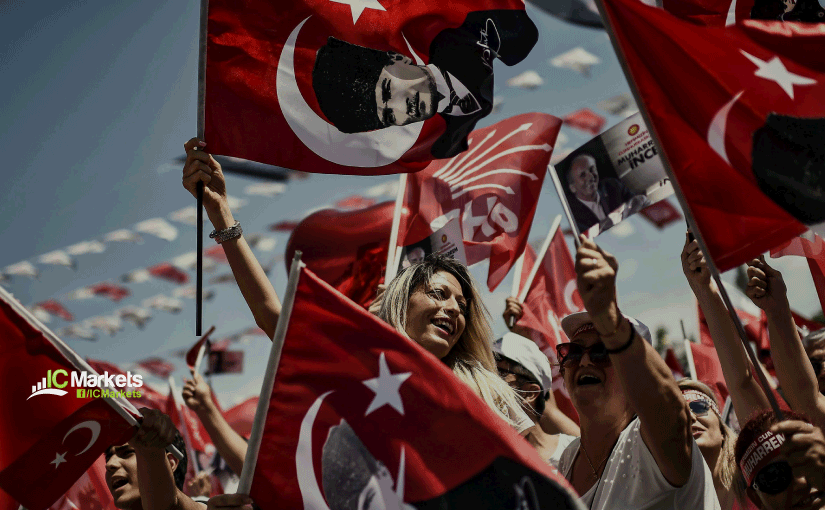

Volatility is back for the Turkish lira, with the local elections planned for Sunday raising the likeliness of major disruptions to their financial markets.

The cost of borrowing liras overnight on the offshore swap market soared past 1,000 percent at one point on Wednesday because local banks are under pressure not to provide liquidity to foreign fund managers who want to bet against the lira.

We expect to see plenty of volatility with the possibility of wider spreads, higher overnight charges and price gaps throughout this event.

Restrictions:

As a result the following restrictions were applied from 28/03/2019 at 13:00 GMT+2:

- TRY Forex pairs were changed to “close only” mode;

Swap values were increased as so:

- MT4 EUR/TRY: Long : -1439.01 Short: 606.62

- MT4 USD/TRY: Long : -1565.8 Short: 435.39

- MT4 GBP/TRY: Long : -1356.99 Short: 421.01

- cTrader EUR/TRY: Long : -143.90 Short: 60.66

- cTrader USD/TRY: Long : -156.58 Short: 43.54

- cTrader GBP/TRY: Long : -135.7 Short: 42.10

Should market conditions deem it necessary, IC Markets reserves the right to make additional changes to the trading conditions prior to and after the Turkish Elections

If you have any questions or require any assistance, please contact one of our support team members via Live Chat, email: support@icmarkets.com, or phone +61 (0)2 8014 4280.

Kind regards,

IC Markets