One of the most unpleasant experiences a trader can face is known as a margin call. To understand the dynamics behind this feature one must first appreciate what margin is in the forex market, which unfortunately is a commonly misunderstood concept.

What is margin?

Margin is essentially a good-faith deposit that’s required by the brokers in order to open and maintain trading positions in the forex market. Furthermore, it also ensures that the trader has sufficient funds in the account. Margin is not a fee nor is it a transaction cost. If you buy on margin you’re effectively borrowing money from your broker to trade – it’s essentially a loan. The deposit is considered margin which is required in order to use leverage! We briefly touched on what leverage is here: What is Forex Trading?

To put it simply, when a trader executes a trade, a portion of their account is put on hold for each lot of currency traded. In addition to this, one must also take into account that as the positions increase so will the margin requirement.

Margin requirements differ from broker to broker. IC Markets offer very reasonable margin rates as low as 0.2% on most FX pairs, as well as flexible leverage options ranging from 1:1 to 1:500.

How to calculate margin?

The formula for calculating margin is as follows: required margin = trade size/account leverage * account exchange rate (if this is different from the base currency of the pair traded).

Using IC Markets margin rates and leverage at 1:500, let’s go through a quick example:

For educational purposes, let’s say that our account is denominated in USD. Trader A has decided that he wants to purchase a standard lot on the AUD/USD pair at a current price of 0.76816. To calculate this, we simply divide 100,000 units (remember, this represents a standard lot) by 500 (your account leverage) and multiply this by the current market price, which we already know to be 0.76816. Following this calculation (100,000/500 * 0.76816), we’re left with $153,63. This is your $ margin requirement for this trade.

So, what about if our account is denominated in AUD? Well, for this the calculation it would simply be trade size/account leverage (100,000/500) which equates to 200 AUD.

Whether your account is denominated in AUD or USD, the margin requirement using IC Markets is 0.2%.

Using our example above:

AUD = 100,000/500 = 200 AUD. (100,000/100 * 0.2 = 200 – 0.2% of 100,000 units).

USD = 100,000/500 * Current market price (0.76816) = $153.63 (This, of course, is the US dollar equivalent of 0.2% trading 100,000 units at current market prices).

How to speak margin?

Understanding trading terminology is of the utmost importance. Communicating with trading peers, your broker and when placing trades, for example, all requires one to be familiar with trading jargon. To illustrate ‘margin’ terminology, let’s explain using an example:

For this, we’re using our IC Markets account, which is denominated in AUD and has leverage of 1:500. Our current account balance is a little under 10k.

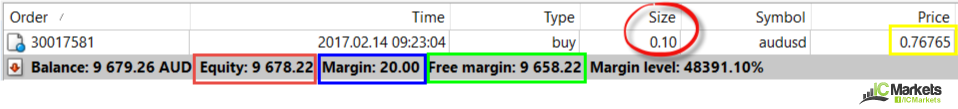

We have decided to buy 10,000 units (as per the red circle) on the AUD/USD. Our trade was filled at a price of 0.76765 as shown in the yellow box.

Our account equity (red box), as you can see, is below our balance due to the current position trading in minor drawdown. The account equity will continue to fluctuate until the trade is liquidated. Be that as it may, the balance will remain at 9.679.26 AUD until the trade is settled.

Margin (blue box) is how much the broker has set aside in order to take this position, which, in our case, is 20 AUD. Remember the calculation from above with an account denominated in AUD (10,000/500 = 20 AUD). This, similar to the account balance, will also not fluctuate during the trade and will only stand at 0 once the position has been closed.

Free margin (green box) currently stands at 9.658.22 AUD. Free margin is the amount of account equity that is currently not being used to maintain the open position. Essentially, it is the amount available in our account to open additional positions, and the amount that our current position (the 10,000 unit buy trade on the AUD/USD) can move against us before we receive a margin call.

As long as our equity level remains above margin, we will not receive a margin call.