JPMorgan is confident that over the next 6-9 months the US will be in recession.

Bob Michele is the company’s Head of Global Fixed Income, Currency & Commodities, and he says the signals are reminiscent of the 2008 collapse of Lehman Brothers.

We’re in that fifty to sixty percent range that the US will be in recession by year’s end and if we push that out into the first quarter, we are somewhere in the neighborhood of over eighty percent. Every indicator that we look at to predict a recession is registering bright red.

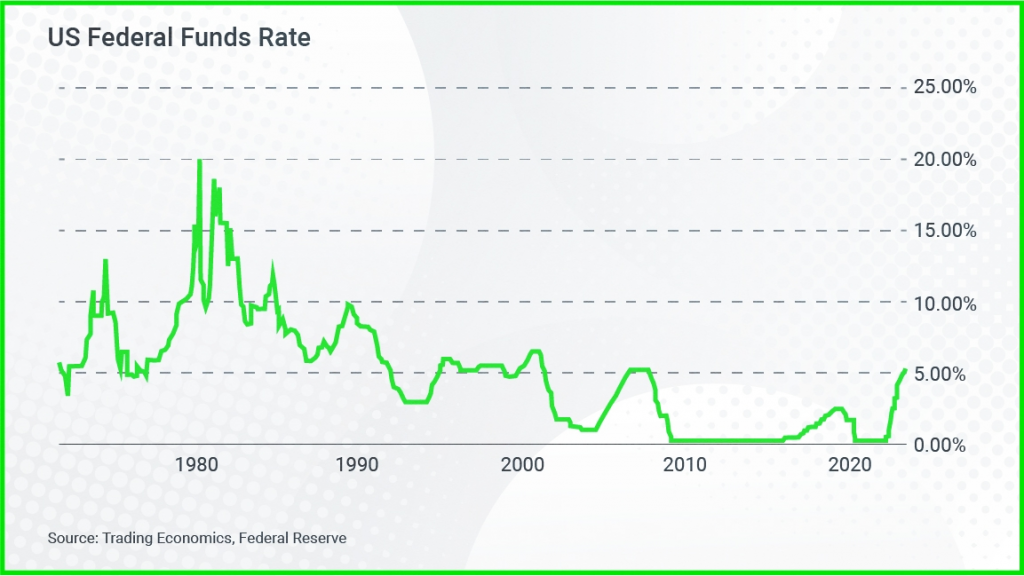

Mr Michele can see a scenario in which the US Federal Reserve will actually begin cutting rates before the United States enters a technical recession.

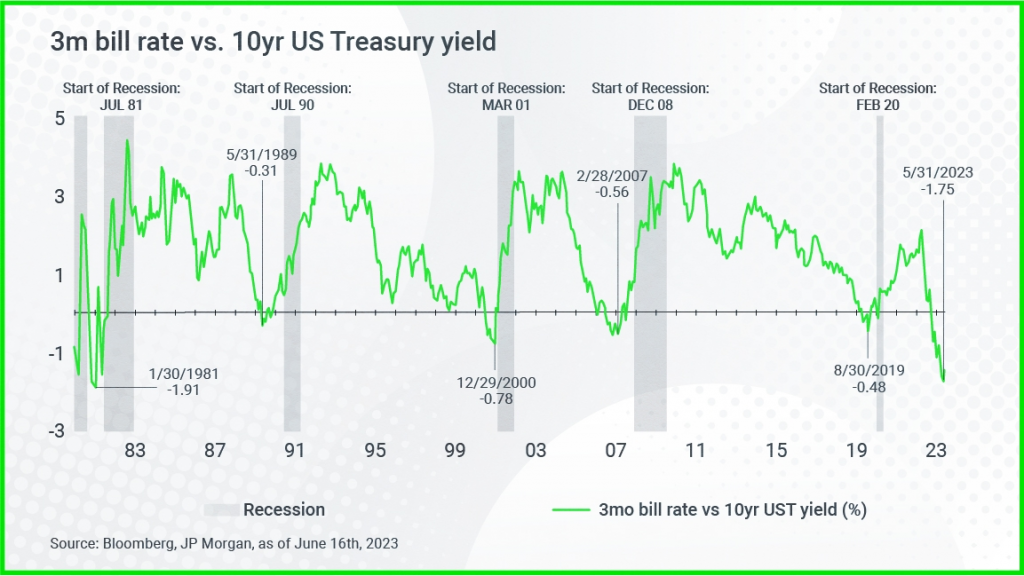

Bob Michele believes the current set of circumstances has parallels to 1981, in which rate hikes in the United States lagged behind rampant inflation.

In 1981, the US Federal Reserve hiked rates in May, but began cutting rates in June, and by July the country was declared to be in recession.

There is also the fear that the current period could be the “calm before the storm”.

In 2008, the S&P rallied before crashing 48% from the August peak to the trough.

We’re hoping it’s not a similar experience to 2008 where we’ll be down forty-plus percent, but you never know.

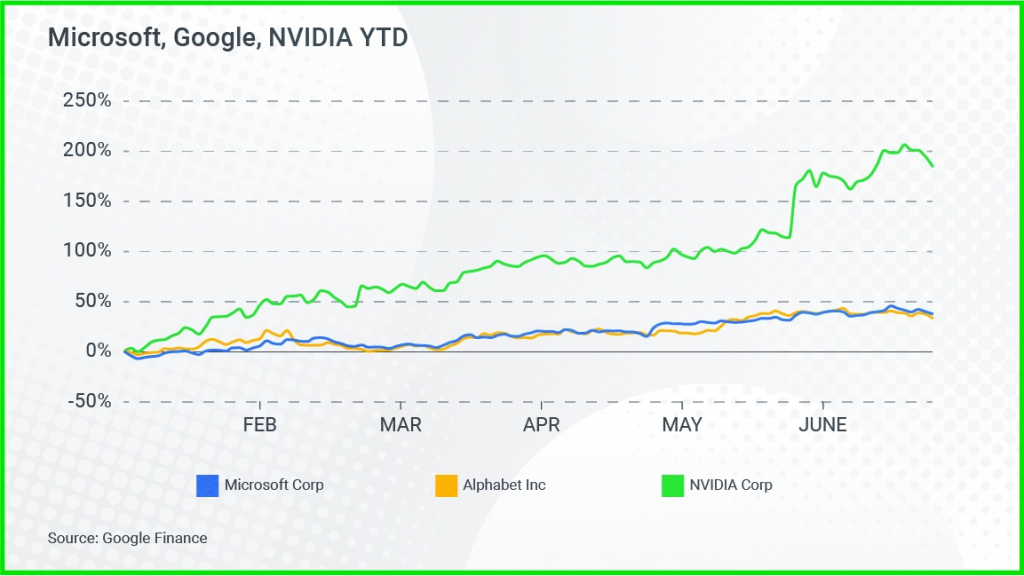

Driving some of the momentum on equities markets right now is the euphoria over artificial intelligence.

Companies with significant exposure to AI have been outperforming the market by a significant margin.

“Ultimately, AI will prove to be correct and become integrated into our lives but the markets are quite euphoric right now, and the range of AI-oriented companies we see today may not be the leaders, ten and twenty years from now,” said Mr Michele.

Another key risk to the US market is the commercial real estate sector.

Many of the regional banks have significant exposure to commercial real estate.

Many of my meetings are in the CBD of different cities, but the office buildings aren’t like fifty percent full, they are like five percent full. Vacancy rates are high and rising. I think there are going to be some significant write downs in commercial real estate.

JPMorgan is advising its clients that the sweet spot in the market right now is in fixed income, particularly at the 5-10 year part of the curve.

“What we are looking for is high quality duration, investment grade corporates, securities credit agency mortgages,” said Mr Michele.

And in terms of the US dollar, JPMorgan believes it will peak around the last interest rate hike by the US Federal Reserve.

The opportunity for investors comes from the Sterling in the United Kingdom and the Japanese Yen.

“Emerging market local debt looks attractive because those central banks started doing their job a year earlier than the developed market central banks, so there’s a lot out there outside of the dollar that will present opportunity by the end of July,” said Mr Michele.