Women are one of the fastest growing investor segments, with wealth manager Coutts saying womens’ income globally increased from $20 trillion in 2018 to $24 trillion in 2020.

Before the pandemic, just 44% of American women invested outside their retirement accounts, but a 2021 study by Fidelity revealed that since 2020 the number of female investors has risen to 67%.

Author of the New York Times bestselling book “The Financial Feminist,” Tori Dunlap, says one of the reasons females started investing during the pandemic was that they finally began to talk about money.

I think it was the wakeup call. Unfortunately, a lot of us needed to realize that the inequality picture was just getting worse and worse and worse.

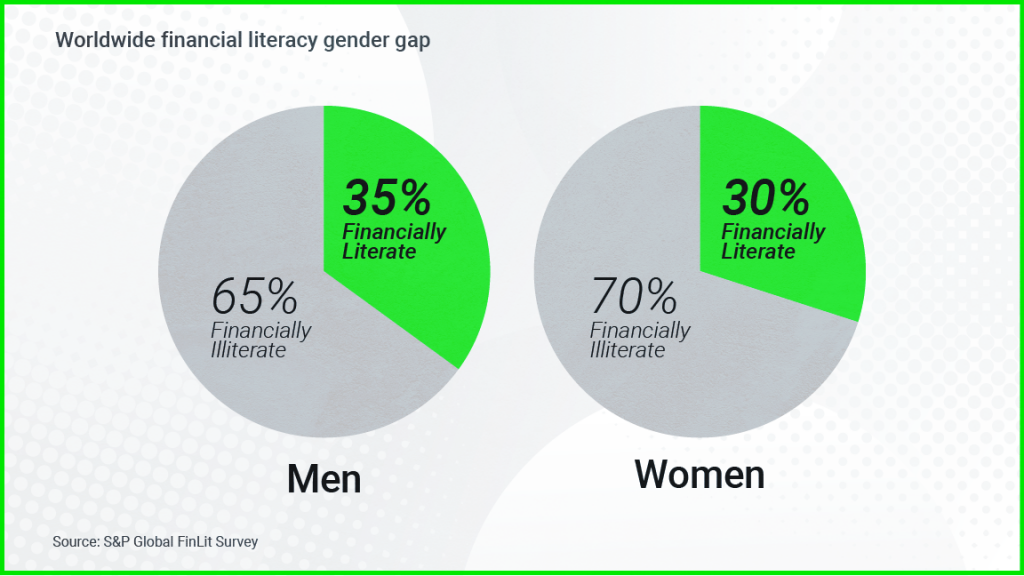

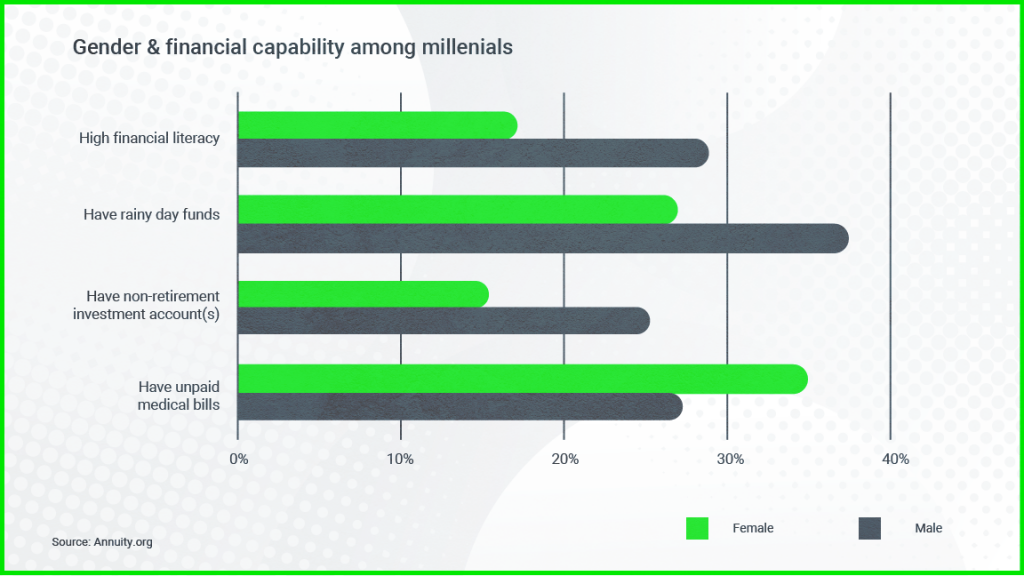

However, despite the rise in female investing, the financial literacy of women still lags behind their male counterparts.

According to Dunlap this is because there is still a stigma about women discussing finances.

“Men are having conversations about how much they make, their salaries, their bonuses, their investments, and their performance – something that is socially unacceptable for women to do.”

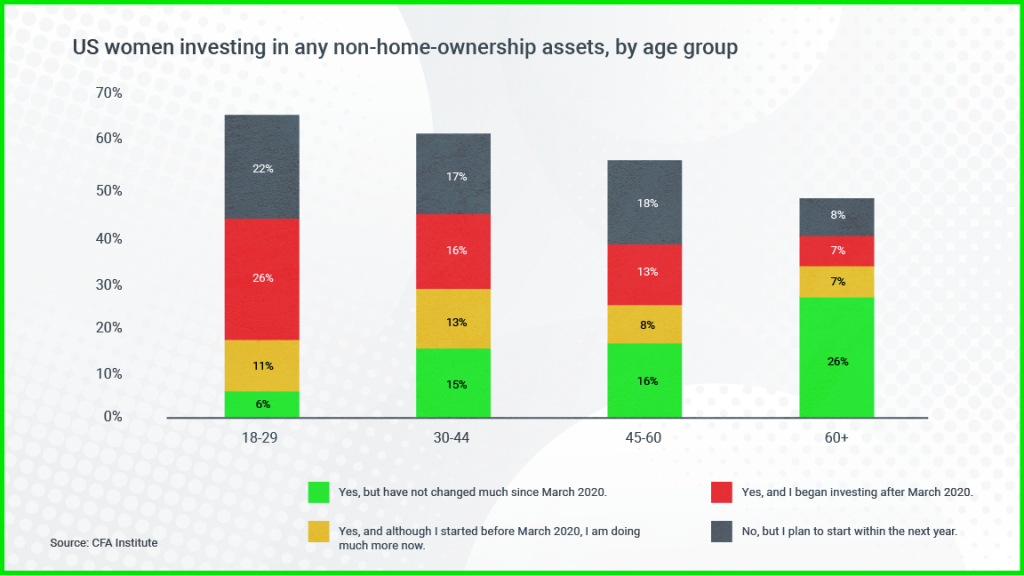

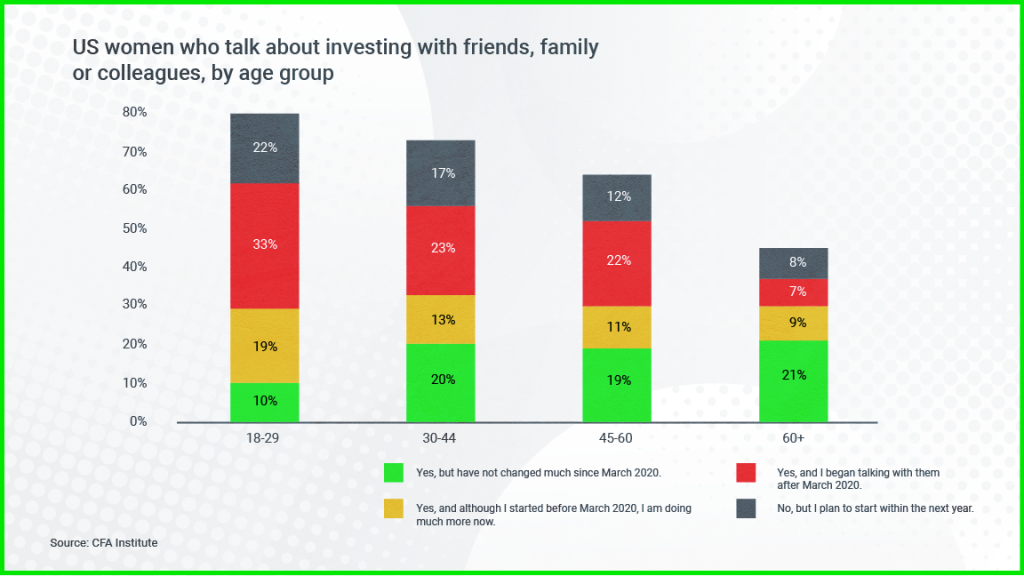

Interestingly, a study by the CFA Institute found that 64% of women in the United States under the age of 30 either already invest, or plan to invest within the year.

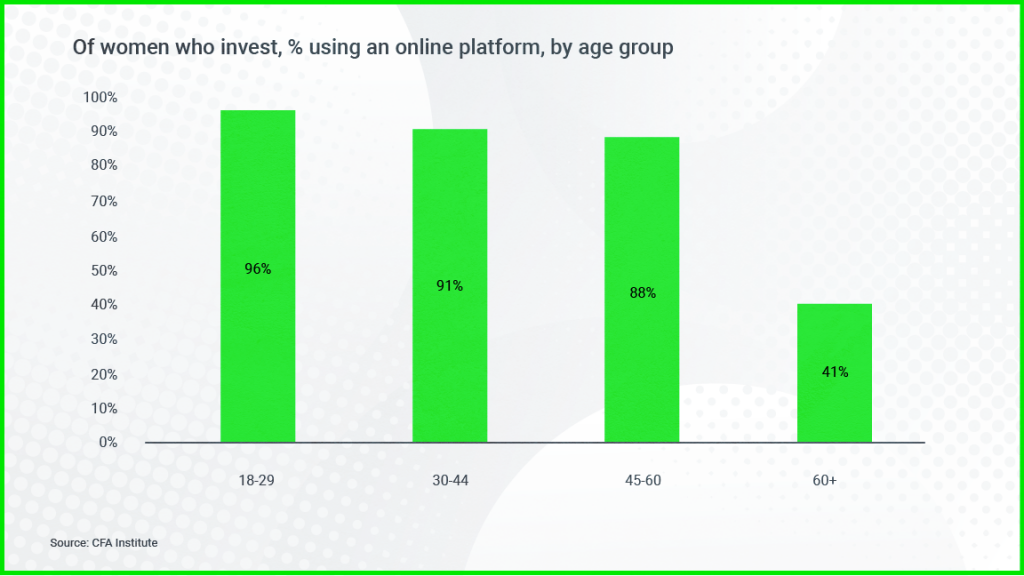

In terms of how these women are investing, online trading and investment platforms are growing in popularity amongst younger women in particular.

Female investors in the United States below the age of 45 are more than 90% likely to be using an online platform for their investments.

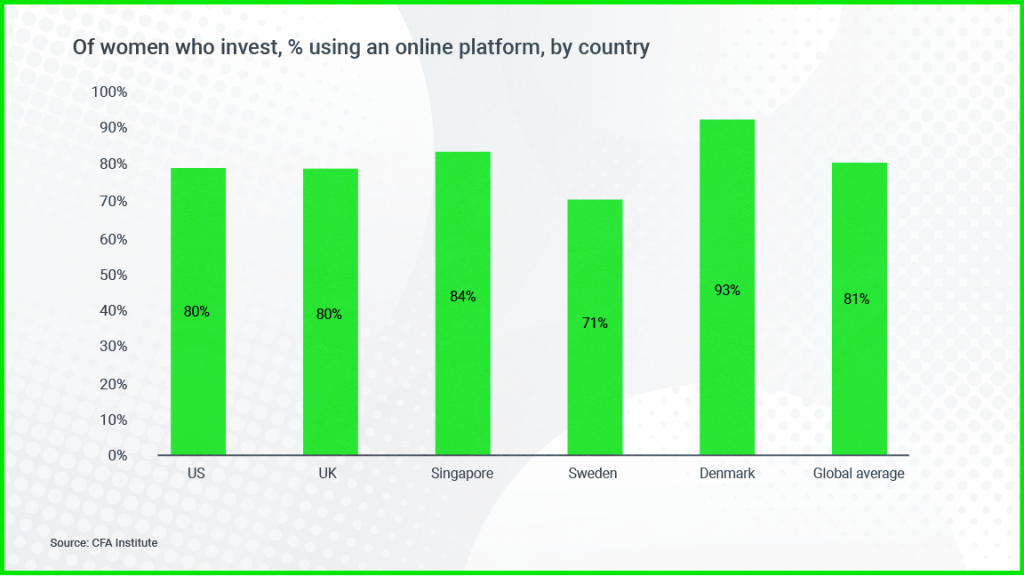

The trend towards online investing is a global phenomenon, which seemed to grow from the pandemic.

This is the moment where we realized, we don’t have to put up with poor treatment. We can leave situations that are toxic, whether that’s relationships or jobs. We can be business owners. We can use money as a tool. And that includes taking ownership and responsibility over the financial pieces of the puzzle you can control.

More than 80% of female investors globally are now using an online platform to build their wealth.

According to Dunlap, the pathway towards becoming a female investor starts with talking about money.

What’s asset allocation? What’s shorting a stock? What is the diversification of your portfolio? Even if you get over the hump of getting started, you quickly get into this analysis paralysis where you don’t feel like you have enough information to navigate this correctly.

And the data shows that these conversations about investing really began to gather momentum during the pandemic.

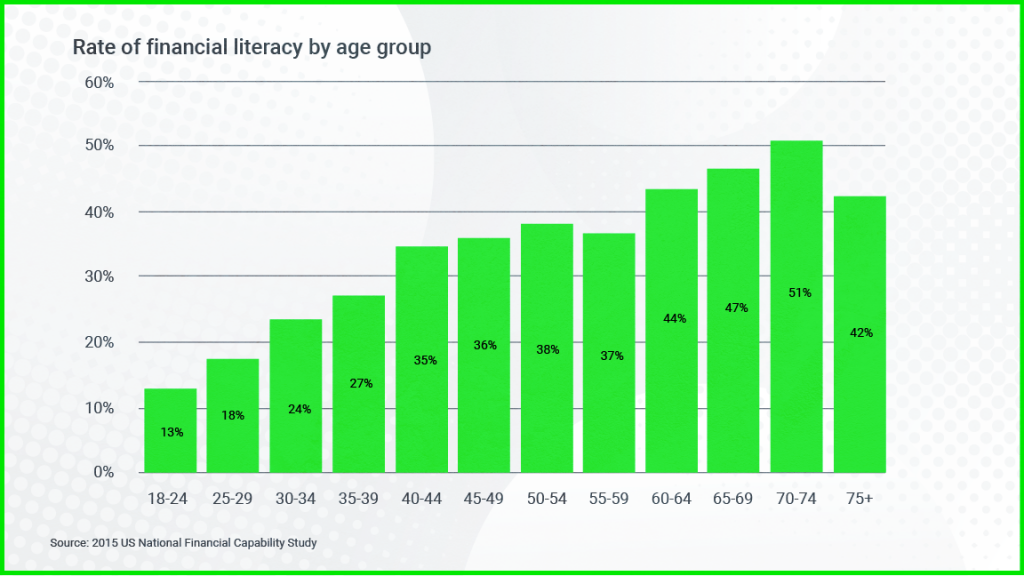

However, while more females are beginning to invest, overall the data shows that there is still a financial literacy gap for millennials, both male and female.

Ms Dunlap puts this gap down to millennials putting off conversations or planning about their retirement as they deem it to be too far into the future.

The problem with failing to prioritize financial literacy can cause a plethora of problems including rising debt, or investing in high-risk ventures and loss of capital.

Dunlap says there are some fundamental concepts that should be taught to new investors.

“I will explain compound interest to anybody all of the time, and that’s a huge reason to invest. Of course, as we talk about the ability to double your money every ten years and how your interest earns interest earns interest, and that’s great.”

Dunlap’s advice for people new to investing is to just get started.

“The only bad mistake you can make when it comes to investing is not investing at all. So I need you to just get started. Truly. The worst worst choice you can make is not making a choice at all.”