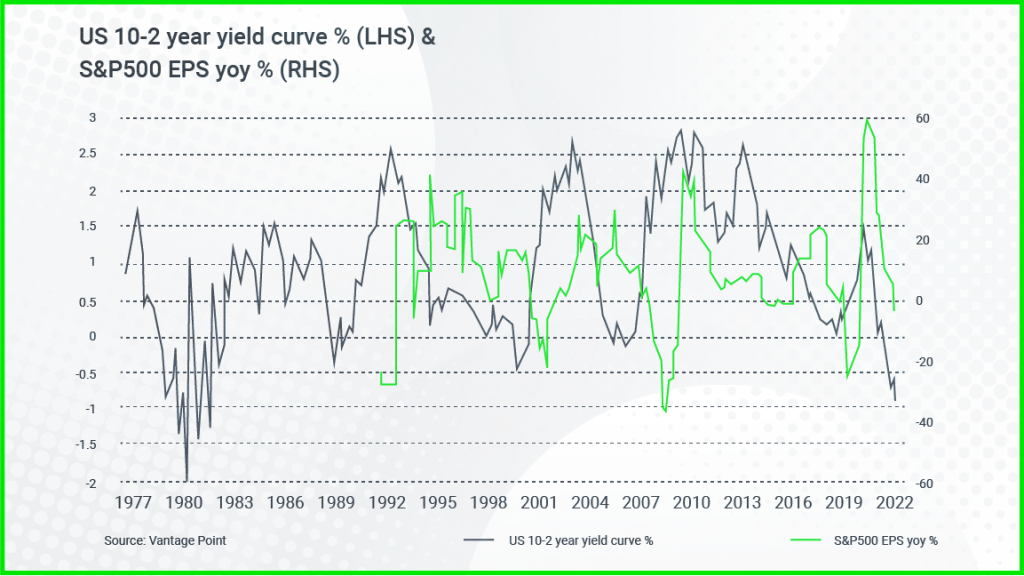

Yield curves have never been this inverted and not signalled a recession. Bank lending standards have never been this tight without signalling a downturn, and leading indicators have never been this negative without signalling an economic slowdown.

Chief Investment Strategist at Vantage Point, Nick Ferres, says 2023 is not a credit episode like 2008, but a consequence of assets not being accurately priced.

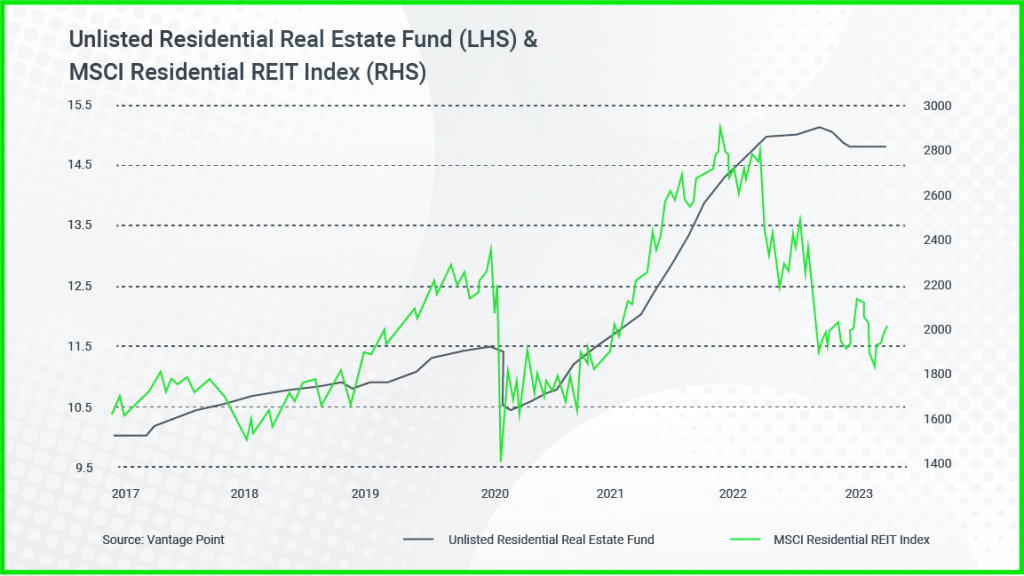

Ferres said the current crisis has stemmed from an asset overvaluation as unlisted assets are “marked to fantasy”.

There’s a mark-to-market problem, especially in unlisted assets, commercial real estate, private equity and venture capital. This episode is not a credit episode like 2008, in our opinion it’s more of an asset valuation episode.

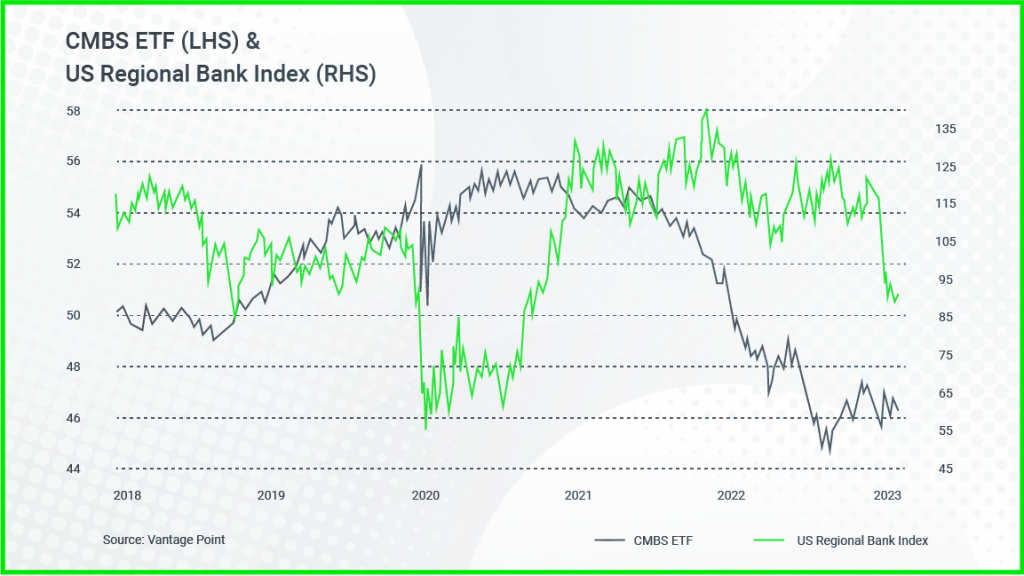

One of the biggest risks stems from commercial mortgage-backed securities, which have been packaged into debt securities, according to Ferres.

A chart from one of the ETFs connected to this sector shows a considerable decline over the last 12 months.

The issue is also reflected in the chart showing the regional bank index in the US.

Regional banks in the US provide 70-80% of the finance for commercial real estate.

Office space is in distress, with work from home becoming a greater factor. Vacancy rates are also much, much higher in major cities like San Francisco, for example. That has put pressure on the valuation side.

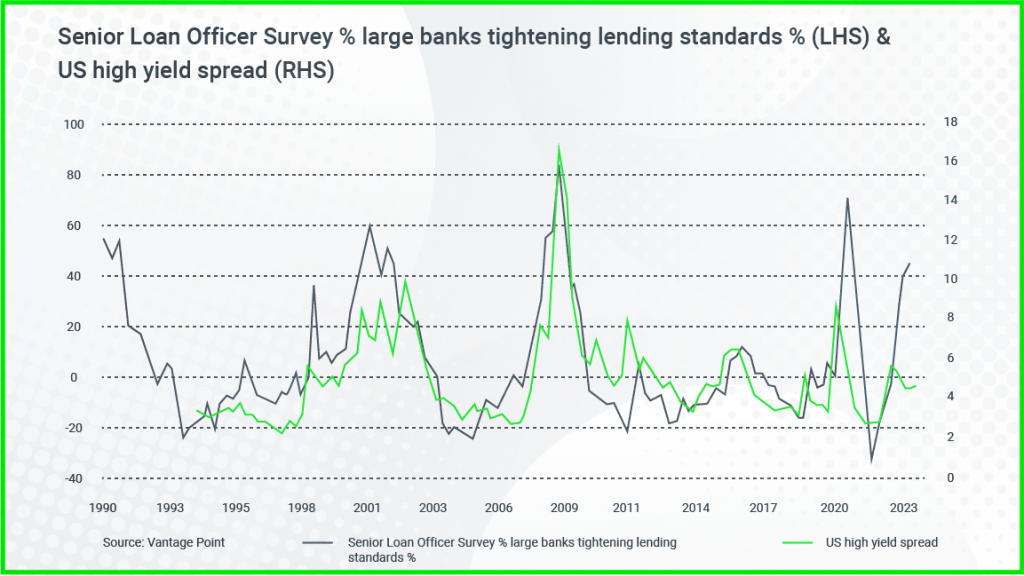

Another leading indicator is the Senior Loan Officer Survey in which loan officers are asked whether they are tightening or loosening lending standards.

Over 40% of senior loan officers in the US said they are tightening lending standards to large firms in the United States.

According to Ferres, you can see the relationship between the credit risk premium, or the credit spread, on the US high yield market and the divergence between the two.

“When the lending standards have been this tight historically, it’s typically led to a recession because it’s tightening the availability of credit,” said Ferres.

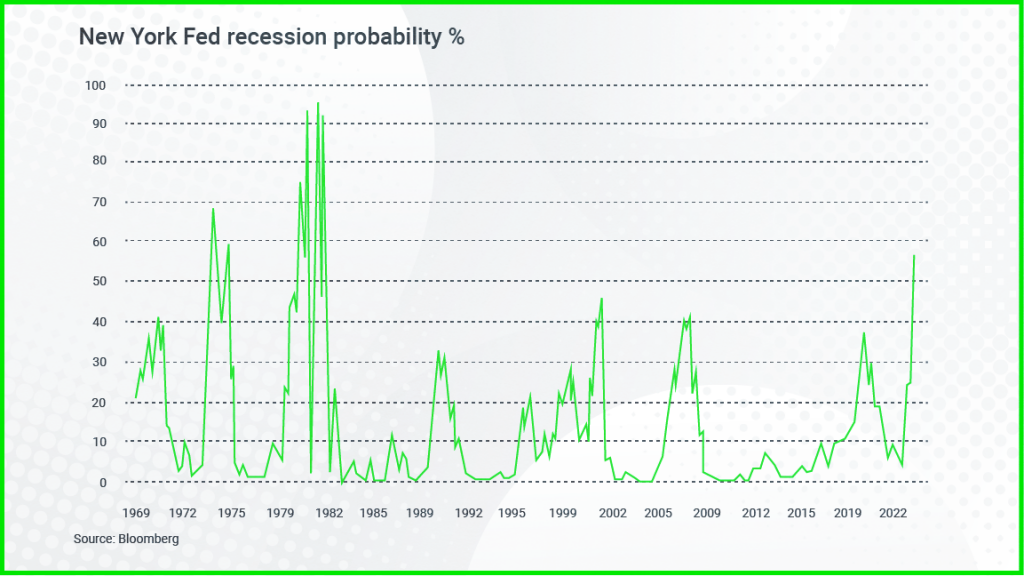

Oxford Economics economist Alex Holmes says the renowned “Cleveland Fed’s” model is now flashing warning signals of an imminent recession in the United States.

“It’s currently pointing to a 60% chance of recession, which is the highest it’s been in decades,” said Holmes.

Holmes also points out that the highly watched yield curve indicator is also showing inherent uncertainty.

However, it may not eventuate in a global recession like in 2008.

“In 2008 it was a credit crunch and a global financial crisis, which rippled throughout the rest of the world. This time around, it’s more likely to be driven by the Fed’s battle with inflation,” said Ferres.

The big question confronting investment strategists is whether the contagion will spread from the US to the rest of the world.

Ferres said Asia is well prepared for a downtown in the US.

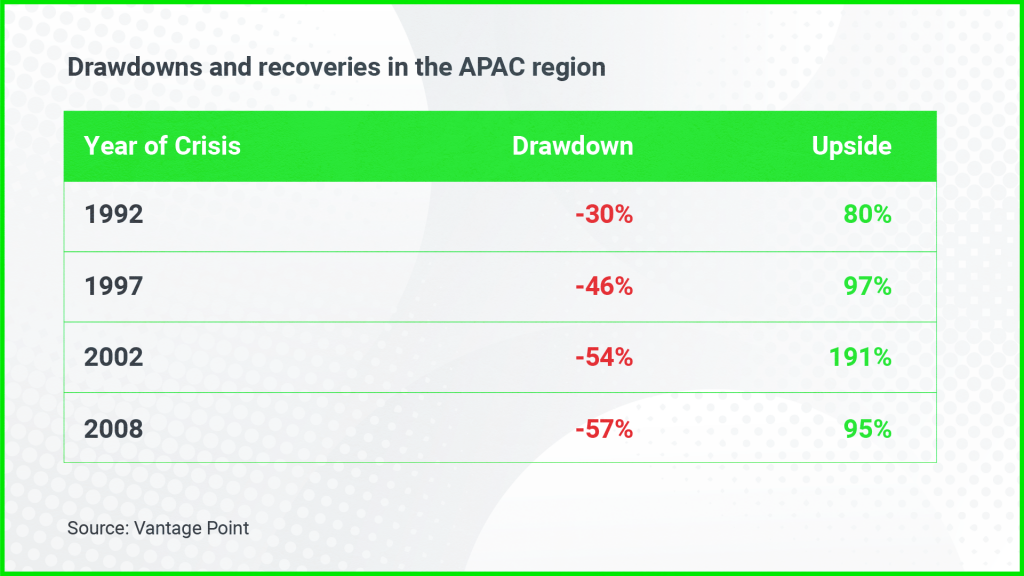

“The good news in Asia is that the bear market started in February 21. So it’s been going for a lot longer. And the drawdown in Asian equities, and emerging market equities more broadly, was much deeper than it was in the US and and elsewhere. So the drawdown in Asia Pacific was about 40% from the peak in 21 to the trough in October last year,” said Ferres.

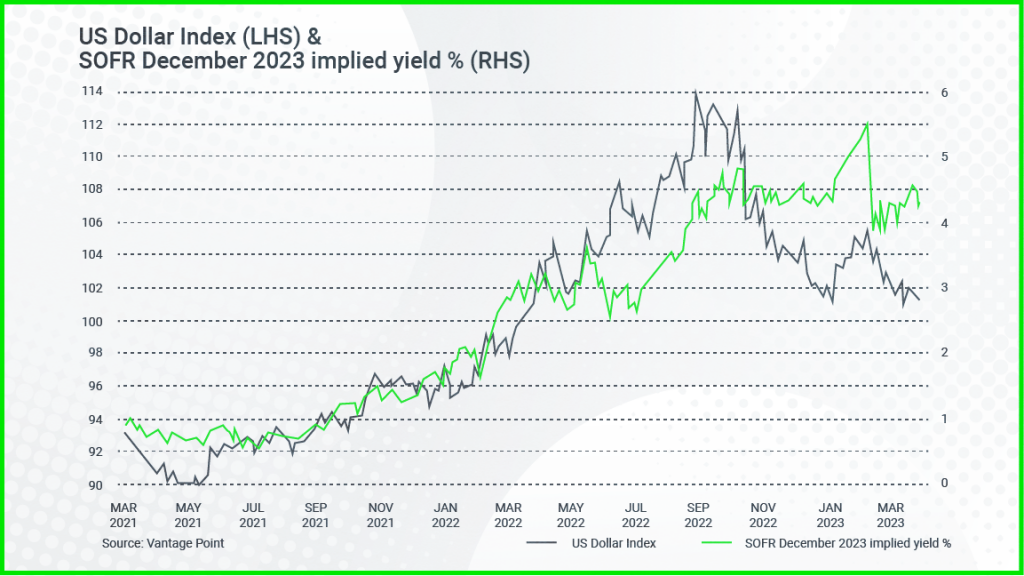

If the US economy does slip into a recession, the impact on the US dollar could actually be positive for the USD.

“The US dollar actually performs well, paradoxically, going into a hard landing because the USD is still a safe haven currency. And so when people are redeeming or repatriating assets back in the US dollars, that is a safe haven flow, and also still around 40% to 50% of all the liabilities in the world are still denominated in dollars,” said Ferres.

If there is a recession in the US, Vantage Point has a plan for reallocating assets:

“We see it as an opportunity. So the good news, in the Asia-Pacific is that valuations are at distress levels both in outright and relative terms. So if we did see another drawdown later this year, we would definitely see that as an opportunity to scale into equities in the Asia Pacific, and assets in this part of the world more broadly.”