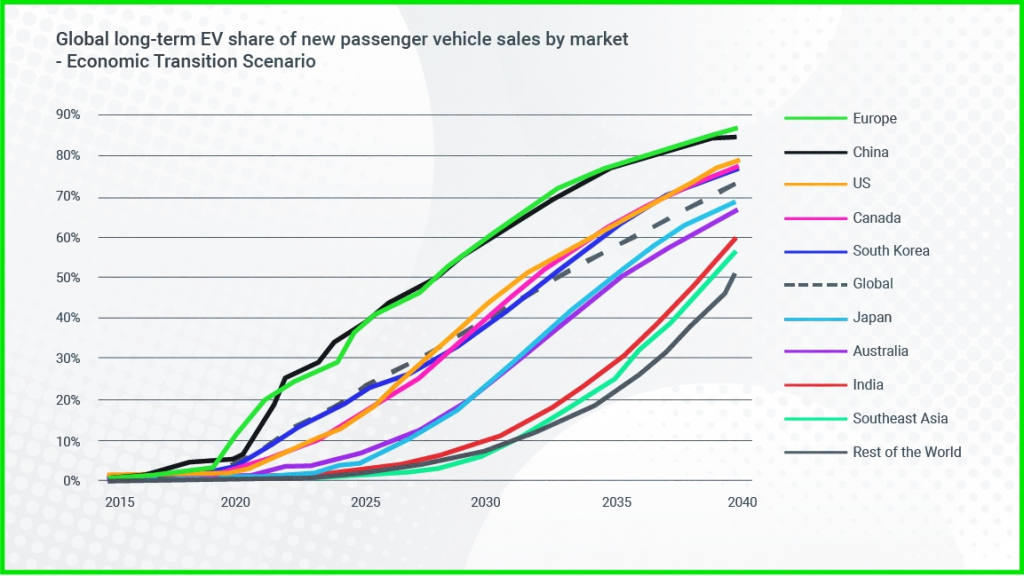

Electric vehicles are predicted to make up 40% of all global new car sales over the next decade, which is driving a boom in battery metals.

Sales of EVs began to surge during the pandemic on the back of government incentives, particularly from China and European governments.

But while sales were initially fuelled by incentives, they are now being driven by insatiable consumer demand.

Dale Henderson, CEO of Pilbara Minerals, which operates the world’s biggest independent hard-rock lithium operation says demand is moving from being subsidy to consumer driven.

It’s very much consumer driven and very much an organic demand as a function of EVs being a superior product that the customers would prefer to buy over a car with an internal combustion engine.

Tesla’s Model Y overtook Toyota’s Corolla to become the world’s best selling car in 2023.

Globally, Tesla sold 267,200 Model Y’s in the first quarter of 2023, compared to 256,400 Toyota Corollas.

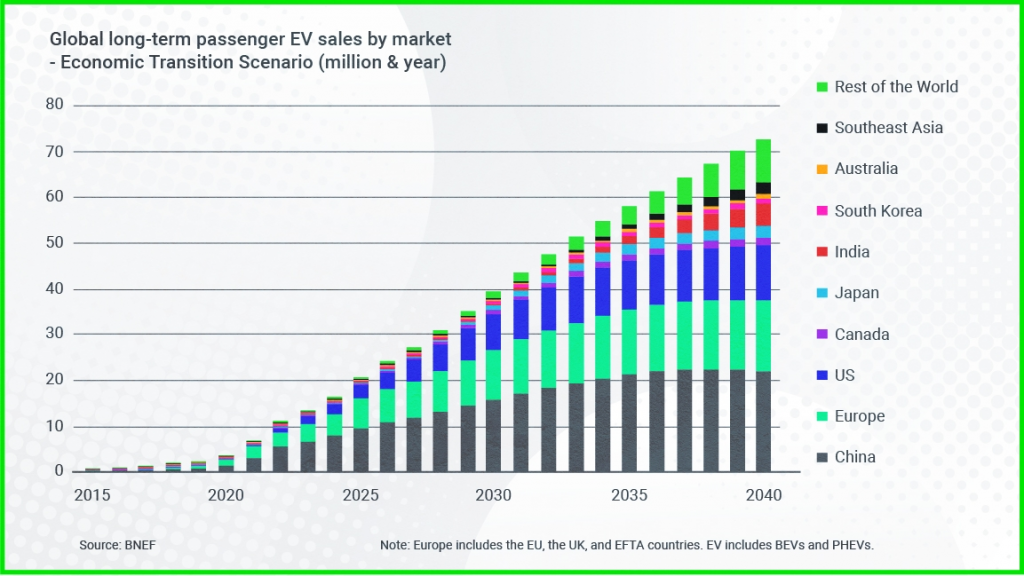

More than 10 million electric cars were sold around the world in 2022, with that number expected to rise to more than 70 million by 2040.

In a 2022 earnings call, Tesla CEO Elon Musk noted a need for more global lithium suppliers referring to lithium as a “licence to print money”.

I’d like to once again urge entrepreneurs to enter the lithium refining business. The mining is relatively easy, the refining is much harder. You can’t lose, it’s a licence to print money,” said Mr Musk.

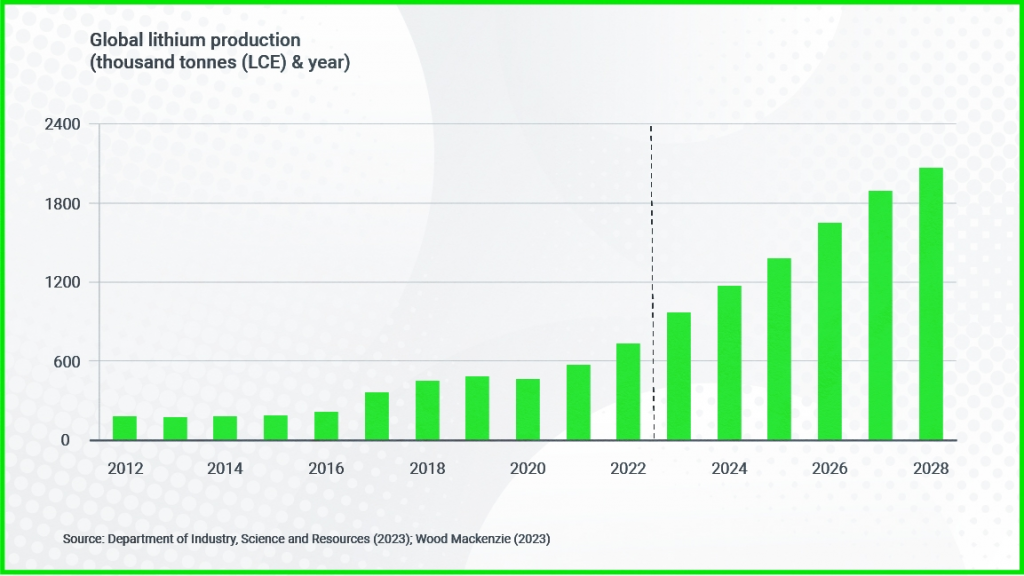

Australia is the world’s biggest lithium producer, supplying about 60% of the world’s lithium.

The industry has experienced extraordinary growth over the past two years. For most of 2021, monthly lithium exports didn’t exceed AU$250 million, but in June 2022, monthly exports of lithium carbonate surpassed AU$1 billion.

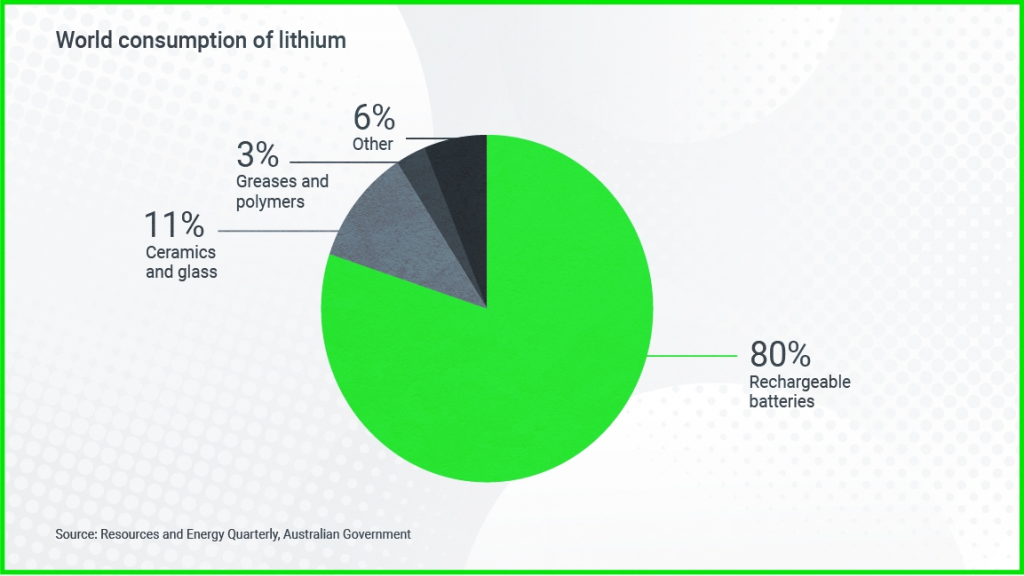

While the lion’s share of demand is tied to electric cars, the use cases for lithium batteries continue to grow.

“There’s a number of other use cases for the lithium and lithium battery, whether that’s e-mobility, scooters, surfboards, but also mass energy storage. So many different use cases are coming to bear and they’ve all got different growth rates and different extensive adoption,” said Mr Henderson.

According to Henderson, Pilbara Minerals needs to more than double production just to meet existing demand.

According to modelling by the Australian Government, the world needs to ramp up production by at least 300% over the next five years.

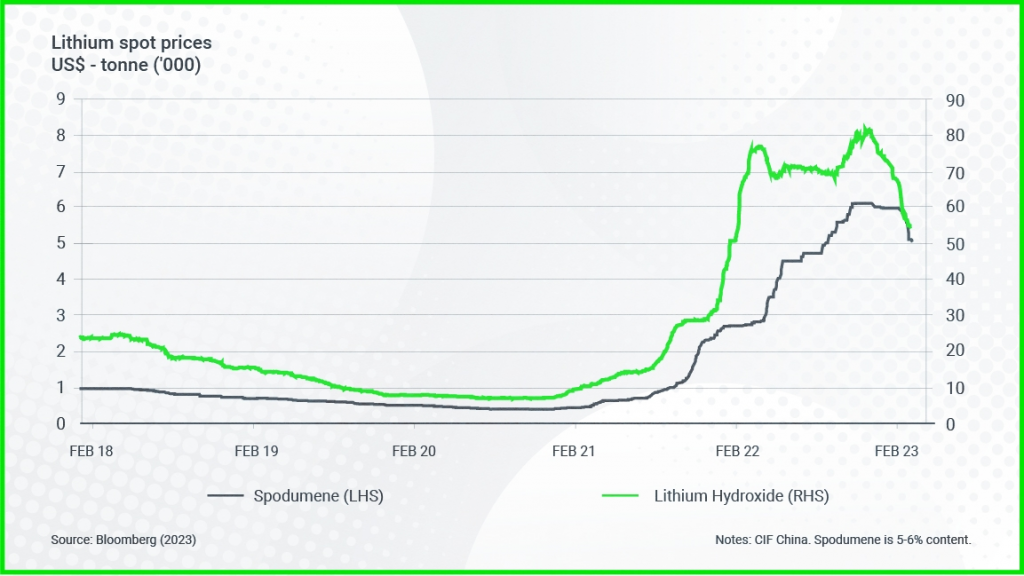

The burgeoning global demand is driving up prices of lithium carbonate.

I think anything’s possible, particularly when you look in the rearview mirror and you see some of the highs which exceeded $70,000 per tonne. So clearly batteries were being sold at those prices. So it seems reasonable to me that prices could return to those high levels and potentially beyond. I guess we’ll wait and see.

The lithium sector has also undergone an intense period of M&A activity with the larger players seeking to acquire high quality lithium assets.

What’s driving this is the race to secure these critical minerals. I think it speaks to demand and it speaks to security of supply.

Many of the major car manufacturers have direct offtake agreements with Australian lithium miners.

Tesla, Ford, Volkswagen and Mercedez-Benz all have direct offtake agreements with Australian lithium producers.

“Many of these car companies are augmenting their business from internal combustion engines to EVs, and they’re in this race to secure their security of supply,” said Mr Henderson.